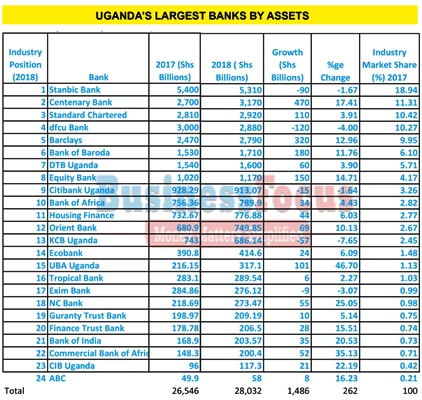

Uganda’s commercial banks continue to accumulate assets.

Total banking industry assets increased by 262% to Shs28.032 trillion in 2018, up from Shs26.55 trillion in 2017.

Uganda has 24 operating banks commercial banks.

In this article, you’ll know the share each bank has of the Shs28.032 trillion total industry assets.

The analysis is based on the 2018 financial statements obtained by Business Focus.

Stanbic Bank remains Uganda’s largest bank by assets despite its assets reducing by 1.167% to Shs5.31 trillion in 2018 from Shs5.4 trillion recorded a year earlier. It controls 18.94% of the total industry assets.

Stanbic Bank Uganda shareholders must be happy with the job being done by the Chief Executive Officer, Patrick Mweheire considering the fact that the bank continues to grow and lead on almost all fronts.

ALSO READ: Uganda’s Most Profitable, Loss-Making Banks In 2018 Named

Centenary Bank’s assets increased by 17.4% to Shs3.17 trillion in 2018, up from Shs2.7 trillion reported a year earlier. With 11.31% industry market share, Centenary that is headed by Fabian Kasi as Managing Director is Uganda’s second largest bank by assets. It displaced dfcu that enjoyed this position in 2017.

Albert Saltson’s Standard Chartered Bank maintained its 3rd position. Its assets increased by 3.91% to Shs2.92 trillion from Shs2.81 trillion. Its market share stands at 10.42%.

dfcu Bank that is led by Mathias Katamba as Managing Director is now 4th after its total assets reduced to Shs2.88 trillion from Shs3 trillion. This puts its market share at 10.27%.

Rakesh Jha, the Managing Director of Barclays has also kept the bank in good shape. The bank that will soon rebrand into Absa Uganda maintained its 5th position. Its total assets increased by 12.96% to Shs2.79 trillion from Shs2.47 trillion. Its industry market share stands at 9.95%.

The above top five banks control 60.89% of the total industry assets.

In 6th position is Bank of Baroda whose assets increased to Shs1.71 trillion in2018, up from Shs1.53 trillion recorded a year earlier. This represents 6.1% market share.

Diamond Trust Bank (DTB) dropped one place. It’s now Uganda’s 7th largest bank after its assets increased to Shs1.6 trillion up from Shs1.54 trillion in 2017.

Having broken into the top 10 most profitable banks in Uganda, Equity Bank is also doing well on other key performance indicators.

It is Uganda’s 8th largest bank by assets; its assets increased by 14.71% to Shs1.17 trillion in 2018, up from Shs1.02 trillion a year earlier.

In 9th position is Citibank Uganda whose assets reduced to Shs913.07bn in 2018 from Shs928.29bn a year earlier. It is headed by Sarah Arapta as Managing Director. It’s the only bank to be headed by a woman among the top 10 largest banks by assets in Uganda.

Bank of Africa maintained its 10th position. Its total assets increased to Shs789.9bn from Shs756.36bn. The top 10 banks control 82.95% of the total industry market share.

Housing Finance is 11th after its assets increased by 6.03% to Shs776.88bn from Shs732.67bn.

In 12th position is Orient Bank whose assets increased to Shs749.85bn from Shs680.9bn.

KCB is in 13th position although its assets reduced to Shs686.14bn in 2018 from Shs743bn in 2017.

In 14th is Ecobank. The Pan-African bank’s assets increased to Shs414.6bn in 2018 from Shs390.8bn.

United Bank for Africa takes the 15th position. Its assets increased to Shs317.11bn from Shs216.15bn.

In 16th position is Tropical Bank. Its assets increased slightly to Shs289.54bn in 2018 from Shs283.1bn in 2017.

Banks with less than 1% industry share

A total of eight (8) banks have less than 1 percent market share in as far as assets are concerned.

ABC Capital Bank has the smallest assets in Uganda. Its assets increased to Shs58bn from Shs49.9bn in the period under review. Its market share is 0.21%.

2nd from bottom is Cairo International Bank whose assets increased to Shs117.3bn from Shs96bn. Its market share is 0.42%.

3rd from bottom is Commercial Bank of Africa whose market share is 0.71%. This is after its assets increased to Shs200.4bn from Shs148.3bn.

Bank of India comes 4th from bottom with a market share of 0.73%. Its assets increased to Shs203.57bn from Shs168.9bn.

It is closely followed by Finance Trust Bank whose market share stands at 0.74%. This is after its total assets increased to Shs206.5bn from Shs178.78bn.

6th from bottom is Guaranty Trust Bank whose market share is 0.75%. Its assets increased to Shs209.19bn from Shs198.97bn.

It is followed by NC Bank whose assets increased to Shs273.47bn from Shs218.69bn. Its market share stands at 0.98%.

This is followed by Exim Bank whose market share is 0.99%. Its assets increased to Shs276.12bn in 2018 from Shs284.86bn recorded in 2017.

We’ll keep posted with more unmatched analysis