Sugar and cement will bear Digital Tax Stamps beginning April 2021

Government through Ministry of Finance has added sugar and cement on the list of goods to bear Digital Tax Stamps (DTS).

DTS was operationalised in November 2019 where six products, namely beer, soda, water, wines, spirits, and cigarettes were gazetted by the minister to apply digital tax stamps. This was mandated for both manufacturers and importers of the said goods.

For smooth implementation of DTS on sugar and cement, URA Friday morning engaged manufacturers of sugar and cement ahead of the implementation of the Digital Tax Stamps (DTS) for the new goods set for 1st April 2021 which has also been demarcated as the “Go live date”.

Present in the meeting were representatives from Bwendero D farm, Tororo Cement, Victoria Sugar Limited, Kakira Sugar, National Cement, UFCIL, Hoima Sugar Ltd, Busia Sugar, SCOUL and Atyak Sugar factory.

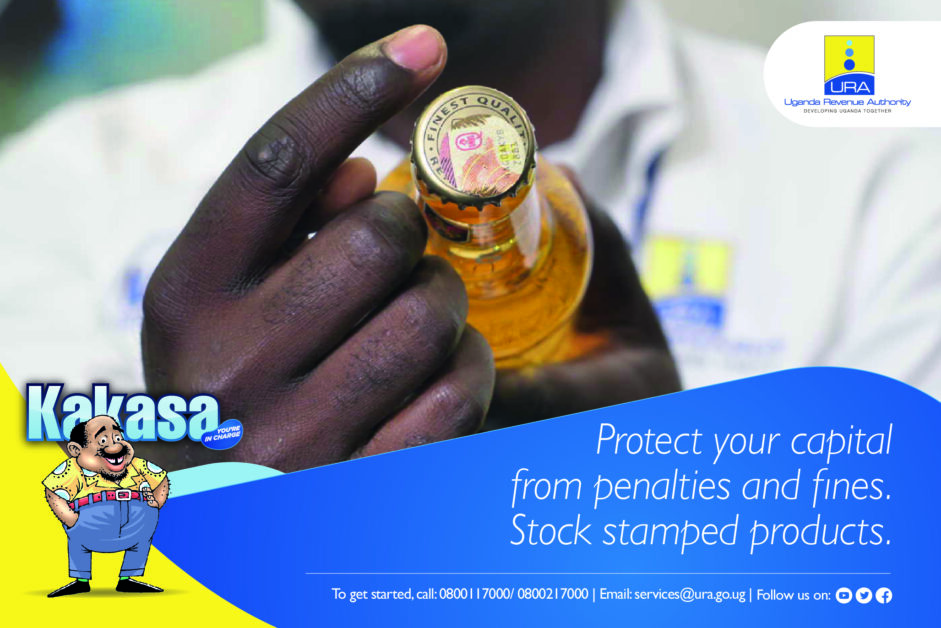

The Digital Tax Stamp is a mark or label applied to goods and their packaging and contains security features and codes to prevent counterfeiting of goods through its trace and track capabilities.

The launch will ride over a two months’ period from 1st April to 1st June 2021 even though the notices for stamp fees for sugar and cement and their manner of fixation were gazzetted on 1st January 2021.

Ian M. Rumanyika, the Ag. Assistant Commissioner Public and Corporate Affairs at URA, says each 50kg bag of cement will have a stamp bought at UGX 135, Cement bulkers will pay UGX 60,000 per truck while each bag of sugar will have a stamp worth UGX 39.

One of the manufacturers raised a question on who bares the cost of an expired stamp. The Assistant Commissioner of Large Taxpayers at URA, John Tinka Katungwensi, said that even though the products expire, the stamp does not.

“The stamps do not have expiry dates. It is you who declare on the web portal the details of production, expiry and the Stock Keeping Unit (SKU) of the product. You must put a serial number on each product,” Katungwensi said.

He added: “You can declare the stamp as unused by declaring it on the web portal as damaged. It is you who decide when to activate the system, whether upon packaging or when you dispatch your products for sale.”

In a question and answer dialogue, the manufacturers were equipped with information to enable them understand their obligations and rights in-line with the tax law and also address the emerging issues with the aim of enabling them own the solution.

Stakeholder engagement and taxpayer education continue to be the central focus of URA in order to understand the pains of the taxpayers.

On the 13th of July 2020, the Hon Minister of Finance, Planning and Economic Development (MoFPED) communicated to URA that he had extended the implementation of DTS to sugar and cement.

The Government of Uganda moved to implement Digital Tax Stamps with a focus on Local Excise Duty.

DTS is a technology solution that was sought to aid tax administration while mitigating revenue losses and deterring existing deficiencies in the tracking and tracing of locally manufactured and imported products which had contributed to less than adequate tax receipts from the manufacturing sector as well as the importation of excisable products.

URA which has positioned itself as a business facilitation partner to all its stakeholders and will continue to sensitize and engage the manufacturers to foster adoption and implementation of the solution.