President Museveni has refused to sign into law the Income Tax Amendment Bill 2023 into law, asking Parliament to review its earlier proposal not to impose tax on digital companies, arguing that the tax will be borne by owners of these companies, not resident Ugandans as alleged by the minority report from the Opposition MPs.

In his 26th June 2023 letter to Speaker Among, the President wrote, “The measure was meant to cater for taxation of digital economies such as; Twitter, Amazon, Netflix etc the clause related to non-residents and non-residents in Uganda says it doesn’t relate to residents in Uganda as it was mistakenly stated in the minority report. It should be reinstated.”

The Ministry of Finance had in April 2023 proposed an insertion of a new clause 16 to the Income Tax Amendment Bill 2023, to impose a 5% Withholding Tax on digital services targeting tech giants including Amazon, Facebook and Google, but later dropped the proposal during a debate at Parliament, asking for more time to conduct a study on its impact on Uganda’s economy.

This was after Government failed to furnish Parliament with a research it had conducted on who will withhold the tax, how it will be enforced and how much revenue these companies were making from Uganda and how much of these profits would be remitted to URA.

Although many of the stakeholders that appeared before Parliament’s Finance Committee raised concern on how the tax would be imposed, Government argued that URA has administrative tax measures similar to this on VAT for multinational companies in as far as collecting of the proposed tax is, thus allaying the fears advanced by some stakeholders interacted with that the tax will be transferred to the residents benefiting from supplies of such services.

While presenting the report for Parliament’s Finance Committee, Keefa Kiwanuka the Chairperson expressed reservations on the implementation of the digital tax arguing that given the fact that the targeted digital companies have no physical presence in Uganda, Government has no jurisdiction making the implementation of the tax hard, but the same tax was agreed by other tax bodies in the East African region.

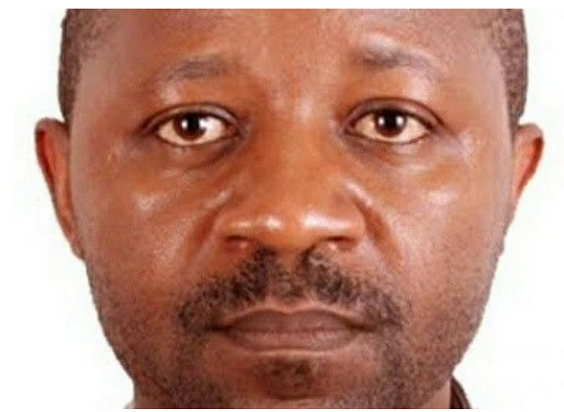

Muhammad Nsereko (Kampala Central) however rejected the proposal asking to have the rate lowered to 2% of the gross income the digital companies are earning from Uganda until Government carries out a study on how the tax will impact Ugandans.

“The moment you increase tax on those non-resident digital players, they just pass it on, when you pass it on, you automatically limit me. Let us do a further study on this tax, let us see its impact on its people,” said Nsereko.

When the proposal came up for consideration, Nsereko informed Parliament that the two warring sides had agreed to suspend the tax until a study on its impact is conducted, stating, “We have agreed to delete and carry out a study on this provision and come back next year with a proper study.”

Taking to the floor to concede on behalf of Government was Attorney General, Kiwanuka Kiryowa who said, “I am persuaded by the submission of Nsereko,that the definition of the law as provided here may extend past the limit of where we would like this law to go. And because of this ambiguity, on what services we intend to tax, we are proposing that this be dropped and at the appropriate time after some study we bring it back.”