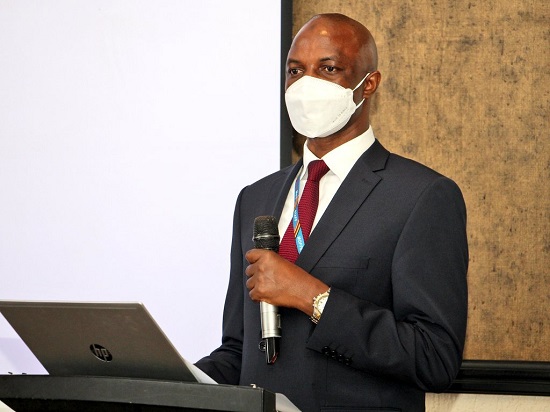

The Secretary to Treasury, Ramathan Ggoobi (pictured) has assured Ugandans in the diaspora that Government has no intentions of taking over or even taxing unclaimed balances in dormant Bank Accounts or Mobile Money Accounts.

Ggoobi made the remarks while addressing members of the Uganda North America Association (UNAA), a body formed by Ugandans in diaspora intended to promote the social, cultural and economic development of the Ugandan community.

This was after the Association put the Ministry of Finance to respond to what Government termed as misleading media reports that there were plans by Government to take depositors’ idle cash on dormant bank accounts under the National Payment System Act.

Ggoobi told UNAA that both the Finance Minister, Matia Kasaija and the Governor Central Bank, Prof. Emmanuel Tumusiime-Mutebile will jointly issue statement on this matter after rumours emerged that money is needed by Government to pay its debt, reports the Secretary to Treasury described as false.

In the August 2021 Monetary Policy Report authored by Bank of Uganda, the stock of public debt grew from Shs65.83 trillion ($17.96b) as of June 2020 to Shs70.3 trillion, representing an increase of Shs4.47 trillion in just one year.

“The legal framework which manages the financial system was designed to protect owners of money. Uganda is among the few Sub-Saharan Africa Countries with a sustainable debt portifolio. I encourage Ugandans in the diaspora to come & invest at home & take advantage of available opportunities,” said Ggoobi.

It should be recalled that in May 2020, Parliament passed into law the National Payment Systems Bill 2019 into law, and President Museveni proceeded by signing the legislation into law, making it the first official law to regulate mobile money, since it’s inception in 200.

Clause 57 of the National Payment Systems Act prescribes how financial institutions can handle the matter of money on dormant accounts.

Clause 57 (1) stipulates that; An electronic money account that does not have a registered transacton for nine consecutive months shall be considered dormant.

The Act further stipulates; 57(2) An electronic money issuer shall, in relation to an account customer that the electronic money account is blocked and provide;

(1) An electronic money account that does not have a registered shall not permit further transactions until the account is reactivated by after blocking of the electronic money account, give notice to the instructions on the process of re-activaton of the account.

Further the Act states in 57(2); An electronic money issuer shall, in relation to an account month before the period specified in subsection (l), that the electronic money account shall be suspended unless there s a transaction on the referred to in subsection (1), give notice to the customer of at least one month before the period specified in subsection (1) that the electronic money account shall be suspended unless there is a transaction on the account.

In clause 57(3); upon the expiry of the notice referred to in subsection (2), the electronic money issuer shall block the electronic money account and shall not permit further transactions until the account is reactivated by the customer.

Additionally, in clause 57(4) The electronic money issuer shall within five working days after blocking the electronic money account, give notice to the customer that the electronic money account is blocked and provide instructions on the process of re-activaton of the account.

In clause 57(5) Where the account is not reactivated within six months after it has been blocked, the electronic money issuer shall close the electronic money account.

The Act further stipulates in 57(6); Upon closure of the electronic money account under subsection (5), the trustees shall transfer the balance of an electronic money account and identifying information to the central bank.

The Act in 57(7) compels Bank of Uganda to refund the money reading in part; The central bank shall refund any unclaimed balances to a holder of an electronic money account or, if the holder is dead, his or her legal representative, upon a request made within seven years after the dormant account is transferred to the Central Bank.

However, if no claim is made on the money after seven years, it automatically reverts back to the consolidated fund.

In February 2020, MTN Uganda reported that it had Shs7.5Bn on dormant accounts.