John R. Musinguzi, the URA Commissioner General addressing the press today

Uganda Revenue Authority (URA) recorded Shs4.07 trillion net revenue collections in the first quarter of 2020/2021 (July to September 2020) against a target of Shs2.99 trillion, thus representing a performing of 135.69%.

This was disclosed by John R. Musinguzi, the URA Commissioner General while addressing the press about Taxpayers Appreciation Season 2020 and the tax body’s performance for the first three months of 2020/21 Financial Year. The event was held at URA’s headquarters in Nakawa on Tuesday morning.

The URA boss noted that a significant surplus of Shs1.07 trillion was posted during the period under review.

“Revenue growth of Shs64.8bn (1.64%) was registered during the period July to September 2020 compared to July to September 2019,” Musinguzi revealed.

This financial year 2020/21 (July 2020 to June 2021), URA is expected to collect Shs19.69 trillion (revised), compared to what was targeted last financial year 2019/20 at Shs20.34 trillion.

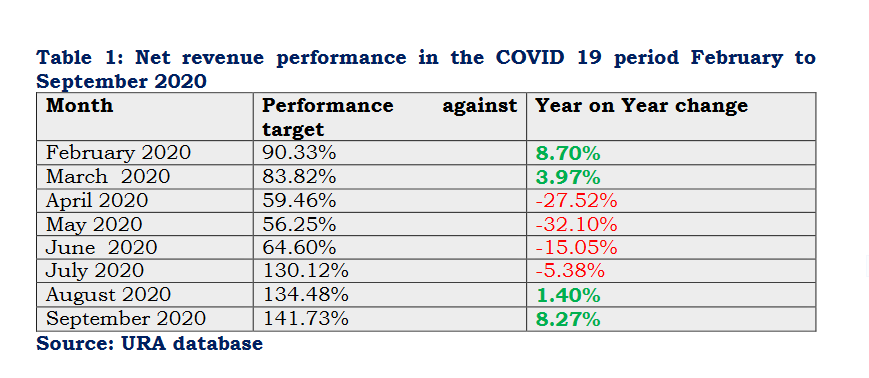

URA boss noted that the growth registered in September 2020 (8.27%) and August 2020 (1.40%) shows resurgence from the impact of COVID-19.

According to URA, declines in revenue were posted in April, May, June and July 2020 as a result of the COVID-19 pandemic.

URA says domestic taxes collections during the period July to September 2020 were Shs2.45trillion, performing at 131.66% and Shs590.75bn above the target.

“In addition, the domestic taxes collection registered a growth of Shs51.01bn (2.12 percent) during July to September 2020 compared to the period July to September 2019,” Musinguzi said.

He revealed that International trade tax collections in July to September2020 were Shs1.714 trillion, performing at 138.87 percent with a surplus of Shs479.79bn.

When compared to the period July to September 2019, customs tax collections grew by Shs23.93bn (1.42 percent) in July to September 2020.

How various sectors performed

In the period July to September 2020, 75.88% of the revenue collected was from the top five sectors.

“The wholesale and retail sector contributed 30.66%, the manufacturing sector contributed 23.17%, 9.30% of the revenue was from the information and communication sector, while the financial and insurance services contributed 7.69% to the revenue in the period,” URA boss revealed, adding: “Public administration sector contributed 5.06%. There was growth in revenue in some key sectors like manufacturing which grew by 18.54%, information and communication grew by 20.49% ,while revenue from the wholesale sector grew by2.30%.”

He added that significant declines in revenue were registered in some sectors.

According to URA, revenue from accommodation and food services declined by 58.82%, education sector declined by 31.94%, revenue from Arts, entertainment and recreation declined by 55.59%, while a decline of 33.56% was registered under water supply.

URA attributes the decline to a slowdown in business in these sectors owing to COVID-19 induced lockdown and restrictions.

Reasons For The July-September 2020 Revenue Performance

Musinguzi revealed that Local Excise Duty contributed a surplus of Shs107.87bn, which was mainly from mobile money transfers (Shs17.52bn surplus), phone talk time (Shs12.51bn surplus), beer (Shs27.69bn surplus) and Over the Top (Shs8.27bn).

