Stanbic Bank Uganda (SBU) is set to recruit 1,000 agents as Ugandan banks ready themselves to embrace a new model of banking-agency (agent) banking, Business Focus has established.

This was revealed by Patrick Mweheire, the SBU Chief Executive Officer at the side-lines of a press conference to announce the bank’s financial results for 2016 at Serena Hotel, Kampala on March29, 2017.

Mweheire said that they are “very positive” that agency banking will boost financial inclusion in Uganda, adding that Stanbic will quickly embrace the model for it is cost effective.

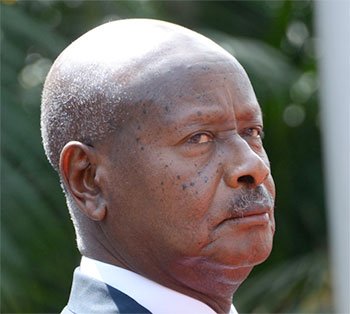

On March31, 2017 President Yoweri Museveni assented to The Financial Institutions (Amendment) Act, 2016 that provides for Islamic banking, banc assurance and agent banking among other things.

Mweheire says agency banking will help SBU boost earnings in branches that have been losing money due to high costs.

“I can tell you that 20-30% of my branches don’t make profits because they don’t have enough volumes yet operational costs are high.

Agency banking allows you to be a bank at a low cost,” Mweheire said in an exclusive interview with Business Focus.

“We hope to sign up to 1,000 agents,” he added.

Asked what it will take for one to qualify to SBU’s agent, Mweheire revealed that guidelines will be provided for by the Bank of Uganda and the law, but added that whoever will have cash will be given an opportunity.

Business Focus understands that an agent will need to have at least over Shs10m and a running business situated in a permanent location to qualify to become an agent of some banks.

On March 29, 2017, commercial banks, under their umbrella body, Uganda Bankers Association (UBA) revealed that they are set to roll agent banking through a shared platform.

UBA has partnered with Eclectics International Ltd, a Pan-African private company to design, develop, deploy and operate the inter-operable shared platform that connects all member banks to the agent network spread across the country.

Eclectics International Ltd is currently serving over 205 banks across 23 countries in Africa.

Agency banking, a model that allows banks to use fellow banks, shops, kiosks and field agents to open accounts, receive deposits, effect withdrawals and carry out other transactions is being embraced world over to deepen financial inclusion.

Under this innovation, financial inclusion is not limited to banking the unbanked but convergence of various bank and non-bank players to provide financial services at lower cost, a wider reach and greater convenience to all end consumers of financial services, unbanked or otherwise.

While the agency model is new to Uganda’s banking sector, companies that manufacture fast moving consumer goods largely use sales agents known as distributors or sales representatives in the countryside.

Note: Keep browsing this site for detailed analysis on how agency banking is set to boost financial inclusion

Hi Business Focus team,

I would like to establish contact with you.

Please let me know how i can get your telephone details

Regards