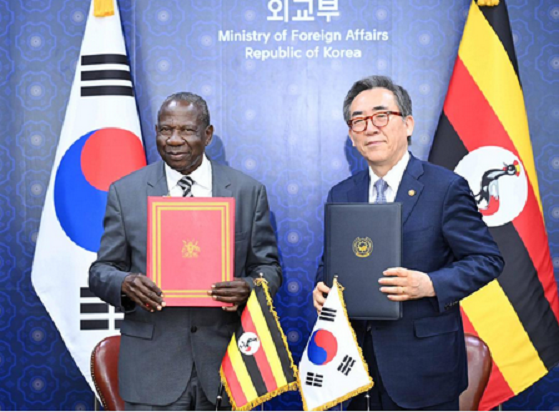

Housing Finance Bank boss, Michael K. Mugabi

Housing Finance Bank (HFB), one of the few indigenous commercial banks in Uganda that have withstood the test of time continues to post consistent growth.

According to the Bank’s Audited Financial Statements for 2019, the bank’s profit after tax grew by 7.6% to Shs22.5bn in 2019, up from Shs20.9bn recorded a year earlier.

Headed by Michael K. Mugabi (pictured) as Managing Director, almost all Housing Finance Bank’s performance parameters were positive.

The bank’s total assets increased by 17.37% to Shs912bn in 2019, up from Shs777bn recorded a year earlier.

HFB’s customer deposits increased to Shs560bn in 2019, up from Shs451bn, representing 24.16% growth.

Loans and advances also increased to Shs553.5bn from Shs511.63bn in 2018.

Commenting about the results, Mugabi said Housing Finance Bank’s consistent growth “has been made possible by dedicated focus on our customer experience, solid strategic partnerships and strong passion in supporting Uganda’s economic and social development.”

“Housing Finance Bank is committed to offering the best customer experience across all our service points,” he said.

The locally bred financial institution has expanded from just a single branch to reach its customers across the country with 19 branches, Interoperability with over 200 ATMs and several hundred bank agents.

“Our enhanced customer experience has been specifically designed to meet the changing needs of customers at every stage of life. Over 2019, we expanded our reach with improved offerings across key channels including: Mobile banking, Retail internet banking, Internet banking, MasterCard, Agent Banking, 24/7 Customer Contact Center,” Mugabi further said.

He added that the bank continues to reach out to more customers with focused value propositions in all life aspects including housing, business, education and infrastructural developments, as the bank of choice, supporting individuals and businesses, to build and sustain their respective ventures for the growth of our country.

“Along our path to progress, we have had an opportunity to build and maintain strong relationships with key development partners across the globe. Locally, our shareholders have played an integral role in ensuring that the core mandate of the Bank is well- aligned to meet the financial needs of our country’s growing population,” he revealed.

Housing Finance Bank has also initiated and sustained relationships with Developers, land owners, Real Estate Agencies, Business Associations, Investment clubs and other stakeholders.

“We continuously engage through forums like “The Housing Baraza” under the theme “Housing For Wealth Generation”, The Uganda Housing Conference and other avenues with a unified objective of improving livelihood and enhancing business growth in our country,” he said, adding: “Housing Finance Bank remains dedicated to supporting and uplifting communities across the country…Throughout the year, the Bank conducted a number of engagements in support of community development, health, education and financial literacy. The Bank contributed and participated in the construction of facilities within universities, churches, schools, and hospitals across the country.”

Outlook

The HFB boss says they are cognisant of the current challenges presented by the COVID-19 pandemic and its impact on all Ugandans.

“However, with our dedicated team of staff, guidance from the Board of Directors, we remain committed to the delivery of practical solutions and interventions that will support our customers during this time and the years ahead,” he said.