By Godfrey Kenneth Gobba

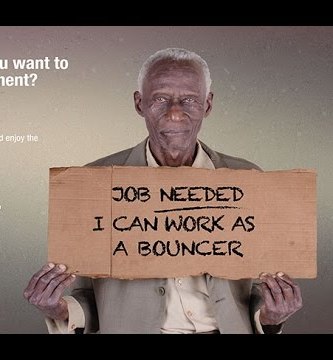

Placing All Your Bets On Social Security

“I don’t need to worry about retirement because I have social security and my company payout is a mouth watering figure,” some people say.

But do you personally know someone or have heard of someone who retired, received their social security benefits, but five years down the road, they could not afford their medical bills?

Or even better, do you know someone or heard of someone who lost their job nine months before retirement and for one reason or another lost their company retirement benefits?

Social Security and Company benefits are heavily dependent on the regulatory environment and company policy. In simple terms, you really have no control over any of that money.

Take control of your own financial future and make your own retirement preparations.

Let NSSF and that company payout be an added bonus or your Plan B and not your life line or your Plan A.

Putting All Your Eggs In One Basket

Chances are that nine out of every 10 people that you know have all their money in either a couple of baskets or a bunch of baskets that are closely correlated.

If you put all your eggs in one basket and that basket gets crashed by a water melon, it could get really messy.

So if you make the mistake of putting all your eggs in Social Security or your poultry farm or your land, you augment the risk of facing a messy situation if your baskets ever got crashed by a falling asteroid.

Diversify and do it efficiently.

Ignoring The Inflation Factor

Many of us studied about this 9 letter word way back in school. We often use it when we complain about the increasing fuel prices or the escalating UMEME rates and if we are running some sort of business we use it to justify an increment in our prices

However, we tend to sail through life completely oblivious to what this cancerous 9 letter word is doing to our money.

If you make the mistake of ignoring inflation, you face the risk of not being able to afford the kind of lifestyle you want to enjoy during your retirement.

Waiting For Next Year To Start Preparing

We all procrastinate at some point in time, well at least those of us that are human.

We are smart, well educated, widely read hard working people. So we at least have a vague idea of what we need to do in order to have a comfortable retirement.

We may not have the best idea but at least we have a clue.

But then, we keep on procrastinating until we are left with one year to retirement.

Panic then sets in once we realize that our monthly salary privileges will soon expire and we are not ready at all. This is when someone who has had a clean working record for the past 20 years or so starts getting tainted with corruption or fraud scandals that ruin their long and clean working career.

If you make the mistake of delaying preparations for your retirement, you can be assured of running out of money during your retirement. It may take you three years or six years or even 15 years, but it will happen.

Don’t wait. Act now while you still have the time and the monthly income privileges.

Ignoring Professional Help

If you are reading this, you are probably a professional in a certain field or have specialized knowledge that can solve a particular special problem.

You also probably have a professional mechanic to take care of your car, a professional doctor to take care of your medical issues, a professional barbeque guy to do his thing when you host parties, a professional tech guy to take care of your gadgets etc.

Just like you know a lot about your particular field, there are also professionals out there that have specialized knowledge about Investments and Retirement that you probably don’t have and can make things a lot easier for you.

If you make the mistake of ignoring professional help, you face the risk of doing shoddy amateur work with your financial future.

You definitely don’t want to be doing that.

The author is CEO, African Investor Academy

Email: godfrey@theinvestmentguru.co.ug