By Wilbrod Humphreys Owor, Executive Director, Uganda Bankers’ Association

Uganda Bankers’ Association (UBA) has noted an opinion that appeared in the Sunday Vision of 16th August 2020 titled ‘Uganda needs banking reforms’ which was also replicated on various online platforms. This was a follow up to an earlier video widely circulated on social chat groups & online media as well.

As an industry, we welcome opinions, debate, proposals and reforms to continue improving the industry. Stakeholder views and contributions are very excellent feedback channels especially if anchored on good intentions, factual statements and balanced representation of issues and subject matters therein.

The Banking sector plays an important role in the economy and this role comes from the mandate of each category of banks or financial institutions. The fundamental responsibility of commercial banks remains safe custody of deposits, intermediation through lending, payments and facilitation of trade and investment among others.

Commercial banks play these intermediary roles through mobilization & custody of savings through deposits that may be in form of savings accounts, current accounts and or fixed deposit accounts for individuals or institutions.

They enable payments on demand by customers through various channels and for permitted purposes.

They also on-lend some of these deposits to borrowers for various purposes like trade, investment, personal or household developments among others. All the above activities are undertaken in a regulated environment and transmitted to the economy through a set of policies, rules, processes, procedures and risk management frameworks.

Commercial banks by their very nature & mandate typically take short term deposits and in turn lend short to medium term usually up to five(S) years to avoid what is called a funding mismatch between sources & utilization in terms of readiness to provide depositors with their money as & when they require it, while also availing a portion to qualifying borrowers with funds to deploy appropriately to support their investments or trade as the case may be.

Development banks oh the other hand typically source long term funds usually from long term patient capital providers like pension firms, insurance firms, long term debt & equity investors etc to provide long term special purpose funds.

Micro finance credit & deposit institutions provide financial services to specific segments of the market in specific transaction sizes as may be defined from time through legislation and oversight specific to them.

Financial markets provide other frameworks through which capital can be mobilized including through the stock exchange and numerous players exist in this space depending on the level of development & attractiveness of the market. So commercial banks are just part of a wider financial eco system and may not necessarily always address every single need and requirement of the market for the simple reason that they are not designed to do so.

Development Banks play a big role in long term development finance and these are typically owned by government and institutional long-term investors,

Banks in Uganda like any other market are part of a global financial web that benefits from international flow of skill, technology, standards and capital among others. Limiting financial institutions to indigenous resources be it human or capital would work against growth & development of an economy not to mention the risk it puts on Ugandans abroad & overseas who equally provide & share skills, mobilize resources and deploy themselves for the good of the institutions & geography within which they work.

Remittances from Ugandans working abroad & overseas contributes significantly to our export revenues & foreign exchange earnings.

The above notwithstanding 72% of the members on boards of directors, 55% of the CEOs and 92% of the executive or top management teams of supervised financial institutions are indigenous Ugandans.

Appointment & deployment of staff is based on competence and not nationality or tribe or gender.

The Banking sector employs over 15,000 staff who derive a living from this employment and by extension support their households & families extended or otherwise. The sectpr annually contributes significantly to tax revenue and undertakes numerous other social causes every year.

The sector provides 100% of its credit extension (currently 16 trillion across all sectors) to persons & businesses registered/domiciled in Uganda, majority of whom are or owned by nationals, employing nationals & supporting families & value chains here in Uganda with resources mobilized both internally & externally.

Real estate (20.9%), trade (19%) personal lending (19%) and manufacturing (12.4%) being some of the key sectors accounting for a total of 71% of these disbursements. Extension of credit by regulated financial institutions cuts across all segments of the population from micro & mobile loans to individuals & businesses accessed by over 10 million borrowers and to another 2.5 million individuals, small, medium sized businesses as well as approximately 150,000 medium to large businesses translating to over 14 million jobs/source of livelihood.

The extension of credit is based on what is usually characterized as 5 Cs and not necessarily nationality as the writer alleges.

The first C is condition which includes the purpose for which one is looking for a loan, the size or amount, the business or operating environment, how the money will be deployed, the terms including the lending rate etc. In all cases be it for arcades or SME business or any other investment the loan purpose is determined by the borrower not the lender. Lenders structure the borrowing to suit the purpose.

The second C is capital. How much of your own money has been put in the business?

The third C is capacity and refers to the viability of that business, including its capacity to generate cashflows to run as well as repay the loan.

The 4th C is character and includes credit history of the borrower, if they have previously demonstrated responsibility, integrity & discipline in use & payment of funds, how long the borrower may have been at that type of business or if there are competent managers to run & govern it.

