Uganda’s commercial banks have been releasing their 2016 financial results in the past few months as prescribed by the law.

Business Focus has critically analysed the results of the 24 banks, taking into account key performance parameters such as profits, customer deposits, loans advanced to customers, bad loans written off, total assets and Non-Performing Loans (NPLs) among others to bring to you the best and worst performing banks in Uganda as of 2016.

It is worth noting that 2016 was hard year not only for the banking sector but the economy at large; it was characterized by election fever, high interest rates, Shilling depreciation and a number of other macro-economic factors that saw a number of companies become financially distressed.

GDP growth for 2016 has been revised downwards from the initial projection of 5% to 4.5% largely due to a sluggish economy.

The year saw Crane Bank, one of the then leading banks in Uganda collapse after it became ‘significantly undercapitalized’. The bank collapsed after recording a whooping Shs3.1bn loss in 2015, down from a net profit of Shs50.6bn in 2014. This was a result of high NPLs that increased by 122.9% to Shs142.3bn in 2015, up from Shs19.36bn in 2014.

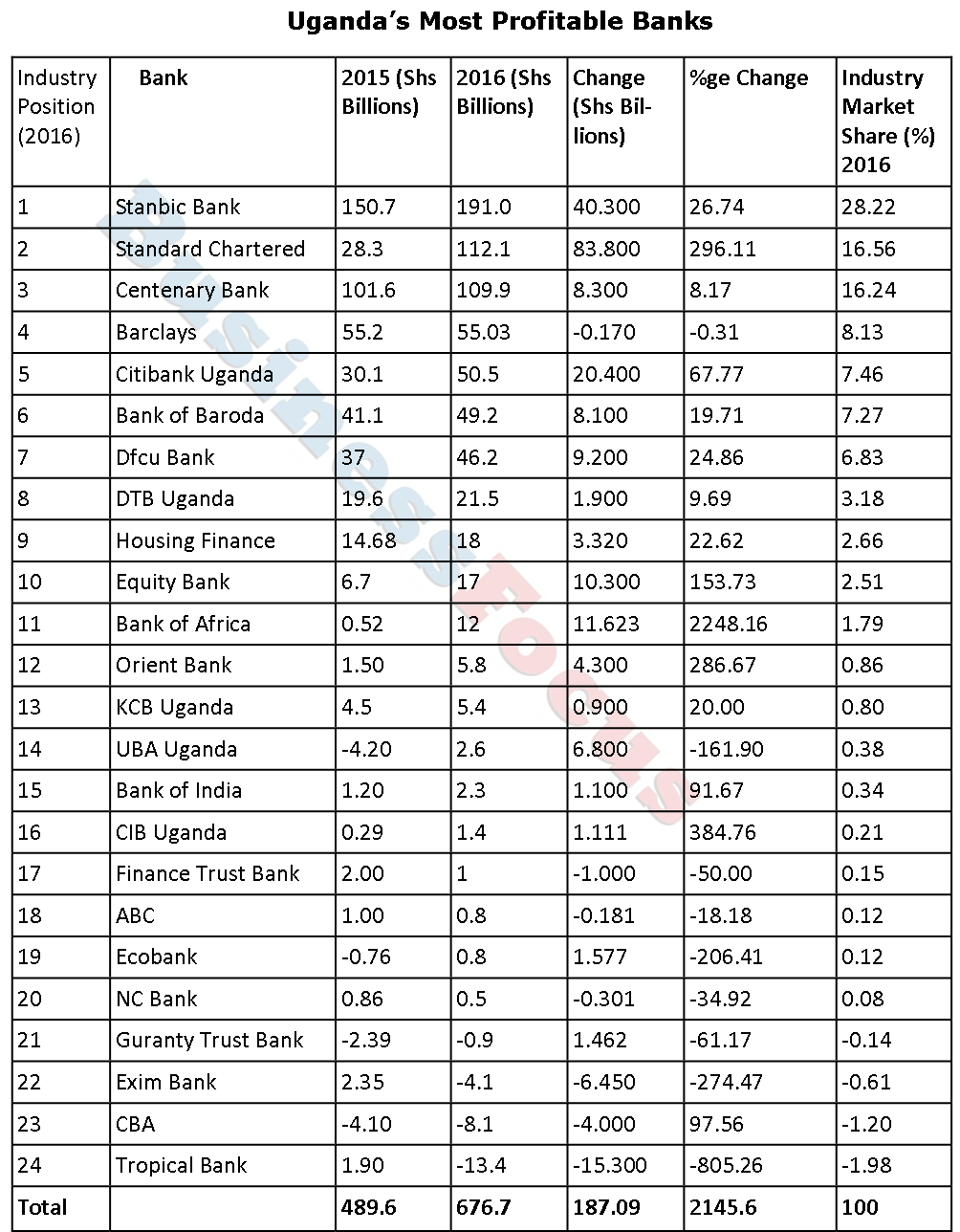

Nonetheless, despite the heavy macro-economic headwinds of 2016, the banking sector largely continued to register growth. Total industry profit increased by 38.2% to Shs676.7bn in 2016, up from Shs489.6bn recorded in 2015.

However, bad loans written off and NPLs increased, a pointer that all isn’t well in Uganda’s banking sector.

Most Profitable Banks

The number of banks making profits increased slightly to 20 in 2016, up from 19 in 2015.

Stanbic Bank Uganda Ltd (SBU) maintained the number one position as Uganda’s most profitable bank for the 4th year running.

Under the stewardship of Patrick Mweheire as Managing Director, SBU made a net profit ofShs191bn in 2016, up from Shs150.7bn in 2015. This represents a growth of 26.7%.

Standard Chartered Bank (StanChart) that sat in the 7th place in 2015 bounced back among the top three most profitable banks in Uganda. It is in the 2nd place having recorded a net profit of Shs112.1bn in 2016, up from Shs28.3bn in 2015. This represents a growth of 296.1%, one of the highest in the industry.

This rebound could be attributed to Herman Kasekende, who was earlier this year transferred to Zambia as StanChart CEO.

Albert Saltson, who replaced Kasekende, attributed the great comeback to substantial changes in strategy, deposit mobilization on products that give them competitive edge and increased focus on recoveries.

