The rate at Uganda government is borrowing, the East African country could soon hit the 50% (of GDP) debt ceiling.

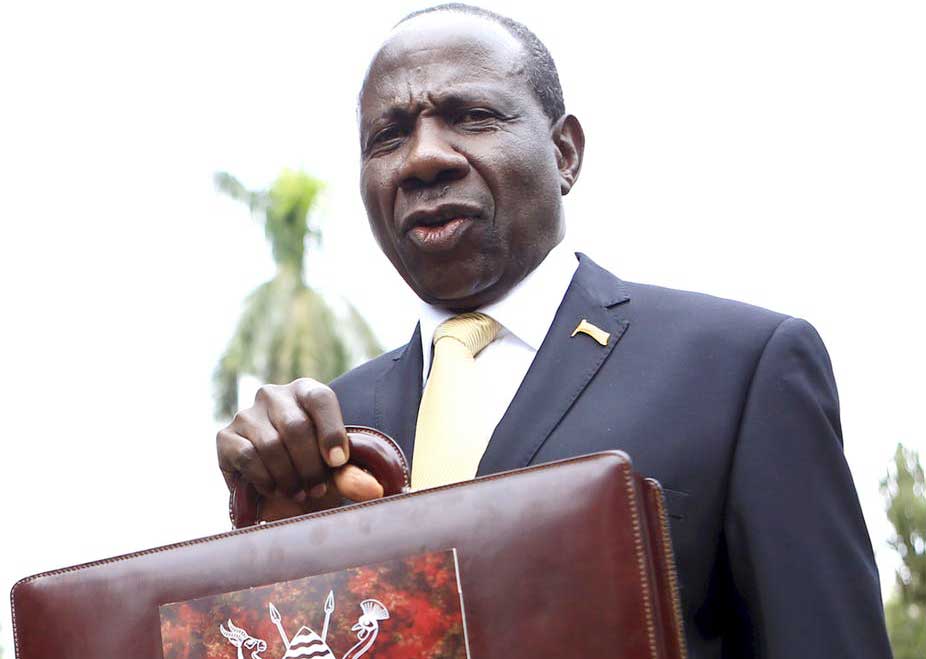

The latest is that government through the Minister of Finance, Planning and Economic Development, Matia Kasaija is set to table a motion before Parliament during today’s plenary sitting seeking Parliamentary approval to borrow over Shs2.4Trn from Stanbic Bank and Trade Development Bank (TDB) to finance the 2019/2020 National Budget deficit.

The details are contained on the order paper in which Government is set to borrow up to Euro 300 million (Shs1.3Trn) from Stanbic Bank Uganda and Euro300 million (Shs1.229Trn) from Trade Development Bank.

In the same plenary sitting, the Ministry of Finance is set to table a proposal to borrow up to Euro 162.4m (Shs665.8bn) from Industrial and Commercial Bank Of China to finance the development of industrial parks (power supply to industrial parks and power transmission line extension.

On 9th May, 2018 the Minister of Finance submitted Corrigenda to the Draft Estimates, and an addendum to the Corrigenda, which revised the total proposed annual budget for FY2019/2020 to Shs40.47Trn of which Shs27.9Trn is for appropriation and Shs12.53Trn is for statutory expenditure.

Government had projected that domestic and external financing will constitute 74.5% and 25.5% of the total resource envelope, respectively.

Uganda Revenue Authority is expected to collect Shs18.8Trn in 2019/2020 from Shs15.9Trn that was earmarked in 2018/2019 indicating 18.1% change with tax revenues set to contribute 47.6% of the national budget.

Non Tax Revenue from Ministries, Agencies and Departments (MDAs), would increase from Shs1.46Trn in 2019/2020 from Shs420.OBn projections made in 2018/2019 indicating 248% increment.

Government also set eyes on the Petroleum Fund and having obtained Shs200bn in 2018/2019, there are plans to dig hands deeper into the oily money and use Shs445.8bn to finance the budget.

Local Government Revenue will finance budget to a tune of Shs201.1bn in 2019/2020 budget from Shs1.06Trn projected in 2018/2019 indicating a decline of 81.1% and Government plans to seek for loans from commercial banks through domestic borrowing in 2019/2020 to a tune of Shs8.5Trn from Shs7Trn allocated in 2018/2019. External Resources will be Shs10.09Trn in 2019/2020 from Shs8.02Trn.

It should be noted that Government recently tabled a loan request to Parliamentary Committee on National Economy seeking to borrow up to Euros 20.6M (about Shs83.7bn) from the Corporate Internationalization Fund of Spain for purposes of mapping of minerals in Karamoja region.

According to the Report of Budget Committee on 2019/20 budget estimates, Uganda’s total public debt stock increased by 12.5% to USD11.52bn (approximately Shs43.31 trillion) as at end December 2018 from USD10.24bn (approximately Shs38.5 trillion) at end December, 20l7.

The report further stated that the external debt stock increased by USD 0.78Bn to USD7.66Bn by end of December 2018 from USD6.88Bn at the end of December 2017, with the increase mainly from China (25 percent) and World Bank (40 percent).

This means that the debt has since increased considering the fact that government has been on a borrowing spree since then.