The 5th C is collateral or security as a worst-case fallback position of the lender should circumstances require recovery. Collateral may be in form of property, guarantees (personal or corporate), undertakings, or ring-fencing transaction flows depending on structure of the loan.

A personal guarantee refers to an individual’s legal promise to repay credit issued to a company or business for which they serve as an executive/ director or partner.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

When directors seek funding for their business and sign a ‘personal guarantee’, it is a legally binding waiver that bypasses the limited liability status of a limited company during debt recovery.

In such cases, the company directors’ personal assets may be at risk as they become liable for the relevaht business debt that is covered by the guarantee.

Signing a directors’ personal guarantee means that, in the case of insolvency, the creditor has the right to come after your personal assets.

The above Cs typically determine lehding decisions and apply acrOss the board irrespective of nationality.

Citizens with a poor or unfavourable credit record coupled with maligning a sector especially when in default works against growth of the credit environmetå and never ever improves the position of the borrowers. Instead it adds a risk premium to the pricing of loans because it puts depositors hard earned money at risk, and makes the good borrowers pay for the deeds of bad borrowers. It also discourages those who would have wished to make available more money to lend and expand the economy since capital is eroded.

Loan default or diversion should therefore not be substituted with nationalist sentiments.

It masks and hides the real issues and should be not be encouraged at any level either by underhand means or even abuse of court processes to frustrate recovery of depositors’ money lent out. Other measures available include restructures, mediation, arbitration among others and is the reason the banking industry supports the center for arbitration & mediation (ICAMEK).

Lending can be structured in different ways to address any of the Cs above and it is normal for more than one bank to lend a borrower either due to size of the transaction or to spread risk or for different financiers to address different needs of the business.

It is important that the borrower fully understands the structure and appreciates the value add & benefits of each structure. Financial institutions always provide borrowers with details of every transactions before sign off and this can be even better managed if the borrower employs competent people, and permits them to perform their professional responsibilities. Good borrowers also tend to attract more favourable terms and there is a high positive correlation between good governance and business performance.

Loan terms typically include disbursement terms tied to specific milestones both to avoid burden to the borrower for funds not utilized as well as a control framework to avoid abuse. Where these terms are deviated from and not remedied in good time by either party, loan stress could arise.

Loan pricing is also impacted by other factors above among others, Interest rates are arrived at taking into account several factors including the cost of risk free alternatives like treasury bill rates, other regulatory bench requirements like cash reserve ratios (CRR), the type & cost of mobilizing deposits to make available for lending, the cost of operations or doing business in a country and level of efficiency of the institutions be it the banks themselves, or lands registration or courts of law for speedy resolution, the level of non-performing loans and risk premium attached to each sector or borrower/customer segment and the margin or rate of return required. Certain aspects like treasury bill rates currently at above 12% apply across the board while others factors vary and impact institutiohsdifferently and as such cannot necessarily have the same lending rates.

T.B rates are rates at which governments borrow and are risk free & attractive to financial institutions. Government borrowing implies revenue or funding deficits caused by different factors including size of GDP (Country’s total earning & economic activity) of the economy, revenue collection levels, expenditure prioritization & funds utilization among others.

The totality of these macro-economic issues informs a country’s risk profile and lending rates and can crowd out private sector borrowing. In Uganda today, one third (1/3) of total industry deposits (Total Industry deposits is at Ugx 24 trillion) is invested in treasury bills.

