The Bank of Uganda has proposed stringent rules on how money from dormant accounts should be returned to the Consolidated Fund.

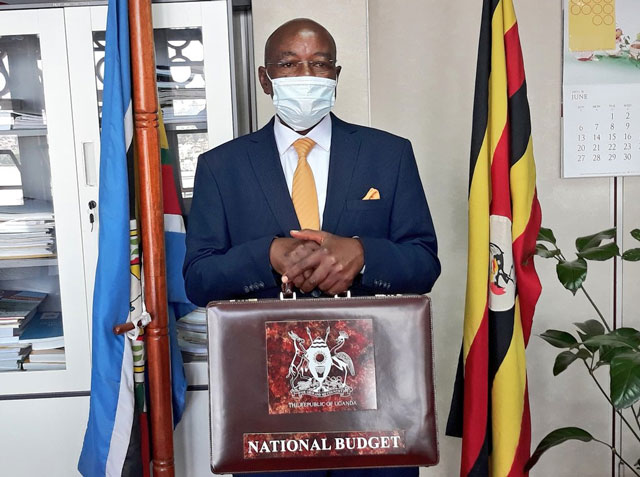

The proposal is contained in the National Payment Systems Bill, 2019 that was tabled before Parliament on Thursday by David Bahati, the Minister of State for Planning.

BoU noted that currently, there is no comprehensive payment systems law though Bank of Uganda has always relied on article 1 62 (1) of the Constitution which provides that Bank of Uganda shall encourage and promote economic development through effective and efficient operations of the banking and credit system to develop the payment and securities settlement systems.

According to BoU, The National Payment Systems Bill, 2019 will deal with payment systems including; the Real Time Cross Settlement System (RTCS) for interbank transfer, the Automated Clearing House (ACH) System for the clearance of cheques and the Electronic Funds Transfers (EITs).

BoU says the objective of the Bill is to regulate payment systems, provide for the safety and efficiency of payment systems, provide for the functions of the central bank in relation to payment systems, prescribe the rules governing the oversight and protection of payment systems, provide for financial collateral arrangements; to regulate payment service providers, regulate issuance of electronic money, provide for the oversight of payment instruments.

The Central Bank opines that due to the absence of a national payment systems law, there is uncertainty in the market with regard to licensing of payment systems service providers who are not financial institutions. As such there is limited regulations and oversight of payment systems and inadequate protection of payment and securities settlement systems.

Dormant accounts

Section 57 of the proposed legislation stipulates circumstances under which funds on dormant accounts will revert back to the treasury, with the Central Bank proposing that; An electronic money account that does not have a registered transaction for nine consecutive months shall be considered dormant’

Bank of Uganda proposes; An electronic money issuer shall give notice to the customer of at least one month before the period specified in subsection (1), that the electronic money account shall be suspended unless there is a transaction on the account.

At the expiry of the notice referred to in subsection (2), the electronic money issuer shall block the electronic money account and shall not permit further transactions until the account is reactivated by the customer.

Also, the electronic money issuer shall within five working days after blocking of the electronic money account, give notice to the customer that the electronic money account is blocked and provide instructions on the process of reactivation of the account.

If the account is not reactivated within six months after it has been blocked, the electronic money issuer shall close the electronic money account.

Upon closure of the electronic money account under subsection (5), the trustees shall transfer the balance of an electronic money account and identifying information to the central bank’

Although, the Central Bank is obligated to refund any unclaimed balances to the account holder of an electronic money account or, if the account holder is dead, his or her legal representative, upon a request made within seven years after the dormant account is transferred to the central bank, the Central Bank shall after the expiration of the period prescribed under subsection (7), transfer the unclaimed balances to the Consolidated Fund.

Speaker Rebecca Kadaga referred the Bill to the Finance Committee for scrutiny and return to Parliament for final decision within 45days.