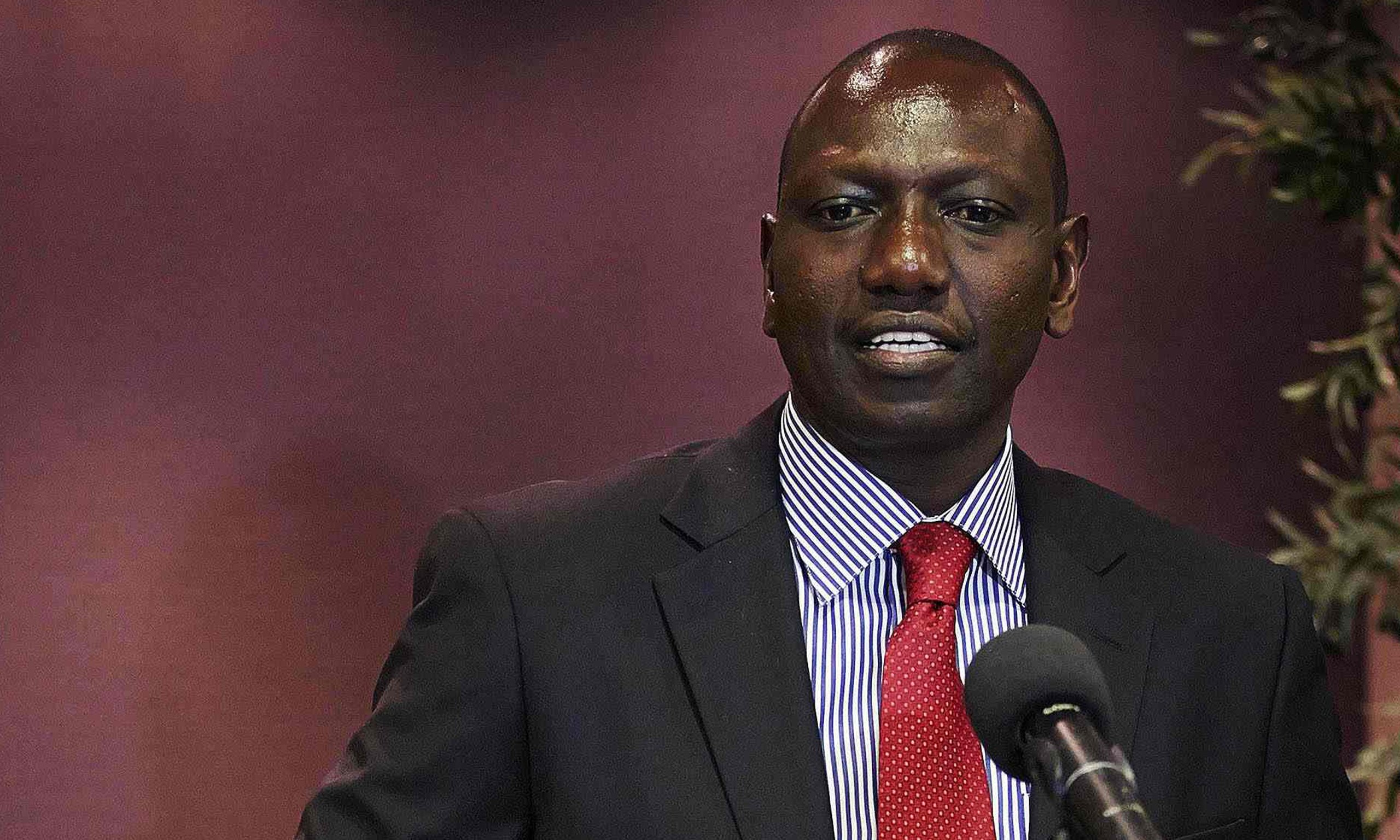

Mathias Katamba, Chief Executive Officer at dfcu Bank

DFCU Limited announced a net profit of Shs 9.3 billion in 2021, down from Shs24.07bn recorded in 2020.

According to to the results, dfcu’s total assets reduced to Shs3.13 trillion, down from Shs3.49 trillion recorded in 2020.

The figures further show that customer deposits reduced to Shs2.28 trillion, down from Shs2.59 trillion recorded in 2020, while loans advanced to customers reduced to Shs1.508 trillion in 2021, down from Shs1.775 trillion posted a year earlier.

