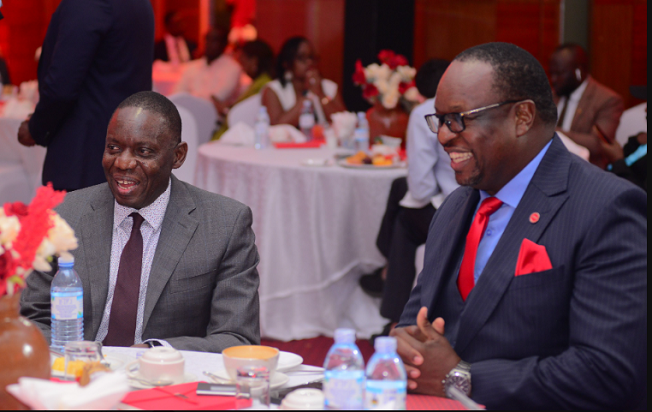

Dr. Michael Atingi-Ego (L), the Deputy Governor at the Bank of Uganda and Absa Bank Uganda MD, Mumba Kalifungwa, share a light moment at the release of the report on Tuesday morning.

The 2023 Absa Africa Financial Markets Index has ranked Uganda’s economy as the strongest in the East African Community region and fourth in the African continent.

The Africa Financial Markets Index endeavours to place the continent as an investment destination by applying global market standards on key issues such as market accessibility, openness and transparency, with the aim of measuring progress in the development of capital markets and demonstrating to individual countries the actions they could take to attract international investment to their markets. In so doing, the Index highlights the importance of central banks, ministries of finance and stock exchanges across the region.

In 2023, the Index looked at 28 African countries and Uganda emerged first in the region and fourth in Africa.

According to the report released at Sheraton Hotel in Kampala on Tuesday, Uganda’s Absa Africa Financial Markets Index score declined to 62.8 in 2023, from 64.4 the year before, though the country maintained its fourth-place position in the index. The decrease was mostly driven by weaker performance in access to foreign exchange.

Uganda’s score fell by 10 points to 67 due to relatively lower scores for interbank Foreign Exchange turnover and international reserves adequacy. Accordingly, reserves declined by almost 18% to $3.6bn in 2022, equivalent to 3.4 months of imports, from 4.6 months a year prior.

Uganda fared better in macroeconomic environment and transparency. Its score rose by 1 point to 86 and the country

retained its second-place position. The improvement was driven by the small fall in external debt to 26.8% of gross domestic product in 2022, from 27.7% in 2021. Meanwhile, the country continues to score highly for its policy transparency, macroeconomic data standards and relatively low inflation rate.

Uganda also scored well in legal standards as well as market transparency, tax and regulatory environment.

The report also highlighted areas for improvement.

These are in the capacity of local investors and building liquidity in domestic markets.

Speaking at the launch of the report, Absa Bank Uganda Managing Director, Mumba Kalifungwa, said that 2023 “was tough” but noted that the country’s “economy remained resilient.”

He attributed the resilience to the investments in the oil and gas sector among others.

Dr. Michael Atingi-Ego, the Deputy Governor at the Bank of Uganda, described the report as valuable.

“It is always an honor for us to participate in this event, which has proven to be a valuable platform to highlight developments in the African financial markets. The Absa Africa Financial Markets Index continues to gain traction, covering 28 countries from the initial 17 when the report started in 2017, most importantly representing 80% of Africa’s GDP,” said Dr. Atingi-Ego.

According to Dr. Atingi-Ego, Uganda’s ranking is commendable, considering the impacts of Covid-19 and the impact of the Rusia-Ukraine war on the economy.

He says banks too remained resilient during the period under review.

He, however, said that in the coming years, the Bank of Uganda will focus on deepening the saving and credit.

He noted that initiatives such as the Monetary and Foreign Policy will aid the building of liquidity in the domestic markets.

He also said that the country will adopt the Foreign Exchange Global Code to support credit ethics in the country.

Dr. Atingi-Ego agreed with the report on the low capacity of local investors.

“Uganda’s leading position in the Region should lead us to a question. Why Uganda? Otherwise, we are wasting this environment,” Dr. Atingi-Ego said.