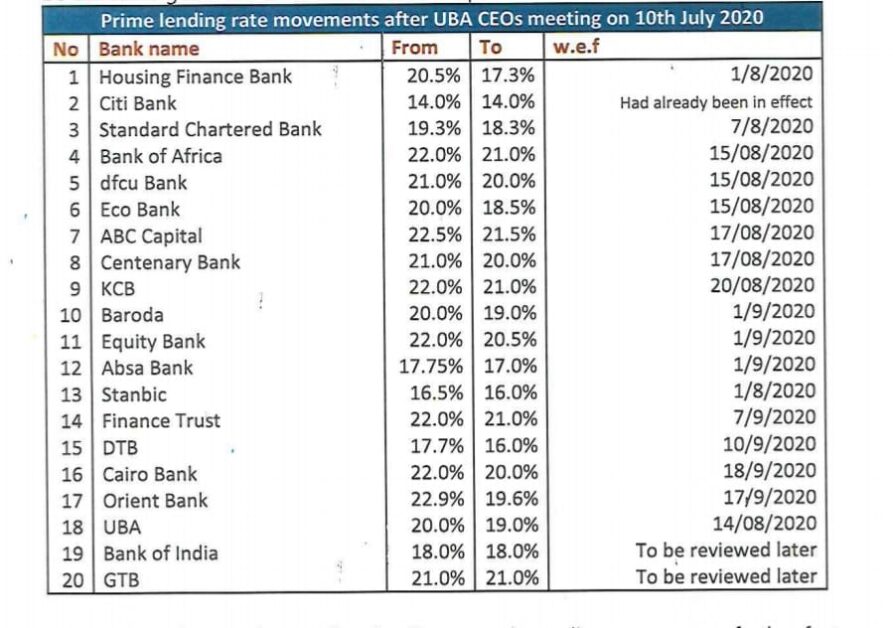

Recently however, we reached a decision to review lending rates downwards in light of the prevailing circumstances and to-date 20 member banks out of the 24 banks have responded already.’

As mentioned earlier, it is not expected that their adjustments will be the same given the differences in make-up.

Banks lend below or above prime lending rates depending on a range of other factors. Large or reputable customers may attract good rates because of their credit history as well as the numerous compensating services they bring or get from the financial institutions.

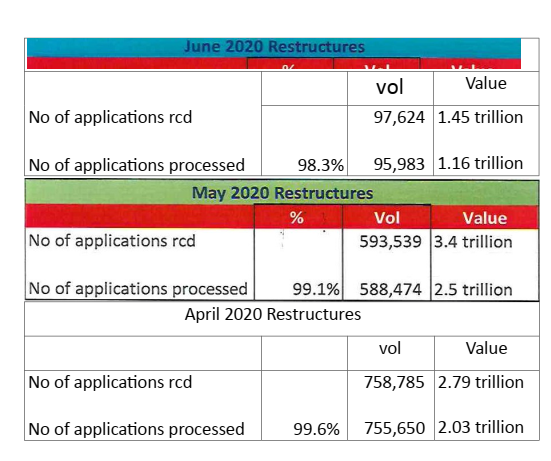

In terms of credit relief measures, the table below summarizes restructures as at as at end of June 2020 indicating 99% of all restructure requests being approved. The trend indicates that higher value loans are now becoming the focal point.

Directed lending to specific sectors usually requires specific/sustained stimuli like guarantee frameworks to mitigate risks or incentives fiscal or otherwise to make it attractive & rewarding to channel credit to such sectors especially if private capital is being utilized.

It is otherwise a very big risk to force or direct financial institutions to channel depositor funds and private capital at lower interest rates to high risk areas with no incentive or stimulus especially during uncertain times like we are in now.

It is a challenge for the financial sector and could have consequences including contraction of credit to certain sectors going by experiences witnessed in other jurisdictions.

Eight financial institutions reported losses last year. It is important that the financial sector is profitable to all its players addressing the needs of different market segments.

It is also important that we maintain the right & consistent policy signals to investors both local & foreign.

The bankers’ association is working with its members on industry initiatives to bring about efficiency within especially via shared technology or infrastructure platforms, with the regulator Bank of Uganda on reforms and engaging Government through the Ministry of Finance & other organs on the wider macro-economic issues.

It is further expected that the much-awaited Islamic Banking will add to the range of bank offerings available in the market.

Regarding regulatory reforms, the bankers’ association together with Bank of Uganda at a retreat held on the 25th of March 2019, constituted a joint banking sector reforms committee to undertake the following,

- Review the existing laws, regulations, guidelines, operations & practices in the

banking sector in order to identify challenges, limitations, constraints and gaps impacting on the sector.

- Specifically bench mark with other jurisdictions, banking practices, laws and regulations in areas not limited to operations, credit, digital financial services, governance, treasury, legal, compliance and any other areas for changes and adaptations as appropriate.

Identify and recommend reforms for consideration to enhance the business environment including new products, services, operational frameworks, emerging risk & mitigation mechanisms etc.

Consultants are on board to support the committee, engagement, of various stakeholders is underway and work is in progress with the expected date of completion being April 2021.

That notwithstanding, the banking sector has over the years undertaken numerous reforms many of them reflected in the Financial Institutions Act and subsequent amendments therein, partly originating from bad experiences of poorly managed banks in the past, some which arose from sentiments packaged in a manner similar to that of the writer.

Reforms have also taken place as a result of developments in the technology space as well as overall macroeconomic environment driven through economic & social policies, market demands and consumer trends among others and will continue as part of continuous improvements.