The banking sector registered impressive results in 2019 compared to 2018 despite loss-making banks increasing from five to seven.

For starters, Uganda currently has 26 commercial banks. However, this analysis focuses on 25 banks given the fact that Afriland First Bank Uganda Limited joined the Ugandan market effective September 12, 2019.

Opportunity Bank Uganda Limited was also elevated to a tier one institution effective September 13, 2019 and has been captured in this analysis because it has been operating in Uganda for many years unlike Afriland.

According to the 2019 financial statements released by banks between March and May 2020 and analysed by Business Focus, banks became more profitable posting Shs906.13bn net profit in 2019, up from Shs793.7bn recorded in 2018. The Shs906.13bn was recorded by 18 banks.

The results also show that seven banks made a whopping loss of Shs56.9bn in 2019, up from Shs39.31bn loss registered in 2018 by five banks.

All key performance parameters were positive for the industry although Non-Performing Loans increased in absolute figures.

Most profitable banks ranked

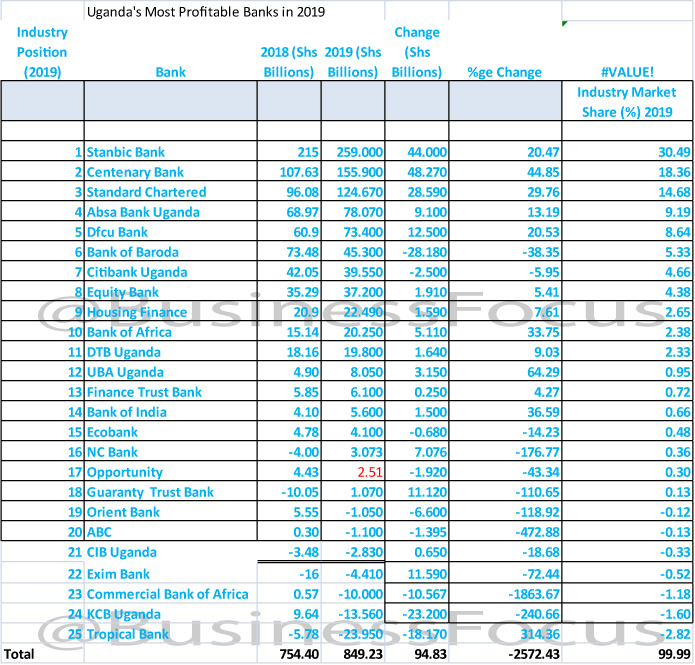

According to Business Focus analysis, Stanbic Bank Uganda is Uganda’s most profitable bank again. Patrick Mweheire, who left the bank as CEO in March 2020 ensured that the bank posted impressive results, recording Shs259bn profit in 2019, up from Shs215bn in 2018.

This represents 20.47% growth. In terms of industry profit market share, Stanbic that is currently headed by Anne Juuko as CEO controls the market with 30%.

Commenting about the results, Mweheire said: “We delivered another great performance and were able to improve on all our key performance goals. …Our revenues grew 20% year-on-year to exceed Shs800 billion and were well diversified between lending and non-lending revenue…We ultimately achieved a cost to income ratio of 49%; indicative of the solid operating leverage in the business. Risk was well managed along key risk types with a final credit loss ratio of 1.5%.”

Centenary Bank, an indigenous financial institution that is headed by Fabian Kasi has cemented its second position in as far as most profitable banks in Uganda are concerned. The bank recorded Shs155.9bn profit in 2019, up from Shs107.63bn recorded a year earlier, representing a growth of 44.8%.

Centenary is followed by StanChart that saw its profits increase by 29.76% to Shs124.67bn in 2019, up from Shs96.08bn recorded a year earlier.

StanChart is headed by Albert R. Saltson as CEO. The increase in profit can be attributed to the bank’s leverage on technology and minimizing NPLs.

In 4th position is Absa Bank Uganda (formerly Barclays) that is now headed by seasoned banker, Mumba Kalifungwa. The bank registered a 13% growth in profit after tax, from Shs69bn in 2018 to Shs78bn in 2019. On factors behind the performance, Kalifungwa said: “… We continue to drive cost efficiencies and manage our portfolio quality as a base for strong earnings. The bank earned more revenue by strategically diversifying income streams and developing a good asset mix which delivered a strong competitive advantage.”

ALSO READ: 40 Women In Top Banking Positions Named

dfcu completes the league for the top five most profitable banks in Uganda. Headed by Mathias Katamba, dfcu registered a 21% growth in profitability from Shs60. 9bn in 2018 up to Shs73.4bn in 2019.

On factors behind the increase in profits, Katamba said: “We focused on cutting down our operating costs by 4% from Shs202bn in December 2018 to Shs193bn in December 2019, in addition to reducing our funding costs by 7% in terms of interest expenditure from Shs105bn to Shs97.6bn giving rise to a 4% growth in net operating income from Shs306bn in December2018 to Shs319bn in December 2019. This effectively set the Bank on a solid footing to further harness institutional capabilities going forward.”

