2017 was generally a challenging year, but not the toughest. Uganda’s economy is projected to grow at 5% in 2017/18, up from 4% (revised) in 2016/17. Throughout 2017, inflation was contained within Bank of Uganda’s target of 5% and the exchange rate was generally stable.

Inflation was stable as a result of enough rains that gave a boost to the agricultural sector, thus containing food crop inflation.

However, maize farmers were hit with the fall armyworm, which was also contained.

The Central Bank continued reducing the Central Bank Rate (CBR), a benchmark lending rate for commercial banks. It is now at 9.5% and commercial banks have responded by cutting on their interest rates. Average interest rates stand at 18.97% as of October 2017, down from 25% a year ago. The Kenya elections and noise over the Constitution Amendment (No2) Bill 2017 were also key highlights that no doubt affected Uganda’s economy.

As 2017 draws near to an end, Business Focus, in no particular order, brings you business moments that shaped Uganda’s economy

Shs6bn oil handshake

This is perhaps the biggest story of 2017. From January to June, the story of President Yoweri Museveni rewarding 42 officials a Shs6bn Presidential ‘handshake’ dominated headlines both in the mainstream and online media. The officials were controversially awarded Shs6bn after their participation in a court case involving Uganda and Heritage Oil and Gas Arbitration.

Uganda won the landmark Arbitration case in London and was awarded US$4.08m in costs.

Many Ugandans became furious over this payment to people who already earn highly. They also argued that the payment wasn’t necessary because the said officials were doing what they are paid to do.

Parliament was equally upset by this payment. This is how Parliament resolved that the Committee on Statutory Authorities and State Enterprises (COSASE) led by Abdu Katuntu investigate the matter to its logical conclusion.

The Committee report revealed that the Shs6bn Presidential ‘handshake’ was illegally executed and that tax payers’ money should be refunded.

“H.E the President approval of this “handshake” was bonafide. However, it was an error of judgment,” the COSASE report reads in part.

According to the Auditor General’s Report, the funds were obtained from monies earmarked for rent and renewal of licenses for IT systems, clearly showing that the ‘handshake’ was never budgeted for by URA, the report adds.

However, that was it; the money has never been refunded and everyone seems to have forgotten about this huge scandal that cost tax payers Shs6bn.

Dfcu Takeover Of Crane Bank

On February 27, 2017, the Bank of Uganda announced the takeover of the now defunct Crane Bank by dfcu-at an undisclosed fee. However, sources say dfcu paid about US$40m.

This event followed BoU’s takeover of Crane Bank Ltd management on October 20, 2016, after the bank became “a significantly undercapitalized institution.”

It is important to note that Sudhir Ruparelia and his family owned 48.7% stake in Crane Bank.

Tom Mugenga, a renowned businessman in Kisoro and Kampala, owned 0.003% shares in Crane bank. Mysterious M/s White Sapphire owned 47.33% stake in the bank. dfcu takeover of Crane Bank was a big moment especially in the financial sector given the fact that it left Uganda with only three indigenous banks (Finance Trust, Housing Finance and Centenary).

Additionally, it made dfcu become one of the most important banks in the country. Indeed, dfcu bank posted Shs114bn net profit in half year results for 2017, up from Shs23.3bn in June 2016.

dfcu is now in the same league with Stanbic Bank Uganda Ltd and Standard Chartered Bank.

In comparison, Stanbic recorded Shs95.4bn net profit in half year results for 2017, down from Shs107.2bn in the year ended June 2016.

In a related development, Crane Forex Bureau Limited, one of the oldest forex bureaus in Uganda was also closed by BoU. The forex bureau belonged to tycoon Sudhir Ruparelia. Other forex bureaus belonging to Sudhir including Karibu Forex Bureau Limited and Redfox Bureau De Change Limited were also closed.

Sanlam Acquires Lion Assurance

In November, Sanlam Emerging Markets Proprietary Limited (SEM) announced that it had successfully concluded the transaction whereby its subsidiary, Sanlam General Insurance Uganda Limited (SGIU), acquired close to a 100% interest in the share capital of Lion Assurance Company Limited (LAC) in Uganda from Trans Industries Proprietary Limited and certain minority shareholders for an initial purchase price of USD6.5 million.

LAC was a leading insurance company in Uganda with its business mainly in motor, financial (loan protection and fidelity guarantee), personal accident and fire insurance. SGIU, which offers a broad range of general insurance products for personal, commercial and corporate clients, has some 5% market share. It will merge its businesses with LAC, thereby increasing its overall market share in the general insurance industry.

SEM’s Chief Executive Officer, Junior Ngulube said: “Uganda is a key market in Africa and the transaction supports SEM’s strategy of bolt-on acquisitions to achieve scale.

