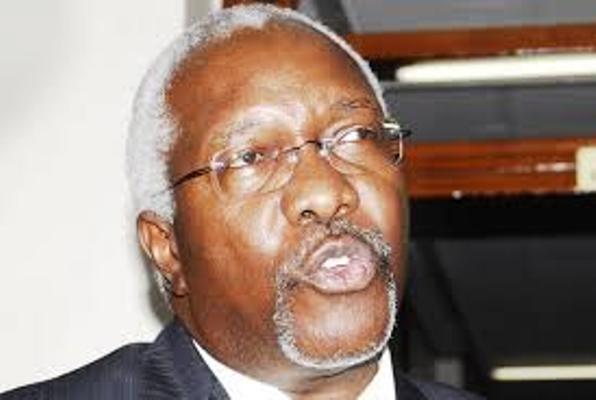

The Auditor General (AG), John Muwanga, has shortlisted at least five top auditing firms to examine Bank of Uganda operations with “a fine-tooth comb” treatment and the sale of Crane Bank to dfcu Bank, the Daily Monitor reports.

Although the companies have been shortlisted to pick the bidding documents, only one will be picked to work with a team of forensic experts from the Office of the Auditor General to investigate Bank of Uganda. The AG team will be led by Mr James Bantu, the director for forensics.

The listed firms are: EY Uganda, a member firm of Ernst & Young Global Limited, Deloitte and Touch; Tomson & Company; KPMG and Pricewaterhouse Coopers (Pwc).

However, sources say some of the shortlisted don’t qualify due to conflict of interest in the investigation, having been clients of the defunct Crane Bank, which is a subject of the investigation. Some firms have been BoU clients.

Sources say PricewaterhouseCoopers and KPMG have previously worked as auditors for Crane Bank.

Some of the audit firms are pre-qualified at BoU and therefore can’t audit their own client.

For example, BoU contracted PricewaterhouseCoopers to carryout forensic audit on Crane Bank.

BoU used the report as a basis to file a case against property mogul Sudhir Ruparelia. The case is pending hearing in the High Court.

The disputed forensic audit report which Sudhir lawyers, Kampala Associated Advocates (KAA), have since called a draft document, was made by Pwc on November 13, 2014.

After realising that Crane Bank was audited by KPMG from 2004-2007 and 2013-2015; Pwc in 2008-2010; Deloitte and Touch 2011-2012, sources say an independent foreign company be outsourced outside Uganda to audit BoU.

It is worth noting that two firms; KPMG and Pwc have come under fire in other countries over shoddy works.

Early this year, the Securities and Exchange Board of India (SEBI) banned all the firms in the PricewaterhouseCoopers (PWC) network from auditing listed companies for two years.

In its 108-page order, the market regulator claimed that the firm was complicit with the main perpetrators of the accounting fraud and did not comply with auditing standards. The story was widely reported in international and Indian media.

In South Africa, KPMG LLP has been under increasing pressure over work done for the wealthy Gupta family, with Finance Minister Malusi Gigaba calling on all government entities to review work with the auditing firm.

Late last year, an influential business lobby group suspended the company’s membership and the governor of the central bank said it was concerned that KPMG’s internal standard controls weren’t of an acceptable quality.

KPMG, one the world’s so-called big four accountancy firms admitted that work for the Guptas fell short of acceptable standards.

Sources say the firms in question don’t qualify to audit BoU because there’s already precedence.

In December 2017, the Commercial Division of High Court prohibited two law firms; David Mpanga of AF Mpanga advocates and Timothy Masembe Kanyerezi of MMAK advocates from representing Bank of Uganda in a case where tycoon Sudhir is accused of siphoning about Shs397bn from Crane Bank, which eventually led to its collapse.

The lawyers were disqualified for having a conflict of interest between Sudhir Ruparelia and Crane Bank.

Sudhir in his application argued that the law firms were “conflicting in acting for Crane Bank and Bank of Uganda, and therefore in violation of the advocate client relations and the Advocates (professional conduct) regulations.”

Before the two law firms were employed by Bank of Uganda, they provided legal advice to Crane Bank, which was owned by Ruparelia.

In the process of representing and advising Crane Bank — Sudhir argued — they became aware of confidential facts about him because of the trust that was involved.

Against the above background, analysts say the three firms in question don’t qualify to audit BoU.

Background To BoU Audit

The Auditor General’s expanded audit into BoU was prompted by petitions from former Crane Bank and employees of the central bank regarding Shs200b allegedly sunk into the defunct commercial bank.

Two whistle-blowers petitioned Parliament and IGG calling for an independent audit into the agreement BoU signed with dfcu Bank.

In one of the petitions, the former Crane Bank shareholders allege that they were excluded in the negotiations of the bank’s sale contrary to provisions of the Financial Institutions Act.

They also argue that the agreement does not state the value of liabilities or assets taken over by dfcu.