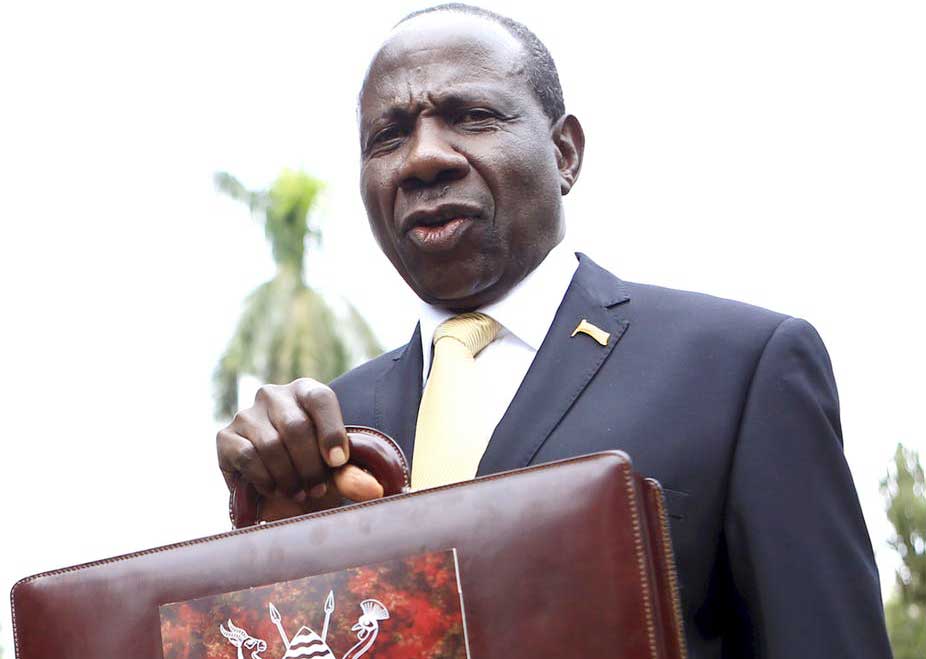

Uganda’s Finance Minister, Matia Kasaija, has refuted media reports that the country could lose property if it fails to service the public debt that now stands at a whopping Shs41.Tn.

Kasaija made the statements on Tuesday following local media reports that the government is poised to lose property over the huge debt. This came after the Auditor General presented a report to the Speaker of Parliament last week.

” I would like to correct this information to indicate that government borrowing is controlled and guided by the Public Debt Management Framework (PDMF-2013),” Kasaija said.

Below is the full speech

PRESS RELEASE – PUBLIC DEBT OF UGANDA

- The Saturday Monitor Newspaper of 5th January 2019 included an article on Uganda’s public debt, captioned “Uganda’s Public Debt Worrying Auditor General”. The Sunday Red Pepper dated 6th January 2019 presented an article with a similar message, captioned “Uganda to Lose Property over UGX 41.51 Trillion Debt”. The two newspapers based their messages on the Auditor General’s report that was presented to the Rt. Hon Speaker of Parliament on Friday 4th January 2019.

- While the Ministry of Finance, Planning and Economic Development will formally respond to the report once it has been presented to Parliament, I want to take this opportunity to reply to some of the issues as follows:

- Uncontrolled borrowing: The two newspapers stated that the uncontrolled borrowing of the Government of Uganda will increase Uganda’s debt burden. I would like to correct this information to indicate that government borrowing is controlled and guided by the Public Debt Management Framework (PDMF-2013) whose objectives are:

- Meet Government financing requirements at the minimum cost, subject to a prudent degree of risk;

- Ensure that the level of public debt remains sustainable, over the medium-term and long-term horizon while being mindful of the future generations, and;

- Promote the development of the domestic financial markets.

- Cost effectiveness: The Government of Uganda aims to finance its activities and projects in the most cost effective manner. Multilateral creditors, like the World Bank and African Development Bank (ADB) have provided the largest part of Government’s financing with the most favorable financing terms. In FY 2017/18, multilateral creditors accounted for 68% of total outstanding debt while Bilateral creditors accounted for 31% and commercial banks only accounted for 1% of the external debt stock.

