On October 20, 2016, the Bank of Uganda (BoU), the regulator of Uganda’s financial sector, took over the management of Crane Bank Ltd after it (Crane Bank) became “a significantly undercapitalized institution.” Consequently, on February 27, 2017, BoU announced the acquisition of the now defunct Crane Bank by dfcu.

The collapse of Crane Bank was on the backdrop of high Non-Performing Loans (NPLs) that increased by 122.9% to Shs142.3bn in 2015, up from Shs19.36bn in 2014. This saw the once profitable bank post a whooping loss of Shs3.1bn in 2015, down from a net profit of Shs50.6bn in 2014.

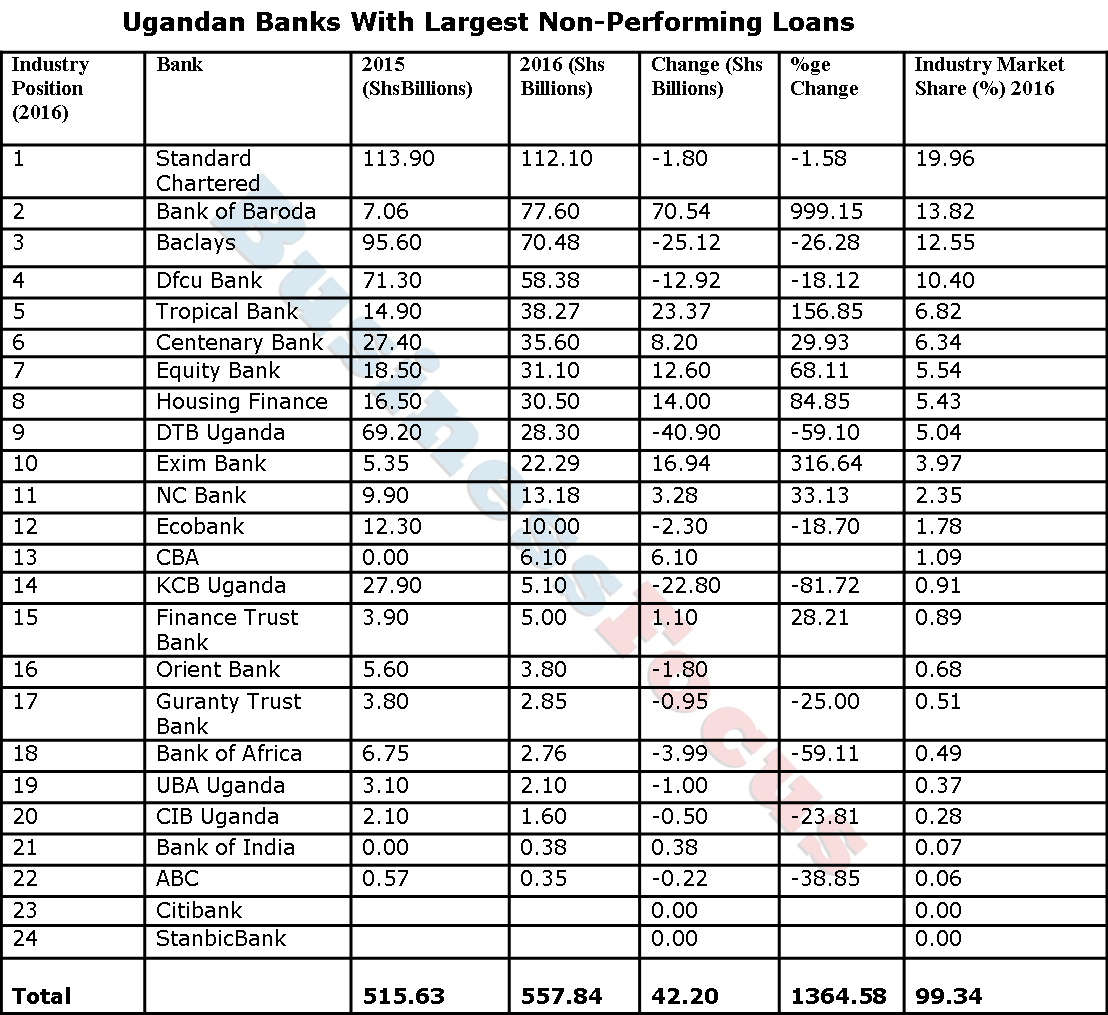

From the above background, it is important to look at banks with largest NPLs as of 2016. This has been derived from the financial results released by Uganda’s 24 commercial banks in the last few months.

