Who’s benefiting from billions of shillings earned from Uganda’s coffee exports?

This is one of the questions frequently asked by coffee farmers and stakeholders.

This is because farmers feel cheated as exporters earn big from the country’s leading cash crop. For example, according to Uganda Coffee Development Authority (UCDA) monthly report for October, 2020, farm-gate prices for Robusta Kiboko averaged Shs2,000 per kilo; FAQ Shs4,000 per kilo, Arabica parchment Shs5,400 per kilo and Drugar Shs5,000 per kilo.

According to the report, the average export price was US$1.50 (5,559) per kilo, 3 cents higher than USD1.47 (5,448) per kilo realized last month. Robusta exports accounted for 86.74% of total exports compared to 87.97% in September 2020, the report says.

It adds that the average Robusta price was US$1.37 (5,077) per kilo, the same as the previous month.

Organic Robusta fetched the highest price of US$1.85 (6,856) per kilo, a premium of 36 over screen 18, and it was followed by washed Robusta sold at an average price of US$1.83 (6,781) per kilo, a premium of 36 cents above the conventional screen 18.

Arabica fetched an average price of US$2.24 (8,302) per kilo, 22 cents higher in September 2020. But who are Uganda’s top coffee exporters.

A total of 428,015 kilo bags of coffee valued at US$ 38.61 million were exported in October 2020 at an average weighted price of US$ 1.50 /kilo, 3 cents higher than US$ 1.47 /kilo in September 2020. This was an increase of 12.95% and 4.49% in quantity and value respectively compared to the same period last year.

Coffee exports for 12 months (November 2019 to October 2020) totaled to 5,409,054 bags worth US 513.99 million compared to 4,465,534 bags worth US$ 435.81 million the previous year.

This represents 21% and 18% increase in quantity and value respectively.

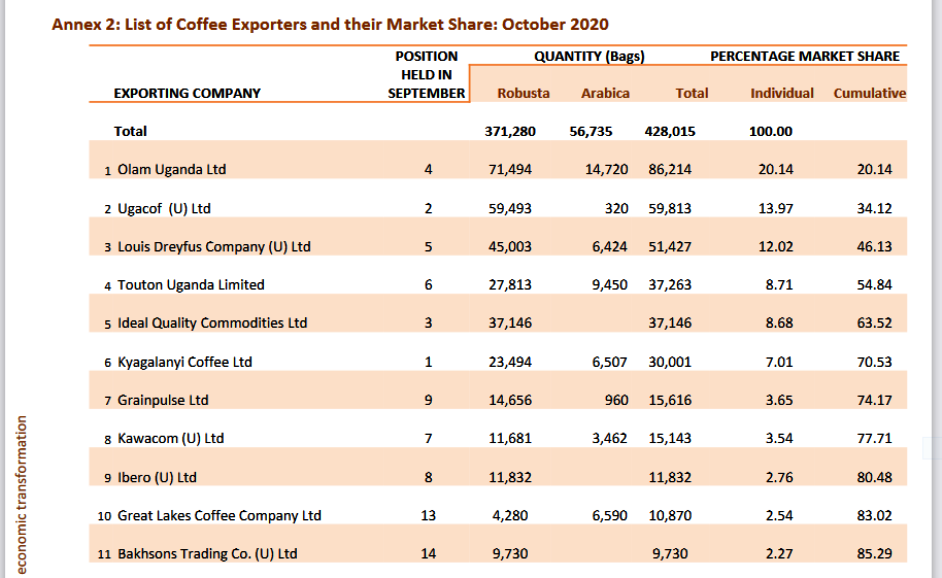

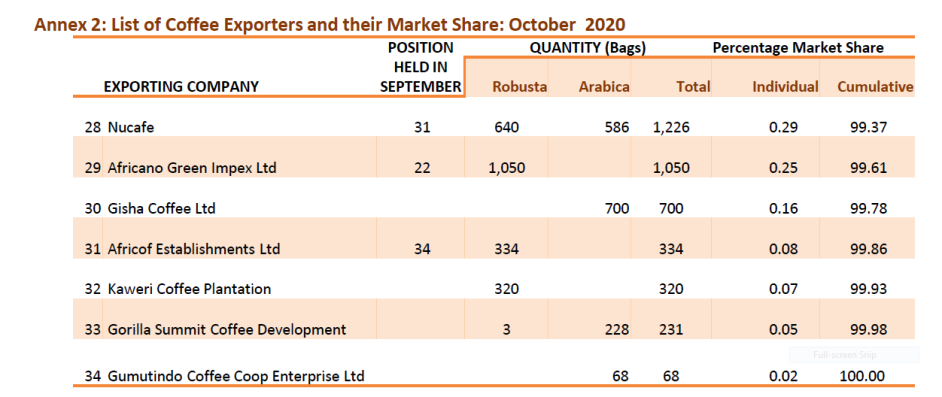

83.02% of the total volume was exported by 10 exporters, out of 34 companies which performed during the month compared to 78.01% in September 2020, reflecting increasing concentration.

The increase in monthly exports compared to the previous year has been attributed to the increased production on account of fruition of the newly planted coffee as well as favourable weather. The export reduction from the previous month is expected since the main harvest south of the equator has ended, UCDA says.

ALSO READ:

How To Earn Over Shs23m From An Acre Of Coffee Annually

Lessons For Farmers From Africa’s Largest Coffee Plantation

MAGIC IS IN SPACING; Ex-Seminarian Explains How To Earn Millions From Coffee Farming

According to UCDA, the top 10 export companies in the month of October 2020 held a market share of 83.02% compared to 78.01% the previous month.

Olam Uganda Ltd led the highest market share with 20.14% compared to 9.23% last month. It’s important to note that the figures in brackets represent percentage market share held in September 2020.

It was followed by Ugacof (U) Ltd 13.97% (14.20%) ; Louis Dreyfus Company (U) Ltd 12.02% (7.29%) ; Touton Uganda Limited 8.71% (6.46%) Ideal Quality Commodities Ltd8.68% (12.00%) Kyagalanyi Coffee Ltd7. 01% (14.20%); and Grain Pulse Ltd 3.65% (3.31%).

Out of the 34 exporters that performed, 19 exported Robusta Coffee only while 3 exported Arabica coffee only, the report says.

Below is a list of top coffee exporting companies of Ugandan coffee;

Destinations of Uganda’s coffee exports

According to UCDA, Italy maintained the highest market share with 38.52% compared with 29.49% last month. *The figures in brackets represent percentage market share held in September 2020.

It was followed by Sudan 13.48% (22.54%), Germany 19.61% (12.37%), India 8.69% (7.39%) and Belgium 5.63% (8.15%).

Coffee exports to Africa amounted to 87,384bags, a market share of 20.42% compared to 138,196 bags (27.29%) the previous month.

Africa countries included Sudan, Morocco, Kenya, Algeria, Egypt and South Africa. Europe remains the main destination for Uganda’s coffees with a 61% imports share.

Seeking for serious supplier of both Arabica and Rubusta coffee.

Nice and good