The introduction of the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) by Uganda Revenue Authority (URA) has led to an increase in the domestic revenue collections, the Auditor General, Edward Akol, has revealed.

This revelation is contained in the December 2025 Auditor General’s report that was laid before Parliament last week.

“The analysis implies that EFRIS has been pivotal to the increased VAT revenue collections. Whereas the system has been majorly implemented for VAT, it has tremendously impacted performance in other tax heads, such as Income Tax, since the information therein is used to confirm taxpayer declarations made in other tax heads, such as Income Tax and Withholding Tax. The plans to extend EFRIS to other sectors is a plausible idea as it is expected to impact revenue collections across the country,” the report says.

It adds that VAT revenue collections recorded slow growth before the introduction of EFRIS in the years 2017/18, 2018/19 and 2019/20, while a significant growth has been registered over the 5 years of implementation of the system.

An analysis into the VAT collection trends over eight years indicated that in FY2018/19, UGX5.125 trillion was collected, UGX4.581 trillion in FY2017/18, UGX5.638 trillion in FY 2020/21 and UGX5.010 trillion in FY2019/20. This was before the implementation of EFRIS.

However, after the introduction of EFRIS, UGX8.780 trillion was collected in FY 2024/25, UGX7.800 trillion in FY2023/24, UGX7.292 trillion in FY 2022/23 and UGX6.452 trillion in FY 2021/22.

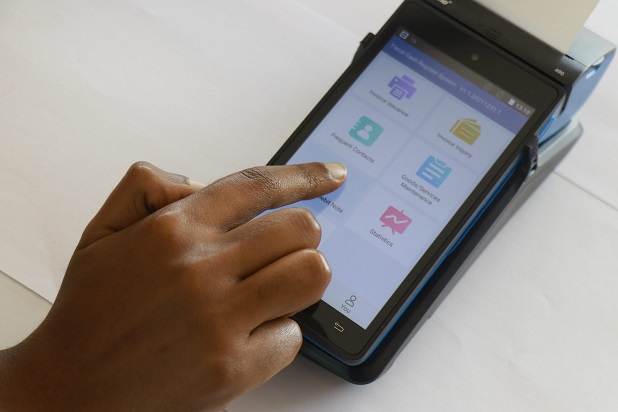

It should be noted that the EFRIS system was introduced in FY 2020/21 and initially mandatory for only VAT registered taxpayers. Effective July 2025, it was expanded to include other businesses (even non-VAT registered ones) operating within specific sectors, which include wholesale and retail of fuel, real estate, construction, and manufacturing.

The EFRIS system was introduced to digitise tax reporting, combat fraud (like invoice trading), and boost revenue by tracking all business transactions in real-time through mandatory e-invoices/receipts, moving businesses from paper invoices to electronic invoices, aiming for transparency and wider tax base inclusion.