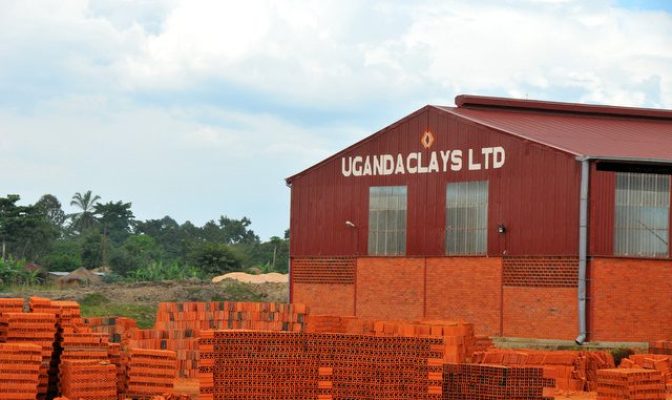

Uganda Clays Limited (UCL), Uganda’s largest local clay products manufacturer is now out of danger.

The first company to list on Uganda Securities Exchange (USE) in 2000 has been struggling to return to sustainable profitability for close to a decade.

UCL nearly collapsed as a result of an expansion gone wrong.

For the past six years, UCL has been known as a loss making entity, highly indebted, with declining market shares and no value to shareholders. Bad reputation, large workforce with low salaries and poor morale and machine breakdowns among other issue have define UCL in the past.

Since 2008, UCL hadn’t declared any dividend to shareholders until 2016 when it gave shareholders a dividend of Shs900m after it posted a profit of Shs2.3bn.

Founded in 1950, UCL is currently owned by National Social Security Fund (NSSF) with 33% shares, NIC with 18% shares while 2,600 shareholders own the company 49%.

Even when it registered Shs604.8m and UShs2.8bn in profits after tax in 2011 and 2012 respectively, UCL didn’t declare dividends due to the debts it had.

In 2013, the company made losses of Shs3.2bn before increasing to Shs5.1bn in 2014. In 2015, the losses reduced to Shs1.2bn-pointing to a possible recovery.

Poor Performance Explained

Before 2008, UCL was a profitable and stable company. However, its trouble started when it took up expensive loans to set up Kamonkoli plant in Budaka district.

The 67 year old company took on loans at market rates from Standard Chartered Bank to establish the Shs36bn Kamonkoli plant in 2008. Other funds were raised through a rights issue and another loan from the East African Development Bank (EADB).

Additionally, it is reported NSSF, which is the largest shareholder in the company, offered Uganda Clays a bailout of about Shs11bn at between 11percent and 15percent interest rate in 2011 to settle some of the creditors.

The loan was utilized to retire a bridge loan from commercial banks and accumulated arrears, purchase spares for the factory at Kajjansi including a used factory line from Isarawe brick factory in Tanzania, a clay filter and to enhance the kiln at the Kamonkoli factory.

On October 31, 2014, the loan and accrued interest [the NSSF loan] was Shs19.06bn, a thing that threatened the company’s existence. However, due to low sales and losses, NSSF wasn’t about to regain its money. Further, the Kamonkoli plant didn’t bring in immediate results due to high costs of production, competition and structural problems.

The company’s recovery journey was compounded with a crisis management.

In 2012, Charles Rubaijaniza was promoted to MD position to turnaround the institution, but resigned in early 2013 under unclear conditions.

Consequently, Eng. Martin Kasekende, a board member took over in acting capacity until 2014 when George Inholo was hired as substantive Managing Director.

Journey To Turnaround The Company

Inholo, a former Country Director at Unilever Uganda was hired to return UCL to sustainable profitability. Therefore, his main priorities were to clear the loans, reduce on operational and production costs and increase sales.

In an earlier interview with this writer when he assumed office, Inholo said this about recovery: “… For us to make a difference, we must make a thorough analysis of the challenges.”

He added: “From my point of view, we have had a problem of high cost of production; the cost of running the company has been overwhelming. The cost of coffee husks and furnace oil (used for baking tiles and other products) is high. We also sometimes experience load shedding meaning we have to power the factory using a generator which isn’t sustainable,” he added. He also promised to work on clearing loans.

Two years down the road, UCL seems to be returning to profitability going by the 2017 half year results.

UCL net profit increased to Shs2.17 billion for the six months ending June 30 2017, up from Shs1.27 billion in the year ending June 2016.

The stellar performance comes on the back of its majority shareholder, NSSF deciding to stop collecting interest on the loan advanced UCL.

Considering UCL’s difficulties, NSSF decided to forego further interest (annual interest had increased to Shs23.2 billion) on the loan and plans to convert its debts into equity.

Addressing shareholders at Uganda Securities Exchange offices in Nakawa on Tuesday, Inholo said another fact that contributed to the surge in profits was reduction in operational costs.

“Control of costs of production continues to be a priority area in the business to ensure that there is consistent improvement in the gross margin,” he said.

The company’s financial numbers show that its costs of sales stood at Shs6.55 billion compared with Shs7.96 billion incurred during the same period in 2016.

Lowering costs of production is a major achievement considering the overall rising costs in the economy.

In terms of total turnover, however, UCL recorded a mere 4% growth in revenue from Shs12.38 billion to Shs12.9 billion.

“Credit rating of the Company has since moved from Red to Green status having retired all the Commercial loans,” UCL stated in its presentation to shareholders.

Officials added that they have negotiated better credit terms with key suppliers– coffee Husks & Petroleum products and a wide range of service providers, a thing that will result into lower production costs.

In an earlier interview, Inholo said their “trusted and quality products” were not easily accessible especially in upcountry satellite towns, a thing the company is working on rigorously.

“To ensure we are profitable, we are going to produce products which are able to sell immediately. This will help us avoid producing and keeping products for a long time,” he said.

Now that commercial loans have been settled, UCL has no reason not to build on this performance to grow the company to greater heights. However, like in the past, management decisions will determine the future of UCL.