The Bank of Uganda (BoU) revoked the banking license of Global Trust Bank Limited on 25th July 2014 under the provisions of the Financial Institutions Act, 2004 and immediately placed it under statutory liquidation. The Central Bank now says the liquidation process has been concluded successfully.

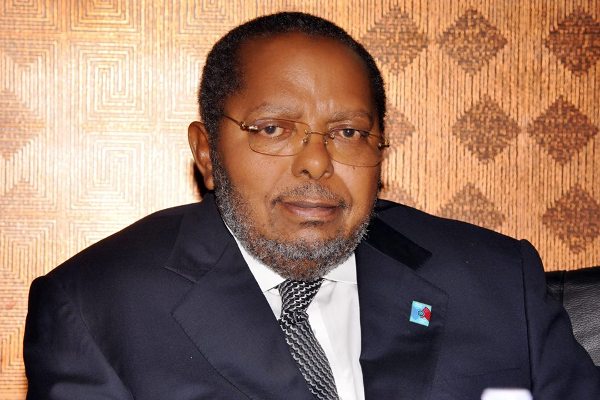

“Bank of Uganda hereby informs the general public that the statutory liquidation of Global Trust Bank Limited has been effectively concluded,” Prof. Emmanuel Tumusiime-Mutebile (pictured), the Governor BoU said in a statement dated February 25, 2020.

Global Trust Bank (GTB) was closed after failing to become commercially viable but most importantly protect customers’ deposits.

Having been established in 2008, GTB had incurred persistent losses, which had accumulated to Shs60bn.

“There has been no improvement in the bank’s financial performance in the last five years and there is no realistic prospect that it would ever become profitable in the future,” Mutebile said then.

He added, “… there were serious deficiencies in the governance of GTB and the accuracy of the financial information it reported to the BOU.

No commercial bank can survive indefinitely unless it is profitable. As such, GBT’s continued operations as a loss making bank would have posed a serious risk to the safety of its deposits. Therefore the closure of GTB was necessary to protect the interests of its depositors.”

To ensure the minimum disruption to GTB’s customers, the BOU arranged for the transfer of all of its deposit accounts, which amounted in value to approximately Shs73bn, to DFCU bank.