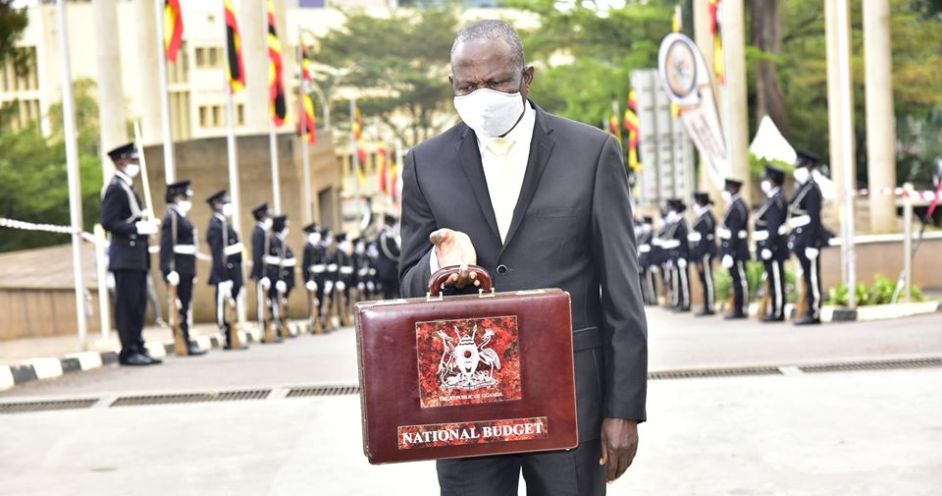

Uganda’s Finance Minister, Matia Kasaija

The East African countries national budgets for 2020/21 Financial Year will play a key part in boosting increase production and improving purchasing power, experts have said.

While discussing the different budget allocations from East African states, in a virtual webinar organised by EY Uganda, Michael Kimoni, the Country Director of EY Uganda said many of EAC’s budgets have emphasized production through a number of tax amendments aimed at widening the tax base and improving livelihoods.

“A lot of disruptions have been evident in the supply chain remittances due to the COVID-19 pandemic. East Africa budget proposals have put more emphasis on boosting production,” Kimoni said.

Fred Muhumuza, an Economist and Researcher said that government’s emphasis on production should be coupled with addressing the market side signals including creating more demand to increase employment opportunities and balance between anticipation and real practice.

While discussing the budget proposals, Sarah Chelangati, from EY, said that the focus on industrialization will go a long way in boosting employment and foster growth.

She said that in the Ugandan budget estimates, tax bodies have dwelled more on tax amendments, new tax regimes among others which she said will allow a reduction in the purchase expenses.

Chelangati further added that the requirements for tax exemptions including annual declaration of tax returns, exemptions like VAT on agriculture supplies, charitable donations among others will support players who have not been performing well during the lockdown.

In comparison with other East Africa states, Hamza Ssali, Tax partner at EY, said that though regional budget proposals target measures to widen the tax base, they have also introduced exemptions.

He said that Kenya has proposed exemptions on services to ambulance services, maize tariffs etc while Tanzania introduced VAT exemptions on agriculture crop insurance to ensure recovery of input tax and to support producers to remain competitive.

By Drake Nyamugabwa