“We continued to take bold measures to simplify our organization structure by stripping out inefficiencies and shifting greater accountability towards performance.

We have made significant progress in executing our strategy, creating a bank that will generate improved financial performance following from our improved cost efficiency, tightened risk controls and focus on our many advantages,” Saltson said.

Having lost the 2nd slot to StanChart, Centenary Bank, the leading indigenous bank headed by Fabian Kasi as Managing Director, sits in the 3rd position, having recorded a net profit of Shs109.9bn in 2016, up from Shs101.6bn in 2015.

Barclays and Citibank complete the top five most profitable banks, having recorded a net profit of Shs55.03bn and Shs50.5bn respectively.

Having lost the 5th slot, dfcu sits in the 7th place, having recorded a profit of Shs46.2bn, up from Shs37bn. It is important to note that dfcu figures doesn’t include Crane Bank acquisition since the takeover was early this year.

Shockingly, the top five most profitable banks (Stanbic, StanChart, Centenary, Barclays and Citibank) control 76.61% of the total industry profit market share.

Ecobank, UBA Post Profits For The First Time

Positively, Ecobank and UBA Uganda posted profits for the first time, having joined the market in 2008. Under the stewardship of Clement Dodoo as Managing Director, Ecobank Uganda made a profit of Shs813m in 2016, up from a loss of Shs764m in 2015.

Additionally, most of the bank’s key performance indicators were positive. Loans advanced to customers slightly increased to Shs117.3bn, up from Shs116.9bn in 2015.

Customer deposits also increased to Shs213.9bn in 2016, up from Shs207.46bn.

UBA made a profit of Shs2.6bn in 2016, up from a loss of Shs4.2bn in 2015. This was largely due to 24% growth in total income of Shs29.7bn in 2016, up from Shs24bn in 2015. UBA is under the management Johnson Agoreyo as its Managing Director/CEO.

Speaking on the impressive reporting of the bank, Agoreyo expressed satisfaction with the resilience of the bank, despite the macroeconomic challenges that exist today. “UBA has clearly turned the corner with an impressive 162 percent growth in profit after tax. We are grateful to our growing list of loyal customers and partners without whom this growth wouldn’t have been achieved”, Agoreyo said.

Besides posting profit, other key performance indicators for the bank were not impressive.

