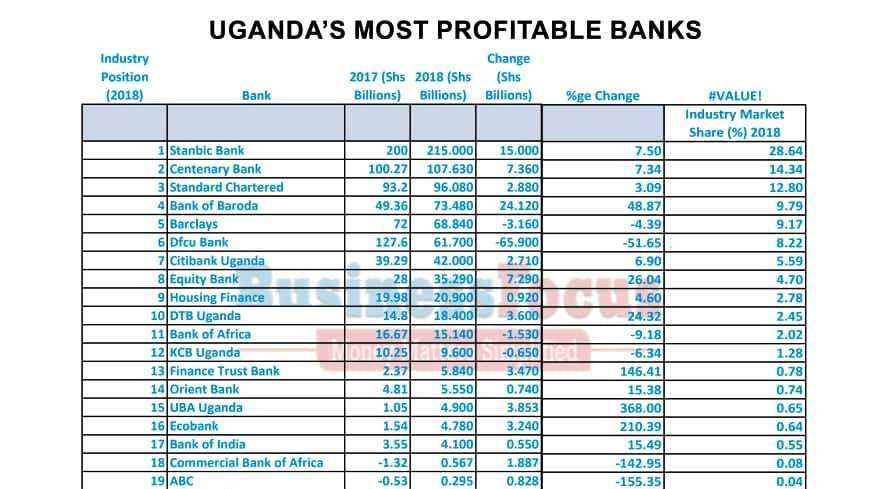

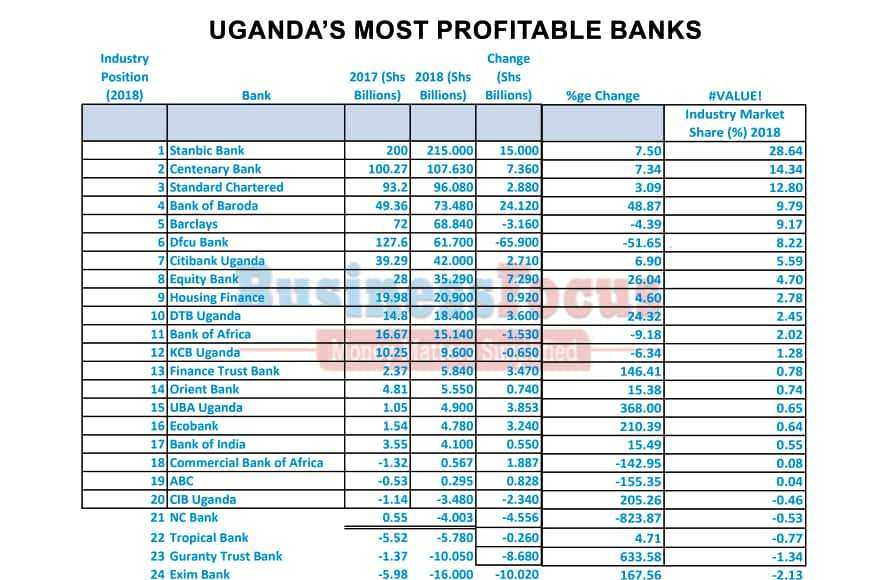

Uganda’s banking industry continued to recover from turbulent times in 2018 by posting generally impressive results. According to industry figures analysed by Business Focus, out of 24 banks, 19 banks recorded net profits of Shs790.092bn in 2018 compared to the 17 banks that posted a profit of Shs785bn in 2017. This analysis is based on the 2018 financial statements banks released recently.

This means that loss-making banks reduced from seven (7) to five (5) in 2018. However, whereas the seven banks made a total loss of Shs15.86bn in 2017, the five-loss making banks in 2018 made a total net loss of Shs39.31bn.

This means that the total industry net profit stood at Shs750.7bn in 2018.

Most key performance indicators including customer deposits, loans advanced to customers and assets were positive for the banking industry, thanks to the recovery of the economy that saw the economy grow to about 6% in 2018. Consequently, industry Non-Performing Loans (NPLs) reduced to Shs388.24bn in 2018, down from Shs577.73bn recorded a year earlier.

Most Profitable banks

Headed by Patrick Mweheire as Chief Executive Officer, Stanbic Bank Uganda remains Uganda’s most profitable bank. Its profits increased by 7.5% to Shs215bn in 2018, up from Shs200bn recorded a year earlier.

Stanbic controls 28.64% of the total industry profit market share.

Speaking about the results, Mweheire noted that his bank has heavily invested in a customer centric model of operation. This, he said, enabled the bank to create innovative solutions and channels which have helped improve convenience for the customers while bringing down transaction costs.

Centenary bank has also remained among the big boys in Uganda’s banking industry. Its shareholders must be happy with the job well done by Fabian Kasi, the banking Managing Director. In 2018, Centenary bank overtook dfcu bank as Uganda’s 2nd most profitable bank after posting a net profit of Shs107.6bn, up from Shs100.27bn.

In 3rd position is Standard Chartered Bank aka StanChart.