“We are also confident that this transaction will offer us an opportunity to strengthen our position in the market while benefiting our clients who will have access to the combined expertise of our staff as well our product range,” Ngulube added. This development is likely to be an industry game changer come 2018.

Sudhir-BoU War

On July13, 2017, the Bank of Uganda (BoU) said it had sanctioned the filing of a suit against Sudhir Ruparelia (the founder and major shareholder of Crane Bank) and Meera Investments Ltd to recoup funds that were fraudulently extracted from Crane Bank (in receivership).

BoU filed a civil suit at the Commercial Court against Ruparrelia and his investments firm Meera Investments Ltd On June 30.

As Receiver of Crane Bank Ltd (Crane Bank) and regulator of the banking sector, BoU said the suit seeks to recover a total of Shs397bn together with Freehold titles to Crane Bank’s branches, general damages, interest and costs. Sudhir’s Crane Bank is also being accused of not remitting US$1.4 million staff contributions to the National Social Security Fund (NSSF).

However, Sudhir hit back saying it was BoU to blame. He put up a strong defense that has literally left BoU in a tight corner.

Sudhir, who is being represented by Kampala Associated Advocates, wants BoU lawyers; MMAKS and AF Mpanga out of the case because he was their client for over 12 years. The high profile case at Uganda’s High Court, Commercial Division is being heard by Justice David Wangutsi.

However, to save the banking sector and Uganda’s economy in general, both parties agreed to try to settle the case out of Court.

Principal Judge Yorakamu Bamwine is the mediator in this high-profile case between Sudhir and BoU. Justice Bamwine’s appointment came after the parties in the case rejected the earlier appointed mediator Harriet Magala. The two parties said they have confidence in the principal judge. As it stands, the war between BoU and Sudhir will possibly be put to an end in 2018.

Oil Pipeline Construction Begins

This was perhaps the biggest event in Uganda’s Oil and Gas sector.

Work on the pipeline that will take Uganda’s crude oil to export markets started in August after Tanzanian President John Magufuli and his Ugandan counterpart, Yoweri Museveni laid the foundation stone at Chongoleani, in the port city of Tanga.

The pipeline, estimated to cost US$3.55 billion, will transport Uganda’s crude oil from Kabaale, in the western Hoima district, to Chongoleani peninsula, near the Tanga port in Tanzania.

The construction of the 1,445km line is expected to start at different points and is expected to be completed by 2020.

After the ceremony in Tanga, the two leaders also laid a foundation stone in Hoima in November.

According to the project report, the 24-inch diameter pipeline will move 216,000 barrels of oil per day at a cost of about US$12.2 per barrel. The pipeline will be pre-heated and covers 1.2 metres underground.

Red Pepper Closure

On November21, 2017, Police raided the offices of The Pepper Publications Limited, the publishers of Red Pepper, arresting five directors and three editors.

The Five Red Pepper directors are; Arinaitwe Otim Rugyendo, James Mujuni, Johnson Byara Musinguzi, Patrick Mugumya, Richard Tusiime and the three editors include; Ben Byarabaha, Richard Kintu and Francis Tumusiime.

They were charged with disturbing the peace of President Yoweri Museveni, offensive communication against Generals Salim Saleh and Henry Tumukunde following a story published in the Red Pepper under the title; “M7 Plotting Kagme Overthrow – Rwanda.”

Red Pepper and its sister outlets were consequently closed, leaving hundreds jobless.

For close to a decade, Red Pepper had grown to become one of the strong indigenous brands in the country, but its closure and detention of its directors and editors for a long period of time will leave an indelible mark on its performance/survival.

It remains unknown when it will be re-opened, but there’s no doubt even if it is reopened, it will almost start from scratch given the fact that its servers were tampered with and computers taken by Police.

Kwese TV Joins Ugandan Market

Kwesé TV, Africa’s newest broadcast network on October 17, 2017 launched its dynamic satellite TV service in Uganda, bringing a whole new world of premium sports and general entertainment content to market.

Kwese’s entry will be closely watched by already existing players such Star Times, MultChoice (Dstv and GOtv), Azam and Zuku among others.

However, Kwese’s entry into the pay Tv will largely benefit Ugandan consumers. Staying true to its ambition to redefine TV in Africa, Kwesé has launched with an industry first payment model which will give Ugandan consumers the choice to purchase pay-as-you-watch subscription packages. This means Ugandans will now have the option to purchase three, seven or 30 day subscriptions to access Kwesé’s full programming line-up.

In 2016, Kwesé’s free-to-air sports channel, Kwesé Free Sports was launched in Uganda.

Nakumatt Exit

Regional supermarket giant, Nakumatt will soon become history in Uganda, a development that will leave many jobless and adversely affect the economy at large.

