The 2020 financial results for commercial banks operating in Uganda are finally out.

Every year, Business Focus exclusively analyses the performance of banks based on their financial statements.

In the last one month, banks have been releasing their financial results in newspapers as required by law.

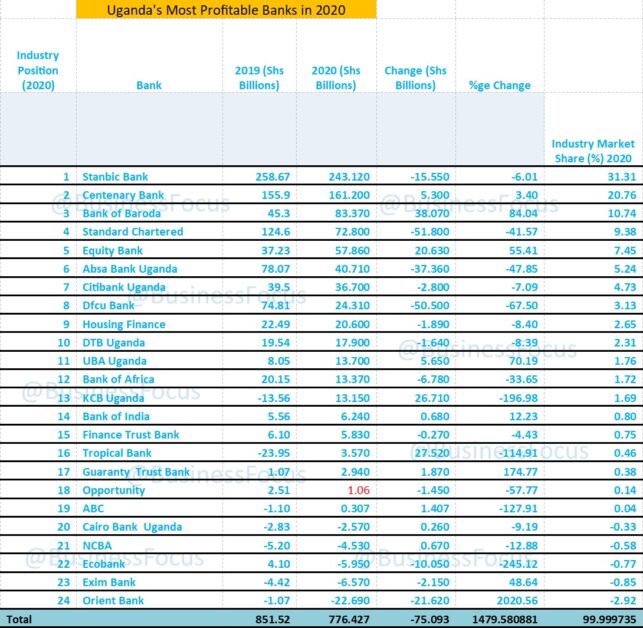

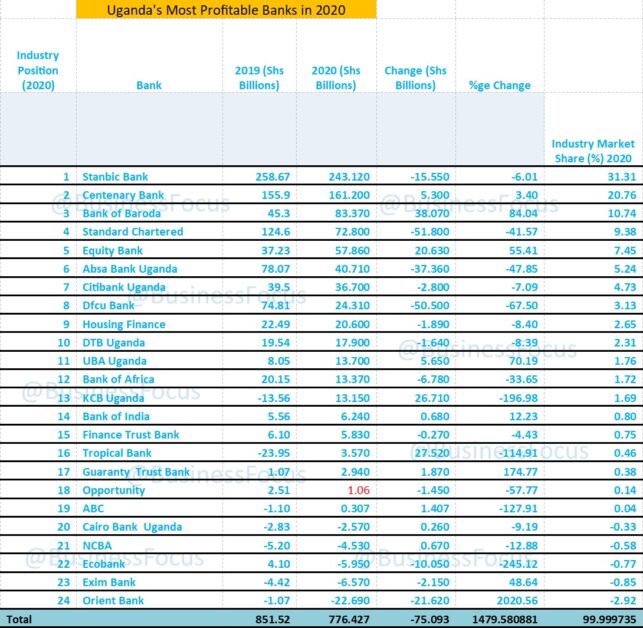

Currently, there are 25 banks operating in Uganda including Afriland First Bank Uganda Limited, a new financial institution. This analysis excludes this bank because it didn’t release its financial results considering the fact that it’s new. It’s also important to note that during the year under review, Commercial Bank of Africa merged with NC Bank to form NCBA.

According to the analyzed financial statements, the disruptions caused by the COVID-19 pandemic on the economy didn’t stop 19 banks from making Shs817.7bn profit in 2020.

In 2019, 17 banks made a profit of 903.65bn. In 2020, loss-making banks reduced to five (5). The five banks made losses amounting to Shs42.31bn. A year earlier (2019), seven banks made a loss of Shs52.23bn.

This means that the total industry net profit in 2020 was Shs776.4bn.

Most Profitable Banks

Stanbic Bank Uganda Limited (SBUL) that is headed by Anne Juuko as Chief Executive Officer retained its top position as the most profitable bank in Uganda. The bank’s profit reduced by 6% to Shs243.12bn in 2020, down from Shs258.67bn recorded a year earlier.

In terms of industry market share, SBUL which is listed on the Uganda Stock Exchange (USE) enjoys a commanding 31.31%.

Commenting on the results, Juuko said the bank’s performance is commendable despite a difficult year riddled with challenges brought about by the pandemic.

“The bank has shown resilience and sustained momentum as it executed on its strategy,” Juuko said. The bank consolidated its growth as most of the performance indicators were positive.

The bank’s shareholders will smile to the bank as Shs95bn has been proposed as dividends, down from Shs110bn in 2019.

Centenary Bank, an indigenous institution headed by Fabian Kasi as Managing Director retained the second spot for the second year running.

Despite the devastating impact of COVID-19 on banking sector and other key sectors of the economy, Centenary’s net profit increased by 3.4% to Shs161.2bn in 2020, up from Shs155.9bn recorded a year earlier. Under this category, Centenary enjoys 20.76% industry profit market share.

