Uganda and other African countries have been advised to take a keen interest in US politics. The outcome of the presidential polls later this year is poised to affect the economies.

This is more important for Uganda, which is pegging its anticipated double-digit growth rates over the next 15 years on exports, among other opportunities.

Richard Newfarmer, the Country Director International Growth Centre, says that some presidential candidates in the US elections are vowing to slap high tariffs on imports into the country, which could affect developing countries.

Speaking at the 8th Uganda Economic Growth Forum, Newfarmer said Uganda’s growth targets are ambitious but that there are opportunities like export growth following the recovery of the global economies from the effects of COVID-19 and the high global inflation, which left the countries in difficult debt situations.

He says these are some of the things that African countries should focus on as discussions are ongoing towards the transformation of global trade infrastructure.

This comes as Uganda commences her journey towards becoming a 500 billion-dollar economy in 15 years, a feat that would be achieved by a stable economic growth rate averaging at least 10 percent per year.

While increased exports, productivity and investments in priority areas like ICT, Agriculture and Agroprocessing, Tourism, Infrastructure and human capital are vital, Dr Newfarmer suggests increased subsidization of investments in areas that have bigger multiplier effects like agriculture, mining and education.

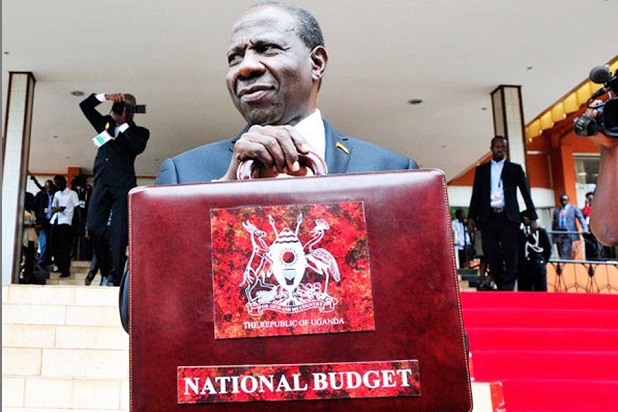

The 8th Economic Growth Forum is organized by the Ministry of Finance, Planning and Economic Development under the theme: Seizing Opportunities for Structural Transformation to Increase Productivity and Resilience.

The experts talked about structural transformation and the need to embrace policies and programs to generate opportunities and measures to address the economic bottlenecks the country faces.

Henry Musasizi, Minister of State for General Duties at the Ministry of Finance, emphasised that Uganda’s strong economic growth has been driven by infrastructure development, investment in human capital development, deliberate government programs for agriculture and agro-industrialization such as the Parish Development Model (PDM) and a conducive macroeconomic environment.

Uganda’s economic growth has over the last 14 years averaged just 5 percent, down from the high and commendable 7 percent registered between 2000 and 2010.

Ramathan Ggoobi, the Permanent Secretary and Secretary to the Treasury said the government cannot afford to have such a low growth rate going forward.

Ggoobi said despite facing global challenges such as tighter financial conditions and supply chain disruptions, Uganda’s economy demonstrated impressive resilience by achieving a growth rate of 6.0% in FY 2023/24, compared to Sub-Saharan Africa’s average of 3.8 percent and the global 3.2 percent.

According to the government’s estimates, the country’s GDP grew to about 53 billion dollars last financial year.

The plan aims to double GDP every 5 years, raise per capita GDP from 1,146 dollars to 7,000 dollars by 2039/40, increase savings from 20 to 40 percent of GDP, raise the share of exports in GDP from 12 to 50 percent and increase annual foreign direct investments (FDI) inflows from 2.9 billion in 2022 to 50 billion dollars by 2040.

The Technical Advisor Economic Affairs, Moses Bekabye, said all these need high-level political will, and reestablishing meritocracy among other interventions if the target is to be achieved.

Bekabye says the strategic vision is based on the immense economic potential that the country has, which remains untapped, adding that it’s also driven by the need to create jobs and increase household incomes by increasing and expanding enterprises and manufacturing capacity.

According to the Ministry, other opportunities include harnessing natural resources (oil and gas, gold and iron ore), population growth and the demographic dividend as well as enhanced regional integration.

Others are increasing domestic savings to finance investments and reduce reliance on external debt, as well as closing gaps in the policy and regulatory environment.

–URN