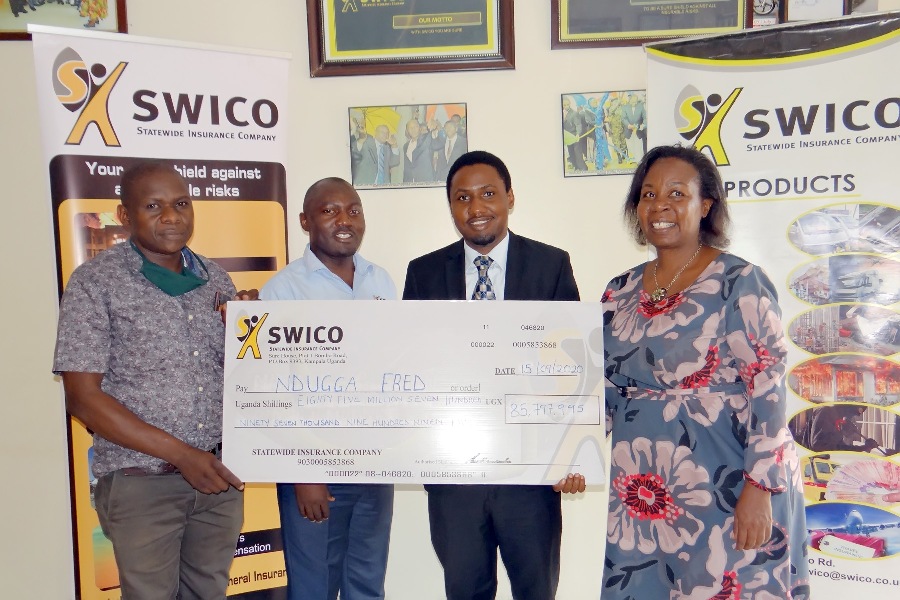

Mr Fred Ndugga (L) receives his compensation cheque from SWICO, represented by Ms Florence Namagembe, the GM (R), Mr Daudi Mugabi, Head of Marketing (2nd R) and the company’s Masaka manager (2nd L)

Mr Fred Ndugga, a Masaka district trader, is a relieved man after receiving UGX 85 million from SWICO (Statewide Insurance Company) as compensation for his stock in the shop that burnt down to ashes on June 13, 2020.

Ndugga’s shop operating under the name Lubwama, Ndugga Ltd in Masaka town, was dealing in general merchandise.

“I am thankful to God that I was already insured with SWICO when my shop burnt down. I have now been fully compensated for everything I lost,” said Ndugga, after receiving his cheque in Masaka.

SWICO has grown and maintained its market share by consistently paying claims on time, and as Ms Florence Namagembe, the SWICO General Manager is quick to point out, insurance, is not as expensive as many fear, explaining that a business worth UGX 100 million in stock would require one to pay only UGX 300, 000 annually in insurance premiums; a much cheaper option than say selling one’s land or borrowing heavily to replace the stock after a loss.

Ndugga was not the only trader in Masaka to suffer misfortune, with at least 20 shops and a wooden video hall also burning down in the district since April, 2020. However, unlike Ndugga’s, many of these businesses were not insured.

“Many families have been badly impacted by these losses. My call to the Masaka business community is to protect your wealth with insurance cover,” Namagembe said.

Insurance penetration in Uganda stands at only 0.8% of GDP, largely because of misconceptions about compensation.

The Insurance Regulatory Authority (IRA) recently issued payment guidelines; claims ranging between UGX 10 million and UGX 50 million will not take more than 15 working days before being cleared. For those above UGX 50 million insurers are required to compensate the client within 20 working days or a month, at most.

“Without doubt, we will register more insurance uptake with this increased efficiency in claims settlement,” Alhaj Kaddunabbi Ibrahim Lubega, CEO of the IRA said, in a recent press interview.

Mr Kaddunabbi is especially optimistic of continued growth of micro-insurance, boosted by increased innovation in product distribution like accessing insurance services via mobile money platforms.

“Micro-insurance which addresses the needs of the everyday person, grew from UGX 24 million in 2018 to UGX 300 million in 2019 and it has continued to grow this year,” he said. SWICO, one of the oldest indigenous insurance companies in Uganda, offers general insurance solutions.