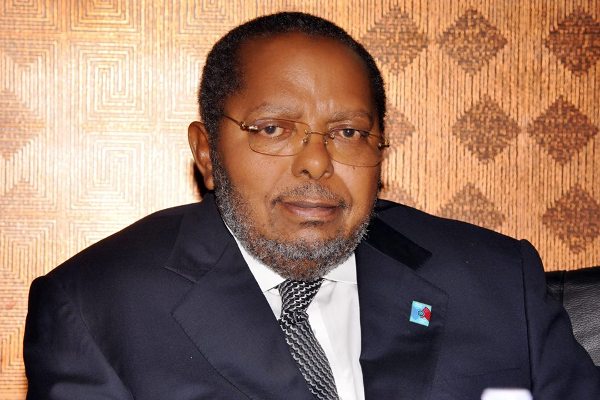

The Bank of Uganda (BoU) Governor, Prof. Emmanuel Tumusiime-Mutebile has revealed that the Central Bank has stepped up efforts to address weaknesses that led to the most recent commercial bank failures.

“Although bank supervision and regulatory structures broadly follow international best practices, BoU has stepped up the strengthening of commercial banks’ financial reporting, internal controls, and governance. Weaknesses in these areas were at the core of the most recent commercial bank failures,” Mutebile said.

He added: “I am very pleased to report that the International Monetary Fund has recently sent to us a resident bank supervision advisor.”

He made the remarks during the High-Level Stakeholders’ Engagement on Building a 21st Century Ugandan Economy held today at Kampala Serena Hotel.

Mutebile revealed that the BoU has successfully ensured financial sector stability, including through resolving commercial banks that posed systemic risks by being very highly interconnected, both by the number and size of transactions with the other commercial banks.

“Currently, commercial banks are well-capitalized, liquid, and profitable. Improvements in asset quality have contributed to an easing of lending and credit recovery. The latest stress tests indicate that the banking system can withstand shocks,” he said.

As the current credit expansion cycle gains momentum, Mutebile said, BoU remains focused on maintaining strong supervision to ensure that banking sector loans and advances do not drastically worsen if the economic growth momentum unexpectedly slows down.

He noted that despite strong economic performance since the early 1990s, Uganda’s financial sector remains shallow.

“Private sector credit could play a bigger role in supporting economic growth than is the case at this moment. At 12 per cent of GDP, private sector credit remains low. Although large corporates have access to credit on more favourable terms, smaller firms in need of financing have limited options,” he said.

He added: “They often do not meet financial accounting standards that would facilitate access to long-term capital. A law to allow movable assets as collateral has been passed.”

However, legal uncertainty over property rights and lengthy proceedings to recover collateral continue to weigh down on banks’ credit risks, Mutebile said.

“The stock market remains largely untapped with only 9 listings of domestic companies and rather limited trading in the shares of those that are listed,” he added.

On a more positive note, Mutebile said around 85 per cent of Ugandans have access to financial services, including through mobile money.

He further noted that the BoU has not only successfully achieved its inflation objective of low and stable inflation, but has done so while supporting economic activity.

“In the last two financial years (FY), Uganda’s economy has grown on average by 6.1 per cent from a growth of 3.9 per cent in FY2016/17. Investor surveys suggest that business conditions and sentiments are strong. Credit to the private sector has improved; helped by accommodative monetary policy stance,” he said.

The economy is expected to maintain this growth momentum and is projected to grow by between 6.0 and 6.3 per cent in FY 2019/20, and between 6.5 and 7.0 per cent in the medium term.