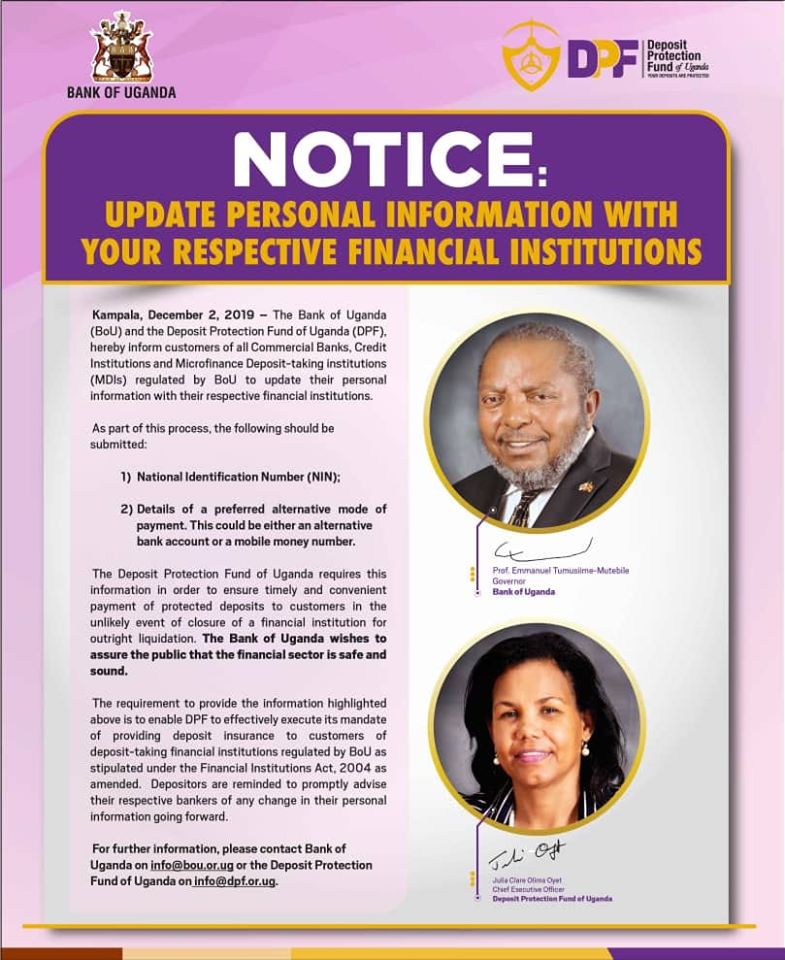

The Bank of Uganda and the Deposit Protection Fund of Uganda has directed depositors of all Commercial Banks, Credit Institutions and Microfinance Deposit-taking institutions (MDIs) to up-date their personal information with their respective financial institutions.

In a statement issued by the Central Bank, customers are required to submit National Identification Number (NIN) and alternative mode of payment. This could either be an alternative bank account or a mobile money number.

“The Deposit Protection Fund of Uganda requires this information in order to ensure timely and convenient payment of protected deposits to consumers in the unlikely event of closure of a financial institution for outright liquidation,” the statement reads in part.

It adds: “The Bank of Uganda wishes to assure the public that the financial sector is safe and sound.”

According to the statement, the requirement to provide the information highlighted above is to enable the Deposit Protection Fund of Uganda to effectively execute its mandate of providing deposit insurance to customers of deposit-taking institutions regulated by BoU as stipulated under the Financial Institutions Act, 2004, as amended.

“Depositors are reminded to promptly advise their respective bankers of any change of their personal information going forward,” the statement adds.

The development comes at the time the 2017/2018 Annual Report and Financial Statements for the Deposit Protection Fund of Uganda (DPF) indicate that the total assets increased by Shs83 billion, from Shs500 billion to Shs583 billion registered as at June 30, 2017 and June 30, 2018 respectively.

The growth in assets was largely financed by ‘fund capital’ which increased from Shs460 billion in June 2017 to Shs538 billion in June 2018, on account of profits derived from investments and contributions from financial institutions.

In line with the key objective of preserving capital and maintaining adequate liquidity levels, 95 percent of the Fund’s assets were held in Government of Uganda treasury bills and treasury bonds.