The year of COVID-19 hit hard Standard Chartered Bank (StanChart), dfcu bank and Absa as Bank of Baroda beat them to the 3rd place in as far as most profitable banks in Uganda is concerned.

Whereas many banks witnessed a reduction in profit, Bank of Baroda’s net profit increased by 84.04% to Shs83.37bn in 2020, up from Shs45.3bn in 2019.

Headed by R. K. Meena as Managing Director, Bank of Baroda which is listed on USE saw the bank record impressive growth on all key performance indicators including customer deposits, loans advanced to customers and total assets among others. The bank has 10.74% of the industry profit market share.

In 4th position is Standard Chartered whose net profit reduced by 41.57% to Shs72.8bn in 2020, down from Shs124.6bn recorded a year earlier.

Headed by Albert Saltson as Chief Executive Officer and Managing Director, StanChart’s industry profit market share is 9.38%. In 2019, StanChart was the 3rd most profitable bank in Uganda.

Equity Bank is slowly but surely taking on giants in the market. The bank posted Shs57.86bn profit in 2020, up from Shs37.23bn recorded a year earlier.

This represents growth of 55.41%, making the bank the 5th most profitable bank in Uganda. The bank now enjoys 7.45% industry market share under this category.

Headed by Samuel Kirubi as Managing Director, Equity Bank has in recent years come up with a number of innovations aimed at delivering excellent services to customers.

While celebrating the 10th anniversary of Equity Bank in Uganda a few years ago, James Mwangi, the Equity Group CEO said he wants his bank to become the leading bank in Uganda in the next 10 years. Going by the bank’s performance, this dream could be achieved.

Shockingly, the top five banks under this category control a commanding 79.64% industry market share, leaving the other 19 banks to share only 20.36%.

Absa Bank Uganda that is headed by Mumba Kalifungwa as Managing Director consolidated its growth despite the profit reducing to Shs40.71bn in 2020, down from Shs78.07bn recorded in 2019. This makes it the 6th most profitable bank in Uganda as of December 2020 with a market share of 5.24%.

Meanwhile, Absa Bank Uganda’s total assets increased by 3.5% to Shs3.54 trillion, up from Shs3.42 trillion recorded in 2019.

The bank’s customer deposits also increased to Shs2.35 trillion in 2020, up from Shs2.18 trillion registered a year earlier. This represents an increase of 8.1%.

Michael Segwaya, Absa Bank Chief Finance Officer said the underlying performance of the bank, as measured by the profit before impairment and tax, remained strong throughout the year, serving as a testament to Absa’s resilience despite the tough economic environment.

“Profit after tax was significantly impacted by the increase in impairment provisions, coupled with the decline in Non funded income. The bank remains profitable and continues to deliver positive returns on equity for shareholders,” Segwaya said.

Absa Uganda boss Mumba Kalifungwa added that despite a tough year owing to the economic impact of the COVID-19 pandemic, the bank achieved total revenue of Shs316bn.

“We remain committed to providing financing to the economy to facilitate trade, commerce and capital formulation for business growth,” Kalifungwa stated.

Citibank Uganda headed by seasoned banker, Sarah Arapta as CEO is now the 7th most profitable bank after posting Shs36.7bn profit in 2020, down from Shs39.5bn recorded a year earlier. Its industry market share stands at 4.73%.

In 8th position is dfcu bank. Headed by Mathias Katamba as Managing Director, dfcu bank posted Shs24.31bn in 2020, down from Shs74.81bn recorded a year earlier. Under this category, dfcu’s market share stands at 3.13%.

However, dfcu’s asset base increased by 18% from Shs2.958 trillion to Shs3.499 trillion, upheld by strong growth in liquid assets and loans and advances.

The company remained well capitalized with capital ratios of 19.34% and 20.94% for tier one and two capital respectively. Liquidity position also remained strong with an average liquid assets ratio above 35%.

“Considering this robust liquidity, strong equity shareholders and healthy capital position, the Board has recommended a dividend payout of Shs50.33 per share equivalent to Shs37.65bn to the shareholders,” Katamba said.

Housing Finance Bank that is headed by Michael Mugabi as Managing Director is the 9th most profitable after registering Shs20.6bn profit in 2020, down from Shs22.49bn in 2019.

The bank consolidated its growth as key performance indicators remained positive. Its market share under this category is 2.65%.

Diamond Trust Bank scooped the 10th position after its profit reduced by 8% to Shs17.9bn in 2010, down from Shs19.54bn in 2019. Its market share under this category is 2.31%.

What is shocking is that 10 banks control a commanding 97.7% of the industry profit market share, leaving the 14 banks to share a paltry 2.3%.