Noteworthy, Citibank didn’t report any NPLs while Stanbic Bank said its NPLs increased by 14% in 2016 (it didn’t provide the actual figures and our efforts to get them were futile).

According to figures obtained by Business Focus, total industry NPLs (excluding Stanbic) increased to Shs557.8bn in 2016, up from Shs515.6bn in 2015.

Standard Chartered Bank (StanChart) tops banks with largest NPLs, having recorded Shs112.1bn in 2016, slightly down from Shs113.9bn in 2015. This accounts for 19.9% industry market share.

It is followed by Bank of Baroda, whose NPLs increased to Shs77.6bn in 2016, up from Shs7.06bn in 2015. This implies that its NPLs increased by 999.1% and represents 13.8% of the industry market share.

Barclays occupies the third place considering the fact that its NPLs reduced by 26.28% to Shs70.48bn in 2016, down from Shs95.6bn in 2015.

It is followed by dfcu that saw its NPLs reduce to Shs58.38bn in 2016, down from Shs71.bn.

Tropical Bank’s NPLs increased by 156.8% to Shs38.27bn in 2016, up from Shs14.9bn. This could explain why it recorded a net loss of Shs13.4bn in 2016, up from a profit of Shs1.9bn in 2015.

Centenary Bank comes 6th with its NPLs increasing to Shs35.6bn in 2016, up from Shs27.4bn in 2015.

It is followed by Equity bank that saw its NPLs jump to Shs31.1bn in 2016, up from Shs18.5bn recorded in 2015.

Housing Finance Bank comes 8th with its NPLs increasing by 84.8% to Shs30.5bn in 2016, up from Shs16.5bn in 2015.

It is closely followed by Diamond Trust Bank (DTB) that recorded Shs28.3bn in 2016, up from Shs69.2bn in 2015.

Exim Bank that acquired Imperial Bank completes the top 10 banks in Uganda with largest NPLs. Its NPLs increased to Shs22.3bn in 2016, up from Shs5.35bn in 2015.

Explaining High NPLs

Uganda’s economy hit a snag in 2011 after the general elections. And the recovery process has been punctuated by both political and economic happenings. The 2011 economic crisis has continued to haunt the economy. In 2012, the National Bank of Commerce (also known as Banyakigezi) went under, in 2014, Global Trust Bank collapsed and since 2011 the banking sector has suffered huge Non-Performing Loans (NPLs) due to a wobbly economy amidst high interest rates that have left many borrowers unable to pay back.

In 2015, Kenyan supermarket chain, Uchumi closed shop in Uganda and currently, a number of big supermarkets are performing poorly. Last year, a number of big companies and top tycoons became financially distressed to the extent of seeking a Shs1trn government bailout. This was after they failed to service their loan obligations that consequently resulted into banks either attaching their properties or placing their companies under receivership.

It should be noted that as a result of excessive expenditure in the 2011 general elections, inflation went up to over 30%. It was reported that the Bank of Uganda (BoU), the regulator of Uganda’s financial sector printed money that the NRM party used to finance its campaigns. Prof. Emmanuel Tumusiime-Mutebile, the Governor, BoU has since admitted excessive expenditure, but denied BoU printing money.

As inflation hit a record high, banks increased lending rates to as high as 30%, a move that resulted into high NPLs and write-offs that saw the banking sector crumble. Several banks recorded losses while profits drastically reduced. During this time, the Uganda Shilling also hit a record low 2900. It was during this time that BoU introduced a new Monetary Policy-the Central Bank Rate (CBR), a benchmark lending rate for commercial banks. Analysts have since criticized this policy for stifling private sector credit growth, thus reducing economic activity in the country. As the economy was beginning to recover from the 2011 crisis, the Shilling started weakening-largely due to balance of payment deficit, strong demand for the dollar and strong US dollar. This was worsened by the 2016 general elections activities that started way back in 2014. Noteworthy, when the Shilling lost ground in 2015(the Uganda Shilling lost 27%), commercial banks increased interest rates to an average of 26% and this dampened private sector credit growth.

The situation has been made worse by war in South Sudan, prolonged drought and general slowdown in business activity.

According to analysts, the wobbly economy resulted into tycoons and businesses defaulting on their loans, a move that has led to high NPLs.

For more about banks with largest and lowest NPLs, read our table below;