Shockingly, the top five most profitable banks control over 80% of the total industry profits.

The other banks that complete the top 10 most profitable banks in Uganda as of December 2019 include Bank of Baroda (Shs45.3bn), Citi bank (Shs39.55bn), Equity Bank (Shs37.2bn), Housing Finance Bank (Shs22.49bn) and Bank of Africa (Shs20.25bn).

From the above analysis, only two indigenous banks make it among the top 10 most profitable banks in Uganda; Centenary and Housing Finance Bank that is headed by Michael K. Mugabi, a Ugandan seasoned banker.

The locally bred financial institution has expanded from just a single branch to reach its customers across the country with 19 branches, Interoperability with over 200 ATMs and several hundred bank agents.

Important to note is that there are only two female CEOs heading banks that made it to the top 10; Anne Juuko of Stanbic and Sarah Arapta of Citi bank.

Other banks that recorded profits are Diamond Trust Bank, UBA, Finance Trust Bank, Bank of India, Ecobank, NC Bank, Opportunity and Guaranty Trust Bank.

It is worth noting that Ecobank that is headed by Clement Dodoo as Managing Director and Annette Kihuguru as the Executive Director posted profits for the 4th year running. All key performance parameters for the Pan-African bank were positive.

Banks In Red

Guaranty Trust Bank headed by Olaken Sanusi as Managing Director and NC bank headed by Sam Ntulume made profits after years of posting losses. NC made Shs3.073bn profit in 2019, up from Shs4bn loss recorded in 2018, while Guaranty Trust Bank made a profit of Shs1.07bn in 2019, up from Shs10.05bn loss in 2018.

Tropical bank recorded the highest losses in 2019; Shs23.95bn from Shs5.78bn loss registered in 2018.

This means that the bank’s losses increased by 314.36%. Tropical bank bosses including Abdulaziz Mansur, the Managing Director and Dennis M. Kakeeto, the Executive Director have a huge task of turning around the bank that has been posting losses for the last five years. Recently, the bank said it posted over Shs2bn profit in the first quarter of 2020. However, it remains to be seen how they will turnaround the bank and post profits sustainably.

From the bottom table, Tropical is followed by KCB that is headed by Edgar Byamah as Managing Director.

While it looked like the bank that entered the Ugandan market over 10 years ago had stabilized, KCB made a whopping loss of Shs13.56bn in 2019, from a profit of Shs9.64bn in 2018.

The loss could be due to NPLs that increased to Shs22bn, up from 8.27bn recorded a year earlier. However, industry sources say KCB’s performance hasn’t been impressive due to management issues and poor strategy.

Commercial Bank of Africa (CBA) enjoys the 3rd position from the bottom table, having recorded Shs10bn loss in 2019 down from Shs567m profit recorded in 2018.

Headed by Anthony Ndegwa as CEO, CBA’s bad loans written off increased to Shs14.1bn from Shs1.15bn in 2018.

Exim Bank that is headed by Sabhapathy Krishnan Triplicane as CEO also continues to post losses; the bank made a loss of Shs4.41bn from Shs16bn loss recorded in 2018.

Exim is followed by Cairo International Bank that made a loss of Shs2.83bn in 2019 from Shs3.48bn in 2018.

ABC Capital Bank returned to making losses after the bank posted Shs1.1bn loss from Shs295m profit in 2018. ABC is headed by Jesse Timbwa as CEO. The bank’s NPLs increased to Shs1.7bn in 2019, up from 614.9m in 2018.

Having posted Shs5.55bn net profit in 2018, Orient Bank made a loss of Shs1.05bn in 2019.

This is after the bank’s NPLs increased to Shs60bn from 14.8bn in 2018. Headed by Kumaran Pather as Managing Director, Orient bank’s other key performance parameters were positive.

Outlook for 2020

Commenting about 2020 outlook, Albert R. Saltson, the Managing Director of StanChart said: “2020 is a challenging year for the global and local economy arising from the impact of COVI-19 pandemic. We remain resilient and committed to stand with our clients, staff, vendors and other stakeholders to navigate these unprecedented times.”

On his part Housing Finance Bank boss Mugabi said they are cognisant of the current challenges presented by the COVID-19 pandemic and its impact on all Ugandans.

“However, with our dedicated team of staff, guidance from the Board of Directors, we remain committed to the delivery of practical solutions and interventions that will support our customers during this time and the years ahead,” he said.

Stanbic’s Juuko said: “In the wake of the global COVID-19 pandemic, we recognise the impact this will have on the lives of many Ugandans and the economy. We are looking at several interventions that can support our customers and work closely with the Government of Uganda to ensure a minimised impact on the economy.”

dfcu Bank’s Katamba said: “We are cognizant of the ongoing global COVID-19 pandemic that may adversely impact the operating environment by majorly disrupting global supply chains, transport and travel. But with guidance and support from our Board, strong management team and dedicated staff, we remain focused on driving efficiency to harness institutional capabilities and growth.”

For tips or feedback on this story, reach out to us via staddewo@gmail.com/0775170346, follow me @TaddewoS @BusinessFocusug

Thanks