The Executive Board of the International Monetary Fund (IMF) Wednesday approved a disbursement of SDR361 million (about US$491.5 million or Shs1.86 trillion) for Uganda under the Rapid Credit Facility (RCF). It will help finance the health, social protection and macroeconomic stabilization measures meet the urgent balance-of-payments and fiscal needs arising from the COVID-19 outbreak and catalyze additional support from the international community.

The Ugandan economy is being severely hit by the COVID-19 pandemic and, in particular, such key sectors as services (tourism), transport, construction, manufacturing and agriculture. The challenging external environment is curtailing remittances and foreign direct investments. The pandemic has also exacerbated the challenges posed by heavy rains in early 2020 and the ongoing locust invasion.

The weakening economic conditions emanating from the Covid-19 pandemic have put significant pressures on revenue collection, expenditure, reserves and the exchange rate, creating urgent large external and fiscal financing needs.

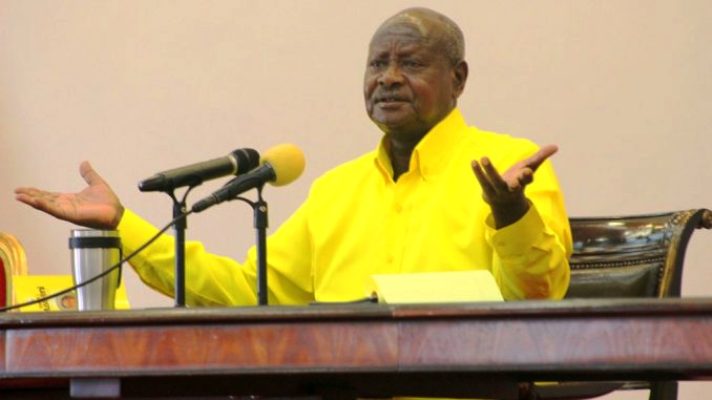

In an interview with business journalists yesterday, Clara Mira (pictured), the IMF representative for Uganda revealed the conditions for this emergency loan that is generally aimed at ensuring macro-economic stability in the country.

Mira revealed that the loan is interest free and the payment holiday is five and a half years. She added that the loan will be repaid in 10 years.

“…This is an emergency financial assistance to help Uganda respond to the crisis. Its interest is zero; it has five and a half years grace period (without payment). Repayment happens in 10 years,” Mira revealed.

She added: “About 70% (US$340m) is going to BoU to support balance of payments and macro-economic stability.”

She explained that due tonCOVID-19 crisis, Uganda’s reserves have been reducing and the US$340m to BoU will be helpful in ensuring that Uganda’s reserves don’t fall below the minimum three and a half months of import cover. This will not only safeguard the currency from free fall considering the fact that there’s a decline in remittances and exports, but will also be instrumental in boosting investors’ confidence.

“The rest (of the money) about US$150m is going to the budget to help development finance; they will use part of it for health supplies,” Mira said

She added that part of the US$150m will also be used for social protection since about 2.6 million people or more are expected to fall into deep poverty due to COVID-19 pandemic.

She urged government to consider covering utilities for the poor.

Most importantly, to ensure that the money isn’t abused, Mira said the loan “will be subject to an audit in one Year.”

She further said Uganda’s economic growth in the current financial year is expected fall from the projected 6% to about 3.3%.