- Public debt position:

- As at end June 2018, Uganda’s total public debt stock (domestic and external) amounted to USD 10.7 billion, equivalent to UGX 41,326.1 billion.

- Out of this, external debt disbursed and outstanding accounted for 67.2% (USD 7.2 billion or UGX 27,939.9 billion) while domestic debt contributed 32.4% to total financing (USD 3.5 billion or UGX 13,386.2 billion).

- The Net Present Value (PV) of Public Debt to GDP increased to 30.8% in June 2018 from 27.4% as at the end of June 2017. However, in Nominal Value Debt to GDP as at the end of June 2018 was 41.5% compared to 37.3% at the end of June 2017.

*The Net Present Value (NPV) of a loan is the sum of all future debt service obligations (principal plus interest) on existing debt, discounted at the market interest rate while, the Nominal Value of a loan equals the loan amount borrowed.

- I want to inform the country through you the media that Uganda’s Public debt has been provided largely by multilateral creditors who offer concessional terms that include a grant element of more than 50% with an average maturity of over 35 years and a grace period not less than 6 years coupled with relatively low interest rates below 1.5% annually.

- Bilateral creditors on the other hand are dominated by China Exim Bank and Japan International Corporation Agency (JICA) who are the biggest lenders. The bilateral creditors offer preferential terms with grant element that range between 20% and above 35%.

- Debt Sustainability: Uganda’s debt remains sustainable with nominal debt to GDP of 41.5% which is consistent with the findings in the Auditor General’s report. This performance includes the financing of the flagship projects like the power generation plants at Isimba & Karuma, the development of Kabaale International Airport and the construction of Entebbe Express High Way, among others.

- The Government will continue to be cautious on taking on new projects after the implementation of the above mentioned flagship projects. To ensure debt sustainability, the Government is implementing the following strategies:-

- Prioritizing borrowing for mainly infrastructure projects to address current infrastructure gap (Transport, Energy, Industrial Infrastructure and Water for Production).

- Continue to invest in export-oriented areas to boost exports in order to increase foreign exchange inflows and also enable servicing of external debt. It is therefore pleasing to announce that we are already reaping the dividends of this interventions, as a result, Uganda recorded a positive trade surplus in the region of USD 471 Million for the fiscal year 2017/18.

- Ensure improved loan absorption by strictly adhering to the loan approval processes i.e. project preparation, negotiation and approval.

- Taking selective and strategic financing options to minimize financing risks with preference given to concessional financing, and commercial borrowing with low interest rates.

- Enhancing domestic revenue efforts. Government starting next financial year will start implementing the new comprehensive Domestic Revenue Mobilization Strategy (DRMS), which aims to raise the revenue to GDP ratio to at least 16% in the next 5 years. This increase in domestic revenue will provide Government with the additional resources for financing development projects and service its debt obligations annually.

Furthermore, the development agenda will be guided by high National priorities with expected high economic return as identified in National Development Plan.

- Domestic Debt: Government borrows from the domestic market to partially finance the fiscal deficit. The current share of domestic debt to total public debt is 32.4% equivalent to 13.3% of GDP.

- Selected sector economic achievements from External debt

- Energy: Investments in Karuma and Isimba Hydro power projects will enhance the current power generation capacity by an additional 783MW to the national grid in the next two years on completion of the 600MW Karuma and 183 MW Isimba power projects;

In addition, investments in Rural Electrification have increased the access by households to 22% in 2017 compared to 11% in 2011. This power investment will support our industrialization and Small and Medium Enterprises growth country wide.

- Roads: The investments in highways and general road network is meant to contribute towards accessing production areas and boost economic activities countrywide. The benefits are in the areas of Trade, Agriculture, Tourism and Time saved especially after completion of the express highways and bridges across the Country. Currently 5,350Km have been paved by end FY 2017/18 and Government is continuing to expand on the paved roads network and a number of roads are under construction.