“The supermarket (Nakumatt) is winding up business in Uganda; it has already closed a number of branches due to debts,” a source told Business Focus, adding: “They wanted government bailout in form of a tax waiver until they stabilize, but it seems it has failed to workout. The parent company in Kenya has also failed to get a strategic investor.”

On September 5, 2017, Uganda Revenue Authority (URA) started the public auctions by selling perishable goods owned by Nakumatt in order to recover $71,000 (about Shs255.5 million) in tax arrears.

This was after URA had taken over Nakumatt’s operations in Uganda to give itself first priority on all income, as several creditors in Kampala and Kenya were baying for the retailer’s blood.

Nakumatt stores at Acacia Mall – Kololo, Village Mall – Bugolobi, Victoria Mall – Entebbe, Katwe and Mbarara have all been closed due to debts. Nakumatt opened its first store in Uganda in June 2009.

Founded in 1987, Nakumatt is a wholly Kenyan, privately held company, owned by the Atul Shah family.

Atul Shah is the Managing Director and Chief Executive Officer of the Nakumatt Holdings Limited, the parent company of Nakumatt Supermarkets. Reports indicate that the Supermarket chain has reached an understanding with Kenya based Tuskys to survive the storm (it will be getting stock from Tuskys).

Agency Banking & Bancassurance

On March31, 2017 President Yoweri Museveni assented to The Financial Institutions (Amendment) Act, 2016 that provides for Islamic banking, bancassurance and agent banking among other things. This was perhaps the biggest moment for Uganda’s financial sector.

With the law in place, Bank of Uganda (BoU) has set guidelines for agency banking to roll across the country. And a number of banks are already training agents before launching this innovation.

For starters, agency banking (also known as agent banking) is….

On March 29, 2017, commercial banks under their umbrella body, Uganda Bankers Association (UBA) revealed that they were set to roll-out agency banking through a shared platform. UBA partnered with Eclectics International Ltd, a Pan-African private company to design, develop, deploy and operate the inter-operable shared platform that connects all member banks to the agent network spread across the country.

Similarly, banks are ready to embrace Bancassurance which simply means the sale and distribution of insurance products through banks.

Commercial Banks are adopting it because selling insurance products gives them a new and lucrative revenue stream without high new setup costs. Stanbic Bank has already secured license from Insurance Regulatory Authority to roll out Bancassurance. In 2018, many more banks are likely to embrace this development.

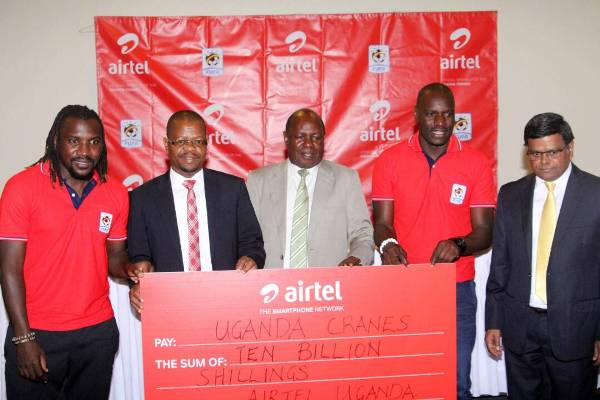

Airtel-Cranes New Deal

Airtel Uganda renewed their sponsorship of the senior national team, the Uganda Cranes for another four years towards the end of 2017.

The telecommunications giants took over from their rivals MTN four years ago in a deal worth slightly over one billion shillings.

The new deal will see Airtel pump Shs10bn (approx $2.94M) in a period of four years.

The deal followed the return of VG Somasekhar to Airtel Uganda as Managing Director, three years after he was recalled to Airtel Africa head offices as Director – Special Projects.

His return could prove to be an industry game-changer considering his history.

Somasekhar steered Airtel Uganda from December 2010 to February 2014, during which period he oversaw the Airtel-Warid merger in April 2013-at US$100m.

Airtel entered the Ugandan market in 2009 after buying Zain Africa operations, resulting into a rebrand in 2010 while Warid launched its operations in Uganda in 2008.

This merger was an industry game-changer due to the fact that Airtel became MTN’s rival on a number of fronts.

Hitherto, MTN was in a league of its own.

Sadolin-Plascon War

In August, Kansai Plascon announced that it had acquired Sadolin East Africa for about $125 million.

Kansai Plascon immediately announced that Sadolin was migrating to Kansai Plascon.

However, AkzoNobel Coatings International BV which owns Sadolin brand said in accordance with the contractual agreement, Kansai Plascon was obliged to manufacture, sell, market and advertise Sadolin brand until the end of January 2018. This sparked off a battle; with AkzoNobel suing Japan based Kansai Plascon for breaching the contract. This also saw paint companies advertise massively as the market was disrupted. The case is before Commercial Court and come 2018, the battle for who controls the market will be between the two paint paints.