Plans to revive Uganda Commercial Bank (UCB)are in high gear after National Planning Authority (NPA)asked Parliament to allocated it Shs3.4bn towards conducting a feasibility study on national bank.

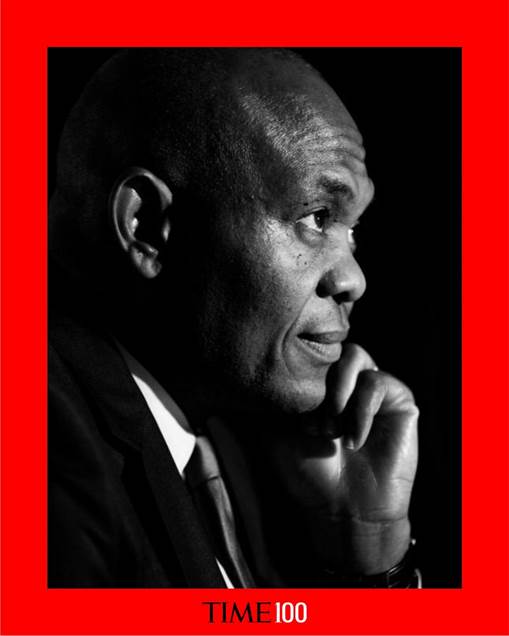

Appearing before Parliament’s Finance Committee to present the Authority’s national budget framework paper for 2020/2021, NPA Executive Director, Dr. Joseph Muvawala said the survey will also help determine Uganda’s priority commodities.

Muvawala noted that the study is aimed at assisting government to come up with ways on how to assist the private sector flourish, saying that government already has three commercial banks (PostBank, Housing Finance Bank, Pride Microfinance) but they are too small to make an impact. Proponents

Those supporting revival of Uganda Commercial Bank say it will offer lower interest rates to Ugandans and thus boost economic growth.

He added that the study will assist them decide on whether they should invest more money in these banks or revive commercial bank.

However, some of the MPs flatly rejected the proposal arguing that the revival of UBC cannot result into reduction in interest rates.

Uganda Commercial Bank is among the government owned businesses that government sold off in the 1990s under the privatisation programme following advice from the World Bank. Its assets and liabilities countrywide were sold to Stanbic Bank.

Some of the revived companies whose assets were sold by government include Uganda Railways Corporation and the recent Uganda Airlines among others.