In the second edition of the nationwide Savings and Investment campaign dubbed ‘Battle for Cash’ where dfcu Bank partners with NTV Uganda and Price Waterhouse Coopers (PwC) with an aim to build a savings and investments culture in Uganda, Akuna Muchezo Development Club emerged as the winners. The challenge in form of a TV show that engages various investment groups through saving and financial literacy workshops across the country and selects clubs to take part in the competition. We recently caught up with one of the members of Akuna Muchezo and had a conversation with them.

Tell us about yourself and the Investment Club?

My name is James Kenyi James. I am 33 years old and a proud father of two handsome boys. I currently work as a Bursar at one of the secondary schools in Nsambya and I am also the Chairman for our Investment Club Akuna Muchezo.

Akuna Muchezo was started 2 years ago. The idea came up while playing Ludo at a social place. At the time, we were only (seven) 7 members, today we are 46 members.

We wanted an idea that would bring us together more often and also enable us to help each other financially. We came up with the name Akuna Muchezo a Kiswahili word which means ‘No playing’ because at that time we were facing very hard economic times and we realized the only way out is by working hard. So much can be achieved when people come together as a group.

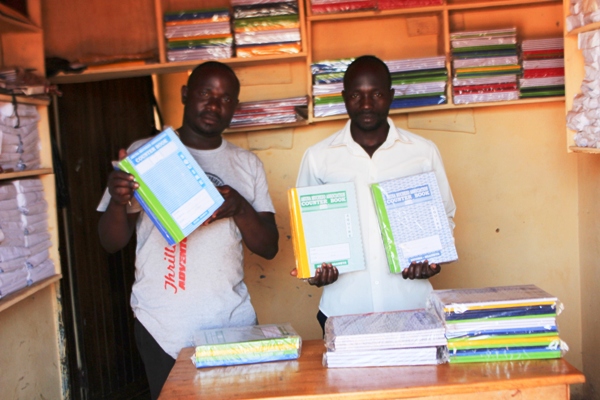

We started out by saving UGX 1,000 per week. After one month, we got an idea of starting a project that would generate extra income. That’s how we started bookmaking and recycling used papers into paper bags. We settled for this project since it doesn’t require too much capital to acquire the skill and the materials were available at Nasser Road which is very near Nsambya. Books hada ready market since there are many schools, bookshops and friends who were willing to give us a chance.

We gathered on a Saturday and got an instructor from telecast who trained us in bookmaking. Weregistered the company, elected leaders and made our constitution. Along the way, some people left the group because of different interest. By the end of the first year, we had 32 members. We applied for CBD funds nonrefundable from governmentand were given 5 million which we invested in the business. This enabled us to buy computers and enlarge our area of operation. We bind the books at our workshop then take them for printing at Nasser road. We then distribute them to our customers.

Recently, your club participated in Battle for Cash Season Two. How would you describe the experience?

We learned about theBattle for Cash competition during the first season but we weren’t ready so we kept cool. Initially, we had an account with a different bank but we were not satisfied with their services. One of our members who had an account with dfcu Bank recommended we shift to dfcu Bank because they had better services and products. We opened up an account at Kafumbe branch and since then we have never looked back.

When they announced the second session, we decided to go for it. We were very raw and we didn’t know what was expected of us but the organizers guided us through it all. Most of our members are illiterate apart from me and my colleague who represented the group. We struggled a bit but in the end, we took the prize home.

What the judges were looking for was creativity in marketing your ideas and also you should have already established some tangible investments on the ground.

We submitted a 10-year business plan and our target is to achieve close to UGX122, 800,000 as working capital. After ten years the business should be able to survive on its own and also pay us because we have invested our time and resources in it.This recognition reaffirmed members’ confidence in the group and now the members are more willing to make investments.

Share the secret that enabled your group to emergevictoriously?

We were creative in selling our concept. Our ability to learn and adapt fast to any given environment. You can’t base your proposal on air whereby you think you will only start after winning the money. We were challenged to keep thinking freshly on how to market our ideas to the world.

How much capital did you start with?What kind of businesses have you invested in?

Initially, we started with 7 million but now we are worth 50million – 60 million in terms of assets and investments.

When we won 30 million last year, we started tangible developments.We had a plot of land which was not developed offered by one of the group members thus we decided to renovate the building and expand ourworkplace.We will use the plot of land for the next five years before starting to pay him rent.

In our budget of 2019, we had two alternatives – buying the digital printing machine or buying the delivery van. We decided to purchase the delivery van since our markets have expanded stretching from the east to west as far as Kasese and fort portal. Before acquiring the van, we used the bus but sometimes the books are damaged along the way.

We based this decision on the season (Jan-Feb) is a peak season for our business since the demand for the books is high, this is the time when students go back to school. During peak season we will use the truck for delivery and hire it out in the dormant season. The money generated from this will be deposited in the group account.

Currently, we have invested in three different ventures that feed into each other; Delivery truck generates income for the group, Binding books,and papers bags also bring in money and we also decided to open up a stationery shop where we display our products and also stocked other stationery products which also generates some money for the group. This three business have different business cycles meaning our coffers will never be empty. We are also looking into investing in real estates in the nearby future.

What lessons did you pick from the Nairobi trip?

I learned so much from the Nairobi Trip, the handbook that was given to us by PriceWater Coopers is now a daily business guide in our investment club. Since most of the other group members are illiterate, I try my best to translate, breakdown and disseminate the information to them so that we move together. The handbook breaks down all the dos and don’ts of investment clubs. Today most of them are willing to invest more in the club over since we started digesting together the information contained in the handbook.

In Nairobi, we were told that we should never stop investing, you have to reinvest the returns if you want to grow to another level. Initially, we would divide profits and savings at the end of the year, but now we have moved away from that. We even decided to change our memorandum of understanding, we will be sharing a quarter of that money and reinvest the balance in other projects. We came up with new investment policy.

What are the challenges you face as an investment club?

The biggest challenge we encounter is a mindset change. Most people want quick money and when you try to challenge them to see the bigger picture they think you are trying to con them.This is common among people who joined the club at a later stage, they haven’t fully integrated into the system.We are considering reducing our numbers so that we remain with people who are at per with our objectives.

Tell us about your future plans?

When we shift to our new workshop, we want to get community members involved in the business. The demand for our products is high and since we can’t supply everywhere. We are looking at training more manpower to work in the workshop. We are also looking at penetrating supermarkets after we get the bar codes from URSB. We also want to form a SACCO called Makindye United Bookmakers SACCO. This will unite all bookmakers both in Makindye west and east together which will enable us to lobby for resources and look for market collectively. We have close to 1,000 bookmakers who operate on a small scale, since the market is large we are looking at working with them. We are also expecting orders to start supplying books as far as South Sudan and Congo come next year.

What advice would you give to someone who is still hesitant to join an investment club?

What I saw in Kenya inspired me a lot, at first I wondered why dfcu Bank was spending all this money on us! But after our first session at PwC in Nairobi I realized the secret, if everyone who went for that trip internalizes and put to practice what we were advised in Nairobi, there is a massive wave that will change their businesses forever. If we are all to develop then we have to turn to investment clubs. The good thing about investment clubs is that you contribute little but develop more due to pooled resource andshared risks. Pooling resources together generates a lot more returns in a short while. Investment clubs are the gateway to financial independence. It’s important as Investment Clubs to have a long term strategy that supports growth.