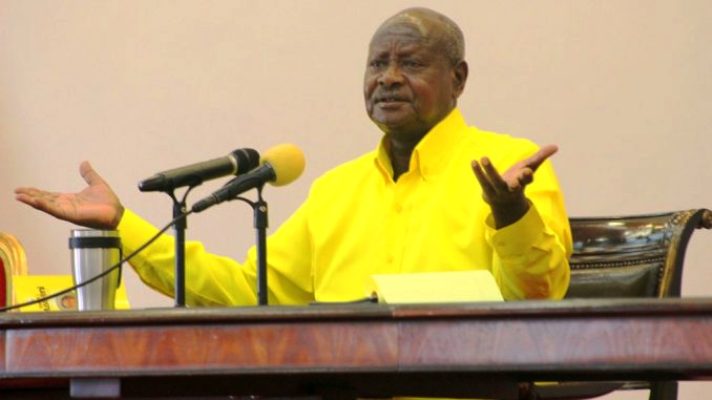

UBL Managing Director, Andrew Kilonzo

The Private Sector Foundation Uganda (PSFU) has released a report indicating that the high cost of Digital Tax Stamps continues to take a toll on manufacturers, with some closing operations, and thousands of jobs lost.

According to the report, there has been an increase in operational expenses incurred by manufacturers equivalent to an average of 16% of their Local Excise Duty obligations, hampering the growth and expansion of businesses. In addition, 56% of the manufacturers registered an increase in the cost of production and 50% of them reported diminished profitability

“The implementation of DTS led to a significant increase in the cost of operations for most manufacturers. These costs include the procurement of hardware, software, and infrastructure required for DTS compliance. These upfront investments have posed significant financial challenges for manufacturers, particularly Small and Medium Enterprises (SMEs) with limited capital resources,” reads part of the report.

While launching the DTS impact study report, Executive Director PSFU Stephen Asiimwe said most of the costs incurred are absorbed by the manufacturers and not passed on to the final consumers, for fear of the impact on consumer demand.

This, he said has led to business closure in some businesses such as alcoholic beverages manufacturers. Companies that have ceased operations due to high DTS costs according to Uganda Alcohol Industry Association (UAIA) include Global Distillers Limited, Four-Star Beverages Limited, Parambot Distillers Limited, Gama Distillers, Kasese Distillers and London Distillers Limited among others.

DTS costs vary across different products, for instance, DTS for wines and spirits are UGX 110 while UGX 13 and UGX 17 are charged on bottled mineral water and any other non-alcoholic drinks respectively.

“Uganda’s stamp prices, on average, are more expensive than those in the East African region by 38% yet all three countries share the same supplier, SICPA. Uganda also has more products gazetted for excise duty when compared to its neighboring countries; several businesses have closed impacting some manufacturers’ capacity to create more jobs, invest in additional infrastructure, and increase their production capacity,” said Asiimwe.

In Uganda, the use of DTS was rolled out in the Financial Year 2019/20 following the launch of the Domestic Revenue Mobilization Strategy by the Finance Ministry. DTS was also aimed at addressing revenue leakages.

The report

Conducted by PSFU in collaboration with PWC Uganda, the report indicates that in Kenya DTS prices are on average 28.7% lower than Uganda’s DTS, Rwanda’s (4.5%), Zambia’s (89.2%), and Tanzania’s DTS costs are 25.9% lower than Uganda’s.

Domestic Revenue (Local Excise Duty) collections continued to grow post the introduction of DTS but at a lower rate in comparison to the historical growth rate.

“Before the implementation of the DTS (Pre-DTS), LED collections experienced significant growth with a 12% increase, reaching Shs 2.13 trillion from July 2016 to June 2019. The analysis represents an overall LED revenue growth rate of 9% between July 2016 and June 2023.”

The Uganda Breweries Limited Managing Director Andrew Kilonzo called for a review of the implementation framework of DTS to achieve the best system at the least cost possible; as well, as a mechanism established for manufacturers and importers to recover incurred expenses.

“For UBL particularly, the cost of installation has been significant as both a machine and manpower are used to print and affix the digital tax stamps on the different range of product. The government must ensure that the implementation of Digital Tax Stamps does not disproportionately burden small-scale producers or consumers.”

UBL for example has since spent Shs451m to install stamp applicator machines in addition to over Shs 77b spent to date in buying stamps.

“This shows that at current rates we are spending an average of Shs20bn annually on stamps alone and another Shs 84m on incidentals. DTS is a significant revenue collection tool for the Government thus negatively impacting shareholder value.”

In addition, the company providing the DTS service to manufacturers in the EAC states is the same, but the cost of excise stamps is mysteriously disproportionately applied to different products in different countries