Loss Making Banks

Tropical Bank leads the bottom table. In terms of profitability, it is the worst performing bank in Uganda. It recorded a net loss of Shs13.4bn in 2016, up from a profit of Shs1.9bn in 2015. It is closely followed by Commercial Bank of Africa (CBA) that saw its losses increase to Shs8.1bn in 2016, up from Shs4.1bn in 2015.

Exim Bank that bought off Imperial Bank recorded a loss of Shs4.1bn, up from a profit of Shs2.35bn in 2015.

Guaranty Trust Bank (formerly Fina Bank) continued to remain in the red zone after it recorded Shs928m in net loss, up from a loss of Shs2.39bn in 2015.

Importantly, although the loss making banks reduced to four (from five), total industry loss increased to Shs26.5bn in 2016, up from Shs14.65bn recorded in 2015.

A year earlier, seven banks recorded a total loss of Shs25bn.

Banks with Huge NPLs

StanChart maybe in jovial mood over the rebound in profitability, but when it comes to banks with largest Non-Performing Loans (NPLs) in Uganda, it leads the chart. Its NPLs stand at Shs112.1bn, slightly down from Shs113.9bn recorded in 2015.

It is closely followed by Bank of Baroda that saw its NPLs shoot to Shs77.6bn in 2016, up from Shs7.06bn in 2015.

Other battling high NPLs include Barclays (Shs70.48bn), dfcu (Shs58.38bn), Tropical Bank (Shs38.27bn), Centenary (Shs35.6bn) and Equity bank (Shs31.1bn). Stanbic said its NPLs increased by 14% but didn’t divulge its figures.

Bad Loans Written Off

Diamond Trust Bank (DTB) comes as number one in terms of huge loans written off. Its loans written off increased to Shs34.4bn in 2016, up from Shs5.9bn in 2015.

Barclays comes second, writing off loans worth Shs15.19bn in 2016, up from Shs14bn.

Other banks that wrote off huge loans include Tropical Bank (Shs11.7bn), Centenary Bank (Shs11.2bn), KCB (Shs8.9bn), Equity Bank (Shs8.3bn) and Commercial Bank of Africa (Shs8.1bn).

Largest Banks By Lending

When it comes to loans advanced to customers, Stanbic still leads. Its loans to customers increased to Shs1.97trn in 2016, up from Shs1.91trn. it is closely followed by Centenary at Shs1.24trn, while StanChart comes 3rd, advancing loans worth Shs1.2trn. It is important to note that lending has previously contributed 54% to the banks revenue, but grew by less than 2% in 2016 as banks became more cautious due to high NPLs.

Dfcu and Barclays at Shs842.4bn and Shs821.5bn complete the top five banks when it comes to lending customers.

At the bottom table, ABC Capital Bank lent Shs14.58bn only while UBA lent out Shs17.7bn. Cairo International Bank managed to lend Shs33.3bn only. Total industry loans advanced to customers increased to Shs9.96trn in 2016, up from Shs9.53trn.

Customer Deposits

Uganda’s largest banks by customer deposits as of 2016 include Stanbic (Shs3trn), StanChart (Shs1.9trn), Centenary (Shs1.62trn), Barclays (Shs1.29trn) and Bank of Baroda (Shs1.16trn).

On the other hand, banks with smallest customer deposits include ABC (Shs19.59bn), Cairo (Shs56.4bn), CBA (Shs64.18bn), NC Bank (Shs75.9) and UBA (Shs86.4bn).

Biggest Banks By Assets

Stanbic continues to dominate key performance parameters. Its total assets stand at Shs4.58trn, up from Shs3.7trn.

It is followed by StanChart with Shs2.7trn, up from Shs2.68trn in 2015.

Centenary’s total assets increased to Shs2.31trn, up from Shs1.97trn, making it the 3rd largest bank by assets.

Barclays with total assets of Shs1.9trn and dfcu with total assets of Shs1.72trn come in 4th and 5th positions respectively.

ABC also continues to dominate the bottom table. With assets worth Shs49.9bn, ABC has the smallest assets in the market.

From bottom, it is followed by Cairo at Shs96bn, CBA at Shs125.4bn, Guaranty at Shs143.16bn and Bank of India at Shs156bn.

However, the top five banks control 59.3% of the industry total assets.

Note: Keep glued to Business Focus for further unmatched analysis about Uganda’s banking industry and other key issues affecting the economy.

Stanbic is doing a visible work