Equity Bank Uganda is leveraging on technology not only to grow, but also bring more Ugandans into the banking fold.

According to Samuel Kirubi, the Managing Director, Equity Bank Uganda, they are increasingly digitizing their products and services to meet customers’ needs.

He gave an example of agency banking where customers are able to deposit and withdraw money, a thing he said has not only eased banking, but also helped reach out to many unbanked Ugandans in rural areas.

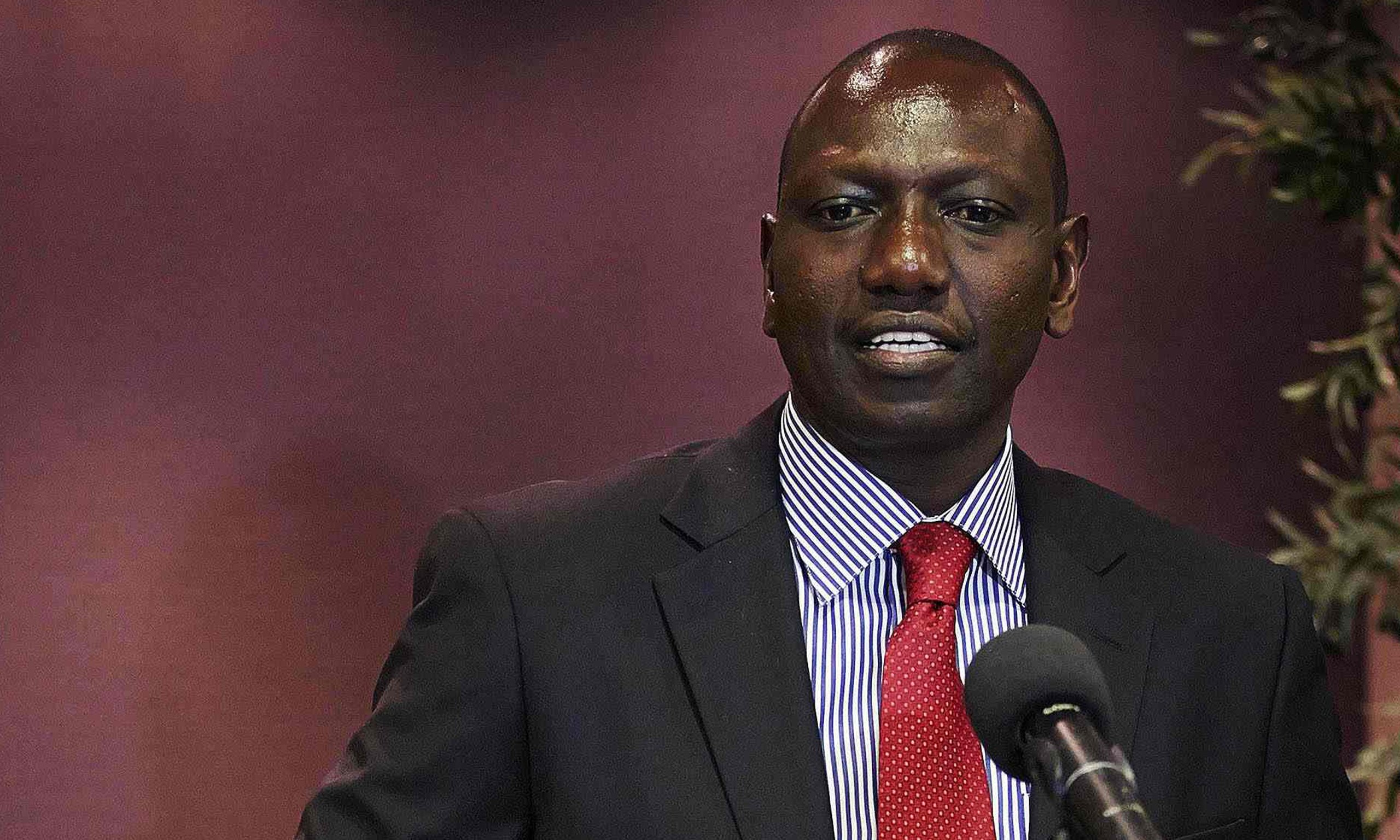

Kirubi (Left in the featured photo) made the remarks yesterday during a break-away session at the Annual Bankers Conference 2019 held at Serena Hotel, Kampala.

He was speaking on a topic; Blending Technology & Finance to harness the potential in Agriculture: Perspectives from Financial Institutions.

Kirubi noted that the bank is partnering with many farmer organizations and companies dealing in crops such as tea, coffee, sugar and cotton to bring their workers and members to the banking fold.

“Once the system is digitized, we are able to monitor your cash flow; it becomes easy to lend to you,” Kirubi said.

He added that digital banking isn’t risk free, the reason why the bank has invested much in the systems.

He gave a taste of what is happening currently at Equity bank in as far as digital banking is concerned.

Kirubi said the bank’s mobile app, Eazzy Banking App which allows one to transfer funds to other accounts and mobile wallets or pay utility bills, has been a magic bullet to the institution.

Introduced last year, Kirubi said the App has so far attracted 50,000 downloads.

“Before the App, we used to have 11,000 transactions a day in all the 37 branches,” Kirubi said, adding: “With the App, we now have over 100,000 transactions a day in all our branches and the scale is growing.”

He noted that 70% of the bank’s loan applications are done online.

“These are micro-loans of Shs500,000 to Shs30,000,” he said.

Kirubi further revealed that the bank has in a period of less than two years grown the number of agents (agency banking) to 2,800 across the country and these register an average of 20,000 transactions daily.

He added that Shs250bn is transacted monthly via agency banking. Kirubi added that the bank has invested US$2m in the agency banking system to make it more efficient and reliable.

Having joined the Ugandan market 10 years ago, Equity bank has already broken into the top 10 profitable banks in a market of 24 banks.

The bank’s profit after tax grew by 26% to Shs35.29bn in 2018, up from Shs28.09bn recorded in 2017.