“The surplus can be explained by increased transactions via phone through voice and text owing to limited movement of people amidst the COVID-19,” Musinguzi said, adding: “Beer production increased by 7.34% in the period, which was matched by an increase of 6.5% in beer sales.”

He noted that VAT collections were above target by Shs179.35bn.

“Cement contributed a surplus of Shs28.53bn, phone talk time, a surplus of Shs17.89bn, wholesale and retail a surplus of Shs22.56bn while spirits registered a surplus of Shs12.84bn,” he said.

He noted that the ongoing infrastructure developments in the country have boosted demand for cement leading to an increase in sales by 28.63%.

The production and sale of spirits increased by 42.77% and 45.68% respectively, owing to spirits being a raw material to the highly demanded sanitizers, URA said.

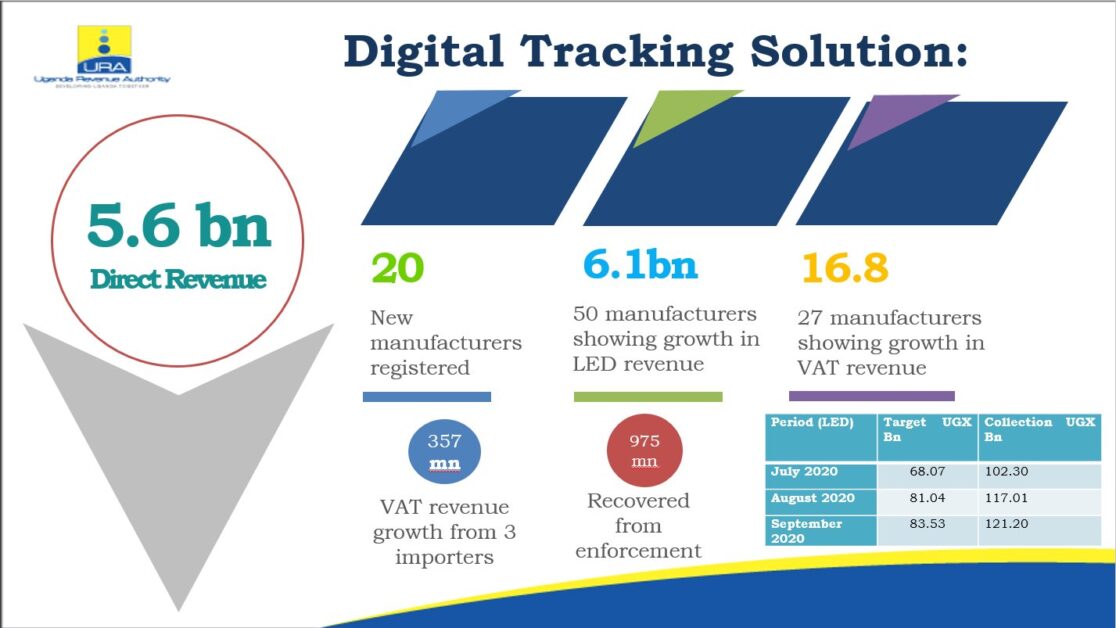

The URA boss further revealed that the implementation of the Digital Tracking Solution (DTS) boosted collections and has aided the enforcement and tracking of locally manufactured and imported products.

“Corporation tax registered a surplus of Shs35.2bn which is mainly attributed to URA’s pursuit of the alternative dispute resolution as a way of resolving outstanding tax matters,” he said.

Musinguzi noted that International trade taxes performed above target as result of the reopening of economies and supply chains.

“Uganda’s imports grew by 31.89% in July to September 2020, compared to the same period in 2019,” Musinguzi said, adding: “Imports increased by 7.41%, which explains the international trade performance.”

The URA boss revealed that in a bid to increase compliance and influence taxpayers’ behavior, various tax administrative measures have been implemented to support revenue generation. These include; Integrity Enhancement, Voluntary disclosure, Enforcement operations, Alternative Dispute Resolution and Full implementation of compliance initiatives like the Electronic Fiscal Invoicing and Receipting Solution (EFRIS), and the Digital Tracking Solution.

