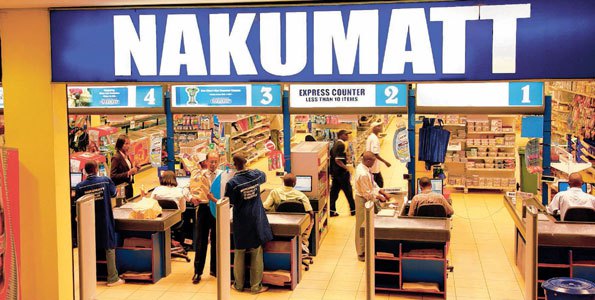

Nakumatt Supermarket is one the several companies which have been put under ministration as the end of last year.

As companies collapse from tough economic times the fate of their workers and whether they get paid their benefits has come into sharp focus.

With the outbreak of Coronavirus, companies across the world are witnessing an unprecedented number of collapses that are waiting to happen.

The number of companies under administration in Kenya at the end of 2021 was eight times higher than in the previous year, jumping from only two cases in 2020 to seventeen.

Several companies have been placed under administration in recent times including General Printers, Kaluworks, Phoenix Publishers, Britania Foods, Nakumatt Holdings, Midland Energy, ARM Cement and Deacons East Africa, Mumias Sugar, Karuturi, and Multiple Hauliers.

Some of the companies are still battling to survive while others have gone to liquidation requiring their assets to be split among creditors.

By the time the companies go under they have usually racked up months of employee pay in delayed salaries and unremitted benefits including contributions to the National Hospital Insurance Fund, pension scheme, and National Social Security Fund deductions.

Lay off workers

Most companies lay off all their workers during collapse while new buyers rarely want to take in the workers.

In such cases, workers should know they have the right to demand full payment of their benefits to compensate them for the loss of employment.

“Under the Insolvency Act, redundancy payments of up to two hundred thousand Kenya Shillings per employee, that are owed to employees and that accrued either before or because of the liquidation are recognised as a preferential debt. As such, they fall under what is known as ‘second priority claims’,” Kellen Maganjo, Joyce Mbui, Vruti Shah, and Rainbow Field, associates at a law firm, Bowmans said in an analysis.

“This means that an employee’s redundancy entitlement of up to two hundred thousand Kenya Shillings per employee will form part of the amounts paid out before the unsecured creditors if funds are available but after the expenses of the liquidation, which take first priority.”

The Employment Act requires an insolvent employer to pay certain debts that it owes its employees, including arrears of wages between one to six months.

In practice, the extent to which companies follow this law is unknown with Mark Gakuru, the Government Official Receiver in Insolvency saying most companies adhere to it.

“It is the law so companies have to comply with it, they have to pay employees first but only up to six months arrears,” he told Smart Business.

Once a receiver is appointed, no creditor can attach a company’s property allowing for stock to be taken before assessing whether a firm can be revived or not.

But in Kenya, administration and receivership have not yielded the best results for some of Kenya’s biggest firms in the recent past. Retail chain Nakumatt, construction experts Spencon, flower firm Karuturi and cement maker ARM all went down after being placed under administration or receivership.

When a company fails to recover forcing it into liquidation, administrators seek to dispose of the company’s property and distribute the proceeds to creditors.

Creditors are to be paid from the sale of distressed company assets. However, secured lenders such as banks rank higher than supplies and other unsecured firms when settling debts.

In rare cases, companies that collapse gets strategic buyers who sometimes offer to protect the workers and sometimes even absorb them.

The Devki Group Chairman, Narendra Raval took over 1,100 employees of Athi River Mining (ARM) Company, previously put under administration, and will be retained by the group’s subsidiary, National Cement Company.

Raval said the decision to retain all the affected employees was deliberately anchored in Devki Group’s resolve to protect their livelihoods and support job creation as the company continues to play a significant role in boosting the country’s manufacturing output and supporting affordable housing drive by reducing the cost of construction materials.

When companies go belly up, an audit is done to assess the options available for the company which assesses who the creditors are and whether the company assets can fund these debts.

For instance, when Kaluworks was put under administration over non-payment of a Sh4.3 billion debt, and a C-oop Bank loan of about Sh4.8 billion receiver manager Pongangipalli Rao reviewed the financial position of the company.

Court papers show the company was knee-deep in Sh12.6 billion debts, including bank loans, unsecured commercial paper holders, and shareholder advances, against assets of Sh1.3 billion when placed under receivership in May 2021.

This meant that if the company sold off the assets there would be a vicious fight over who among the Sh12.6 billion creditors would get a piece of the assets.

Luckily for Kaluworks, shareholders then offered to bail out the company, injecting Sh1.2 billion to pay off the debts and secure control and ownership.

However, in most companies, the fight for assets draws out banks, and suppliers, with secured creditors getting paid first, which means banks usually get their money ahead of smaller creditors.

Employees who cannot fight for their rights or hire expensive lawyers to defend their interests are protected by the law.

The Kenyan law has inbuilt employee protections into the legal structure with clear remuneration policies during retrenchment, redundancies, and insolvency.

The law ensures that employees do receive some form of payment as a result of their loss of employment as a matter of importance.

According to the Employment Act 2007 when an employer retrenches employees for business or operational reasons, such as automation taking over the work that people used to do, the employees are entitled to severance pay at the rate of not less than 15 days’ pay for each completed year of service

The Insolvency Act ranks the employees’ entitlement as second on the priority list just after the liquidator who holds the yam and the knife when it comes to cutting a dead company into pieces for those owed money.

When it happens that the insolvent company simply does not have the resources to pay these debts the Bowmans team says in its analysis noting that in such circumstances the Government of Kenya may be asked to step in.

Before any payments are made, the Cabinet Secretary must be satisfied that the employer is insolvent, that the employee’s employment was terminated, and that the employee was entitled to be paid the whole or part of any debt.

Where an administrator or receiver manager has been appointed to take control of the insolvent company, the Cabinet Secretary will only make payments on receipt of a statement from that officer of the amount owed to the employee.

“An employee of an insolvent company may apply to the Cabinet Secretary for Labour and Social Protection to pay an amount of the debts the employer owes the employee. These payments are made out of the National Social Security Fund,” the Bowmans team said.

-The Nation