- Health: Government has continued to invest in the development of health infrastructure. Examples include; the Mulago National Referral Hospital extensive re-construction and equipping. This Project also included construction of a new 320 bed Specialized Maternal and Neo-natal Health Care which is complete. The construction and equipping of Kawempe and Kiruddu Hospitals was completed. The Cancer Institute has been reconstructed and re-equipped and is also fully functional. Through some of these loans, the following has been achieved in the health sector; Decline in infant mortality rate to 43 per 1000 from 56 per 1000 live births in 2011 among other achievements.

- Education: Infrastructure in Education has been and continues to be a priority for Government. There have been a number of secondary schools and National Teachers colleges that have been rehabilitated. Over 650 schools across the country have been constructed in a bid to expand infrastructure in Government USE schools to accommodate the rapidly growing numbers of students and house teachers in especially hard-to-reach areas. Skilling Uganda program that has also boosted the Business Technical Vocational Education and Training (BTVET) part of the sector for example five technical colleges (UTC Elgon, in Mbale; UTC Kyema; UTC Bushenyi; and UTC Kichwamba to nationally harmonized & internationally comparable level. Government also embarked on rehabilitation of the universities under the Higher Education Science and Technology (HEST) project.

- Municipal Infrastructure Development: The Uganda Support to Municipal Infrastructure Development (USMID) program aimed at enhancing institutional performance and improvement of urban service delivery in the 14 Municipal Local Governments of Gulu, Lira, Soroti, Moroto, Mbale, Tororo, Jinja, Entebbe, Masaka, Mbarara, Kabale, Fort Portal and Hoima.

In a nutshell therefore, Government borrowing is sustainable and directed at infrastructure investments which have contributed to sustained growth rates of the economy having achieved 6.1% in FY2017/18 up from about 4% in the previous year and is set to continue in this trajectory over the medium term. The expansion of the economy leads to increased capacity to collect more revenue which improves the country’s ability to service its debt.

- Measures to address absorption challenges

In order to address the absorption challenges, the following measures have been put in place:

- Government is ensuring strict adherence to the project investment management system (PIMS) process by financing projects that have fulfilled the PIMS requirements.

- Ensuring adequate provision of counterpart funding for respective votes specifically to address compensation requirements and Project Affected Persons (PAP) to acquire the right of way.

- Providing capacity development for Ministries, Departments and government Agencies s’ in project development and contract management which is ongoing.

- Regular review of the Public Investment Plans to identify projects that have ended and create fiscal space from within the budget for financing new projects.

The above measures have been effective and as a result there has been improvement in the absorption rate from 40% in FY 2014/15 to 76% in FY 2017/18 respectively. These improvements will continue even as we build our capacity in all aspects of project management cycle.

- Conclusion

I would like to assure the Country at large, that our debt is sustainable, and is projected to remain sustainable in the medium to long term. The debt levels are comfortably below the international sustainability thresholds (e.g below 50% debt to GDP ratio) beyond which debt starts getting unsustainable, and are significantly below the sub-Saharan average (45.4% debt to GDP).

We therefore compare very favorably with peer countries, because most of our debt has been contracted on concessional terms, unlike other countries in the continent who have contracted a lot of commercial debt like Eurobonds. Moreover, with the investments that our debt is financing, the capacity of our economy to service its debt obligations will significantly increase. In addition, the increase in revenue arising from implementation of the new Domestic Revenue Mobilization Strategy will reduce the country’s borrowing requirements in the future.

In addition, all debt payments are programmed and prioritized to ensure that debt is paid as and when it falls due. The risk for government defaulting on debt repayment is nonexistent in our budgeting cycle and should not be of concern to anyone.

Government will however continue borrowing cautiously and selectively for infrastructure development with intention to grow the economy which in turn boosts domestic revenues, promote exports to earn foreign exchange which we use to service our external debt thus enhancing our capacity for debt sustainability.

MINISTER OF FINANCE PLANNING AND ECONOMIC DEVELOPMENT

January 2019