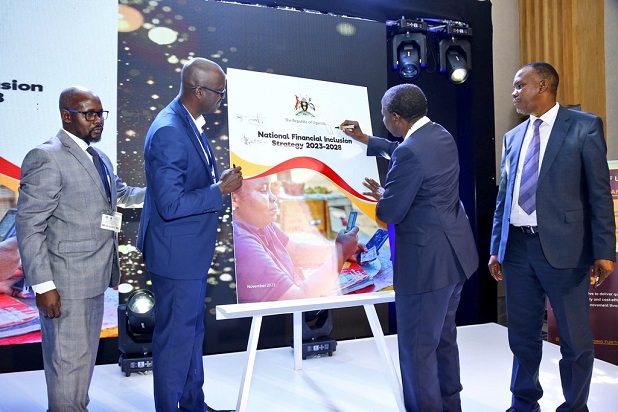

Kasaija launching the second national financial inclusion strategy

Uganda’s Finance Minister, Matia Kasaija, has has called for affordable financial products, noting that financial inclusion is vital for the national development agenda.

He made the remarks on Thursday as he launched the second national financial inclusion strategy (NFIS II) 2023-2028 at Four Points by Sheraton, Kampala.

This follows the expiry of 1st strategy (NFIS I) 2017-2022. The vision of the second strategy is; “universal access and usage of a broad range of quality and affordable formal financial products and services delivered in a responsible and sustainable manner.”

Kasaija said financial inclusion helps in growing the economy, reducing poverty, creating jobs by supporting entrepreneurship and business expansion as well as promoting gender equality and promoting rural development.

“We need to reduce access barriers to formal financial sectors.We need to deepen usage of affordable and quality financial products.We must work to strengthen financial consumer protection and capabilities,” said Kasaija.

Acting Director Economic Affairs, Moses Kaggwa, who represented PSST Ramathan Ggoobi, said compared to 2017, more Ugandans now have a financial account, more have access to credit when they need it and more are able to save.

“A big success has been the rapid increase in financial access points from 548 per 100,000 adults in 2017 to 2,386 per 100,000 in 2022. Active banking agents have increased from 133 in 2017 to 25,635 in June 2023,” he said.

Regarding Parish Development Model(PDM), Kaggwa said Shs1.13 trillion had been disbursed by mid- November, 2023 to 10,585 SACCOs.

He said 974.8 billion has so far been loaned to 965,243 beneficiaries.