Headed by Albert Saltson as theChief Executive Officer, StanChart has been grappling with high NPLs in recent years. When Saltson replaced Herman Kasekende in early 2017, NPLs were choking the bank.

He has done a commendable job of reducing NPLs to Shs22.2bn in 2018, up from Shs78.6bn in 2018.

This saw the bank post a net profit of Shs96.1bn from Shs93.2bn recorded a year earlier.

Bank of Baroda that is headed by Aswini Kumar as Managing Director moved two places to become the 4th most profitable bank in 2018.

Its profits increased by 48.87% to Shs73.48bn in 2018 up from Shs49.36bn in 2018.

Barclays maintained its 5th position in as far as Uganda’s most profitable banks is concerned. Its profits reduced by 4.39% to Shs68.84bn from Shs72bn in 2017.

Barclays is headed by Rakesh Jha as Managing-Director.

What is shocking is that the top five most profitable banks control 74.74% of the total industry profits. Additionally, these banks are headed by men!

dfcu bank that was the 2nd most profitable bank in 2017 now enjoys the 6th position. Its net profit fell by 51.65% to Shs61.7bn in 2018, down from Shs127.6bn recorded a year earlier.

This means seasoned banker, Mathias Katamba, who officially replaced Juma Kisaame in January this year has a huge task of meeting shareholders’ expectations by ‘fixing’ issues affecting the bank’s performance.

Citibank Uganda’s profits increased to Shs42bn from Shs39.3bn, making it the 7th most profitable bank.

It is headed by Sarah Arapta as Managing Director.

Having entered the Ugandan market over 10 years ago, the ambitious Equity bank maintained its 8th position. Its profits increased by 28.04% to Shs35.3bn in 2018, up from Shs28bn in 2017.

Equity Bank Uganda is headed by Samuel M. Kirubi as Managing Director. He is deputized by Anthony M. Kituuka as Executive Director.

In 9th position is government owned Housing Finance Bank (HFB). Headed by Michael K. Mugabi as Managing Director, HFB’s profits increased to Shs20.9bn in 2018, up from Shs19.98bn.

Diamond Trust Bank completes the top 10 most profitable banks after posting Shs18.4bn in 2018, up from Shs14.8bn a year earlier.

Also shocking is the fact that out of these 10 banks, only one is headed by a woman (Sarah Arapta of Citibank).

Additionally, the above 10 banks control 96.03% of the industry market share in as far as profits are concerned.

It is also important to note that United Bank for Africa (UBA) and Ecobank recorded profits for the third year running after posting unimpressive results in the past years.

Headed by Johnson Agoreyo as Managing Director, UBA’s profits increased to Shs4.9bn in 2018, up from Shs1.05bn in 2017.

Ecobank that is headed by Clement Dodoo as Managing Director saw profits increase to Shs4.78bn in 2018 from Shs1.54bn recorded a year earlier.

Finance Trust Bank that is headed by Annet Nakawunde Mulindwa (the other woman leading a bank) also recorded an increase in profits to Shs5.84% from Shs2.37bn.

Orient Bank that is headed by Julius Kakeeto as Managing Director also registered an increase in profits; it posted Shs5.55bn net profit from Shs4.81bn.

Loss-Making Banks

In 2018, five banks remained in the red compared to seven in 2017.

The five banks made a whopping net loss of Shs39.31bn.

From the bottom of the top, Exim Bank leads the chart. Its net loss increased by 167.56% to Shs16bn up from Shs5.98bn loss recorded in 2017.

Sabhapathy Krishnan Trplicante, the CEO of Exim bank has a huge task of turning around this institution that is reportedly plagued with a lot of issues including hiring of ‘incompetent staff to key positions’.

Second from bottom is Guaranty Trust Bank that is headed by Olaken Sanusi as Managing Director. The bank that has had mixed results for several years saw its losses increase to Shs10.05bn up from Shs1.37bn in 2017.

Troubled Tropical bank enjoys the 3rd position from the bottom table. Its losses increased to Shs5.78bn up from Shs5.52bn. There are hopes though that Dennis Mugagga Kakeeto, the Acting Managing Director will fix the issues undermining the bank’s performance.

Kakeeto replaced Sameh M. Krekshi, who was fired last year on orders of Bank of Uganda (BoU).

According to the termination letter dated October1, 2018, Gerald M. Ssendaula, the Bank’s Board Chairman accused Krekshi of overdrawing his account contrary to BoU regulations.

NC Bank takes the 4th place in as far loss-making banks are concerned in Uganda. The bank made a whopping loss of Shs4bn in 2018 from a profit of Shs553m in 2017.

Troubled Cairo International Bank (CIB) completes the bottom table of loss-making banks. CIB Uganda is headed by Ahmad Maher Nada as Managing Director. Its losses increased to Shs3.48bn from Shs1.14bn in 2017.

Check out table for details about Uganda’s most profitable and loss making banks.

As always, we’ll keep you posted with unmatched analysis on banking sector performance in 2018.

These Banks are putting alot of transactional charges which may not be affordable to the low income earners who constitute the biggest percentage of the Ugandan this calls for the review of their model of the business approach on their operation in order to tap into the bigger percentage of population.