“The integrity function has been upgraded and strengthened to focus on effective staff compliance management and ZERO tolerance to corruption. Staff are continuously engaged and urged to work with Integrity, Patriotism and Professionalism,” Musinguzi said.

He added: “Since we started the Voluntary disclosure, a total of Shs16.5bn has been recovered. We urge taxpayers to take advantage of the Voluntary Disclosure program at the earliest time possible before URA commences aggressive compliance actions.”

He revealed that despite the interruption of the COVID-19 pandemic from March 2020, DTS has resulted into increased enrollment of taxpayers for the DTS gazette products.

“During the first Quarter of the FY 2020/2021, we have continued to embrace the use of Alternative Dispute Resolution (ADR) mechanisms in resolving some of the disputes with taxpayers. Significant achievements were registered in this area with some cases being resolved amicably out of Court/ Tax Appeals Tribunal. During this period, more than Shs100bn has been collected through amicable settlements. ADR provides a win-win solution to both the taxpayer and URA,” Musinguzi said.

He added: “We, therefore, encourage taxpayers to embrace the use of Alternative Dispute Resolution mechanisms by approaching us with feasible proposals for settlement of the disputes with URA for discussion. We are more than ready to pursue this approach.”

Outlook For The Financial Year 2020-21

Musinguzi noted that URA has a huge task ahead as the authority is expected to collect Shs4.4 trillion in tax revenue in the second quarter of 2020/2021.

He noted that going forward, URA “will continue to focus on promoting accountability among our human resource to ensure that we all serve with Integrity, Patriotism, Professionalism and total commitment.”

“ We have negative tolerance to corruption and I am calling upon the public and the taxpaying community to join us in this struggle,” he said.

The URA boss added that URA will leverage on the use of technology to hit its revenue collection targets.

“We have introduced and we will continue to promote the use of technology to enhance the taxpayers’ experience and Revenue Administration,” he said.

He added: “We are therefore putting more emphasis on the use of technology in the following areas; (i)Surveillance for wider coverage of porous borders by use of satellite technologies, Regional Electronic Cargo Tracking System, drones and enhanced cross-border intelligence information exchange.(ii)Increased automation of the key business processes. As you may be aware, we have introduced the Auto-conversion of the transit entries (WT8) into ware housing entries (IM7). This auto-conversion will therefore mean that, all transit entries after “validation” will automatically assess into warehousing entries, except for government project cargo. This change will lead to reduced clearance time at arrival by over 48 hours, instant cargo offloading and examination at warehouse, less cumbersome clearance of cargo from the warehouse, improved cargo and bond control and monitoring. The general public is therefore hereby informed of this major change in Customs Clearance process.(iii)Enhanced use of technology to improve service delivery. The focus will be improved accessibility and simplicity of our services. (iv) Tax education. We recognize that tax education remains a major area of focus for us to ensure that the taxpayers fully understand their rights and obligations. We will therefore deploy a number of technologies to educate the public and taxpayers. This will also include the online tax education webinars and “How To” video tutorials of our services that we have already rolled out. I want to thank the public that have enthusiastically embraced the online approach of engagement given the current dispensation.(v)Data analytics. We will continue to focus on use of data analytics to enhance our efficiency in evidence based decision making. (vi) Continued Rollout of DTS and EFRIS We are continuing to increase the onboarding of clients on Digital Tracking Solution (DTS),Electronic Fiscal Receipting and Invoicing Solution (EFRIS) and also increase coverage of more products and services.”

Musinguzi added that URA will also focus on capacity building and skilling of staff technical competences.

“We continue to skill our staff and build core specialized tax capabilities in core business areas such as tax audit, tax investigation, taxation of the digital economy, International tax and data analytics focusing on a data-driven approach to promote revenue generation and enhanced voluntary compliance,” he said, adding stakeholder collaboration and engagements will also be given priority.

“We have embarked on improving our stakeholder relations and engagements with the private sector and government agencies to leverage on each other’s strength in achieving our objectives. Key areas of collaboration are in information exchange, system integrations and capacity development,” he said.