Following the release of the 2021 financial results, we held a one – on – one interview with Mathias Katamba, the Chief Executive Officer of dfcu Bank, the main trading subsidiary of dfcu Limited.

Below are the excerpts of the interview;

Q: What are the highlights of the Bank’s performance?

A: We delivered strong topline growth with a 21% increase in operating income driven by a 17% increase in net interest income and a 35% increase in non-interest income.

We also achieved a 26% reduction in interest expense, and improved operational efficiency demonstrated by a significant improvement in the cost to income ratio from 63% to 49%.

Q: What drove the significant topline growth?

A: As part of our retail strategy, we introduced new solutions in the various customer segments focusing on small businesses and supporting financial inclusion.

In doing so, we further reduced the composition of fixed deposits on our balance sheet. In our quest to deepen the support for key business sectors, we widened our offerings in the global financial markets and trade finance space hence increasing our outreach and trading volumes.

Our deliberate focus on improving the customer journey saw us increase investment in digital channels including expansion of the intelligent ATM fleet, new functionalities on both agent and online banking, and on boarding new partners supporting payments. These initiatives translated into increased utilization of our digital channels.

Q: How have you managed to consistently reduce operating costs in a challenging environment?

A: The Bank continued to invest in systems, technology and good practices in our pursuit of operational excellence. The benefits from process automation and digitization of customer journeys as indicated earlier reduced the cost to serve customers, consequently bringing down the cost to income ratio from 63% to 49% for the year.

Q: What drove the reduction in customer deposits during the year?

A: The drop in customer deposits was a result from the deliberate move to optimize funding costs by shedding expensive fixed deposits. The composition of customer deposits has improved from over 30% fixed deposits historically to 25% during the year under review.

Q: We noted a reduction in net loans and advances. What caused this?

A: Due to the slow economic activity, the Bank took a cautious approach to credit growth focusing on the specific sectors that remained active in the period while providing relief to those had restrictions.

Whilst there was a reduction in the lending book, it is important to note that the number of borrowing customers increased during the period, underpinning our retail focus.

Q: With all the progress noted above, what impacted the Bank’s earnings?

A: We achieved a good leap forward on the core metrics with robust growth in total income and continued reduction in operating costs. The pre-provisioning profit i.e. profit before provisions, fair value losses and tax grew significantly from Ushs114 Billion in 2020 to Ushs 190 Billion in 2021. The Bank’s overall profit was significantly impacted by the loan impairment charge, resulting from the adverse impact of the Covid – 19 pandemic, the associated containment measures on our customers businesses and the impairment of the financial asset. We continued to support our customers, especially those operating in sectors that remained locked down for an extended period, with credit relief and business recovery loans.

The full reopening of the economy provides renewed optimism about the prospects of our business customers getting back to full operations which will improve their repayment ability, increasing demand for credit and providing a positive outlook for our performance.

Q: What are the other highlights for the year?

A: During the year we intensified our engagement and interaction with customers, stakeholders and community at large using various platforms. The weekly Investment Club financial literacy sessions provided avenues for continuous engagement, feedback and learning. Furthermore, the Women in Business program continued to nurture the entrepreneurial spirit of women through regular tailored trainings.

The introduction of flagship lending solutions for small and informal businesses where they acquire credit with flexible collateral requirements has enabled us to support many upcoming entrepreneurs across the country.

Additionally, through other programs such as the Top 100 Medium Sized Company Survey done in conjunction with our partners we offered a platform and opportunities to harness value and build sustainable businesses.

Through the Agribusiness Development Centre, a partnership between dfcu and Rabobank foundation, we complemented efforts towards improving the skills set within the Agriculture sector, by providing technical support to Farmer Based Organization’s (FBOs) within the agricultural value chain.

Q: What should customers and stakeholders expect from dfcu going forward?

A: Following the full reopening of the economy, we expect that economic activity will bounce back with real GDP projected to grow by 6% in 2022. We also expect demand for credit to return as businesses recover and reposition for growth.

We will continue to focus on the growth of our retail business, supporting businesses and individuals in the post covid recovery during 2022, in addition to building resilience in our loan book through rehabilitation and debt recovery programs.