From the above analysis, it’s also clear that foreign owned banks remain dominant; only Centenary Bank and Housing Finance Bank are the only indigenous banks (largely owned by Ugandans) to make it to the top 10 most profitable banks in Uganda.

The good news is that indigenous Ugandans heading banks are on the rise and performing well; Anne Juuko at Stanbic, Fabian Kasi at Centenary, Mathias Katamba at dfcu, Sarah Arapta at Citibank and Michael Mugabi at Housing Finance Bank. Juuko and Arapta are the only females to manage one of the most profitable banks in Uganda.

The other women heading banks are Annet Nakawunde of Finance Trust Bank and Annette Kihuguru of Ecobank.

Other banks that posted profits in 2020 include UBA (Shs13.7bn), Bank of Africa (13.37bn), KCB (Shs13.15bn), Bank of India (Shs6.24bn), Finance Trust Bank (Shs5.83bn), Tropical Bank (Shs3.57bn), Guaranty Trust Bank (Shs2.94bn), Opportunity (Shs1.06bn) and ABC Capital (Shs307m).

The 5 Loss-making Banks

It is important to note that having made the biggest losses in 2019, Tropical and KCB bounced back in 2020 by posting profits as indicated above.

Orient Bank now leads from the bottom after posting a loss of Shs22.69bn in 2020 from Shs1.07bn loss recorded a year earlier. Orient has failed to consistently perform. This perhaps explains why it was recently taken over by Kenya based I&M Holdings PLC. Kumaran Pather is currently the Orient bank CEO.

From bottom, Orient is followed by Exim Bank whose losses increased to Shs6.57bn in 2020 from Shs4.42bn recorded in 2019. Exim that is now headed by Henry Lugemwa Kyanjo as Ag. CEO has been making losses since it joined the Ugandan market a few years ago.

Having recorded profits for three successive years, Ecobank fell back into a loss making position. It made a loss of Shs5.95bn from Shs4.1bn profit recorded in 2019.

Annette Kihuguru, who replaced Clement Dodoo (he’s Group Director, Integrations at Equity Group Holdings) in Acting capacity as Managing Director will have to up the game to ensure that the Pan-African bank that has been in Uganda for over 10 years bounces strongly. With her experience and a strong team, she should be able to stabilize the bank’s performance.

NCBA that merged with Commercial Bank of Africa made a loss of Shs4.53bn in 2020 from Shs5.2bn loss in 2019. The bank is headed by Anthony Ndegwa as Managing Director.

Cairo Bank Uganda that rebranded from Cairo International Bank completes the list of the five banks that made losses in 2020. The bank posted a loss of Shs2.57bn in 2020 from Shs2.83bn loss recorded a year earlier.

For further details on how your bank performed, check the table below detailing the most profitable banks in Uganda.

2021 Outlook

Stanbic’s Juuko said the bank’s priorities will include transforming client experience.

“Our aim this year is to continue to deliver on our promise to make dreams possible for our clients,” she said.

She added that the bank will also prioritize managing its risks. Sustainability will be another key priority for the bank.

Absa’s Kalifungwa is optimistic about the strides being made towards economic recovery.

“…With increased access to the vaccine both locally and globally, we anticipate a pick-up in key sectors including international trade, Agriculture, Construction, Manufacturing and Services sectors,” Kalifungwa said, adding: “We intend to invest in sectors crucial to socio-economic development and economic recovery by growing private sector credit. The economy has shown resilience and I am optimistic it will recover from the contraction we witnessed last year.”

He revealed that the bank has prioritized investment in innovation as they seek to leverage the strength of digital technology “to create seamless experiences for our customers and consequently, realize our ambition to become a digitally led bank.”

Dfcu’s Katamba says over the years, the bank has made significant investments to shore up institutional capabilities that enabled it to navigate the pandemic and its resultant effects.

“…Even though challenges remain for a number of sectors, we remain committed to supporting small and medium scale enterprises, advancing the cause of women in business, supporting key sectors of the economy in Agriculture, Manufacturing, Trade, Construction, Communications and Services,” Katamba said.

He added: “We have also laid the foundation to play an active role in the emerging Oil and Gas Sector. We shall also continue to invest in capabilities that increase convenience for customers in the digital and alternative channels space and innovate products and services that improve the efficiency of our services and provide an all-round excellent customer experience.”

For tips, advertising and inquiries, reach out to us via: staddewo@gmail.com, 0775170346/0705888301

Very Good Summary! Kindly give us for 2021 also.

Excellent analysis, the next issue may include interventions by Bank of Uganda &the impact of branchless banking innovations to mitigate these losses.

Good news here

Good information keep it up

Very Nice Presentation. Elaborate the overall performances of all Commercial Banks in next edition.

William thanks alot for the information, could u also hint on the MDI’s