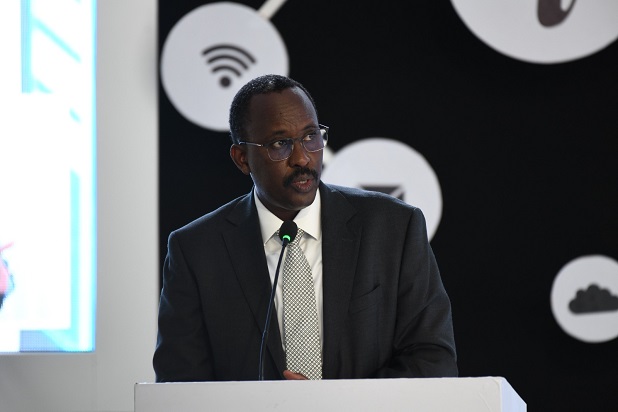

URA Commissioner General, John Rujoki Musinguzi

Uganda Revenue Authority has introduced a new tax compliance system that will help taxpayers maintain compliance and avoid adverse consequences. The domestic taxes compliance improvement plan (CIP) for the financial year 2024/25 lists 20 areas that, when not addressed by taxpayers, usually lead to inaccurate and incomplete returns.

This in turn attracts fines and penalties as as the taxpayer is declared non-compliant.

A part of URA plans to optimise revenue mobilisation, the CIP is a set of activities undertaken to address risks arising from taxpayer behavior that may undermine tax collection. Under the plan, a new initiative dubbed “Real-time Audit has been created to examine taxpayers’ transactions in real-time, and where irregularities are detected, prompt alerts will be sent to the taxpayer on how to address the said issue.

This means taxpayers will receive regular notifications called “Real-time Tax Advisories” (RTA), based on what URA will have discovered in its review. The RTAs will highlight potential tax implications and offer relevant guidance on how to resolve them. This will help taxpayers minimise their tax liability and ensure timely compliance with tax obligations, according to URA, meaning that it is advantageous to both parties.

“The Advisories are aimed at helping the taxpayers in reducing their exposure to additional taxes, interest, and penalties, by encouraging timely and accurate declarations and tax payment,” says a statement by URA. The system therefore seeks to facilitate taxpayers to access URA services like the Tax Clearance Certificate, the Authorised Economic Operator status, and tax exemptions, among others.

The system was informed by the fact that improper behavior by taxpayers adversely affects revenue mobilisation. Some behaviors that obstacles to revenue mobilisation have been identified by the CIP, and the related risks include suspicious and unexplainable loans in their balance sheet, when a trader is eligible for VAT registration but is not registered, and inaccurate registration details.

Others include Local Governments not declaring all employees in their Pay As You Earn returns, variances between sales declarations and VAT declarations, a trader who has not declared VAT on imported goods, overstated trade payables, businesses in gross loss positions and partners not registered for income tax.

In total, there are 20 areas of focus considered risks. URA urges taxpayers to review their internal controls in the said areas as they transact during the year to ensure the accuracy and completeness of their declarations. URA is bidding to meet the 32 trillion shilling target that was set by the government for the tax body this financial year, up from the 29.6 trillion target for last year, when the collector fell short by 2 trillion shillings.

-URN