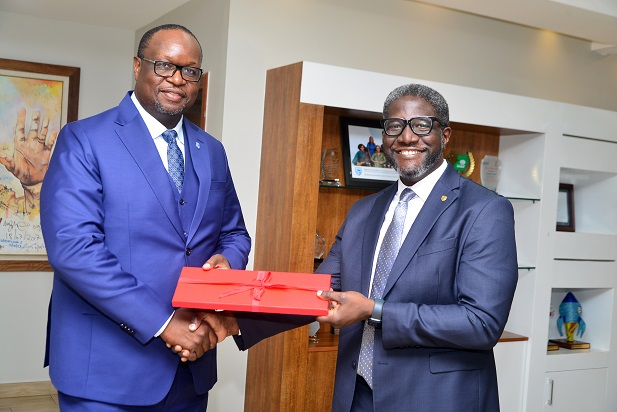

Airtel Uganda MD Manoj Murali with some of his senior colleagues

Airtel Uganda Ltd, the mobile telecommunications company, has closed its public offer of shares with a subscription rate of 54.45 percent.

Trading of shares on the Uganda Securities Exchange starts Tuesday at 9.30 am after the bell is rung.

The initial public offer opened on August 30 and closed on October 27, having been extended for a week, “to enable more participation by the retail (Ugandan) investors,” according to Airtel Uganda Managing Director, Manoj Murali.

A joint announcement by Absa Uganda Ltd, the transaction advisor and Crested Capital, the lead sponsoring broker, published by Airtel, shows that, 4,355,902,835 (just over a half) were allocated. These include sale shares and incentive shares.

The company offered 8 billion (20 percent) shares to the public at 100 shillings a share.

The National Social Security Fund (NSSF) purchased shares worth 199 billion shillings or 10.55 percent of the total outstanding shares of the company.

“Following the offer, professional investors will hold 10.55 percent of the total shares outstanding of Airtel Uganda, with retail investors holding 0.34 percent,” the announcement says.

The IPO attracted a total of 4,614 subscribers, while total proceeds amounted to 211.43 billion shillings, out of the 800 billion it had expected from the offer.

After ringing the bell on Tuesday, Airtel Uganda becomes the second telecommunications company to be listed on the USE.

MTN Uganda went public in 2021 having raised 535.9 billion shillings from a 64 percent of the 4.5 billion shares it had offered.