A photo montage of some bank CEOs/MDs

Commercial banks in Uganda once again beat the COVID-19 pandemic and its associated disruptions on businesses and the economy at large to post impressive results across all key performance parameters in 2021.

Since inception five years ago, Business Focus has exclusively analyzed the performance of banks based on their financial statements.

This website interprets and reports these financial statements in a simple and easy-to-understand manner.

For starters, commercial banks are required by law to publish their financial statements/results for the previous year (which ends every 31st December) in a national newspaper before May of the following year.

It’s against this background that banks have in the last one month been releasing/publishing their audited financial statements for the year ended 31st December 2021.

This website has exclusively compiled and analyzed the results so as to help customers, partners and stakeholders of these financial institutions to know how their banks performed as well as help them make informed decisions. This analysis is also important for students with a bias in banking and finance as well as policy makers.

It is important to note that Uganda currently has 26 banks including PostBank which became a fully fledged bank in December 2021, having operated as a credit institution for many years. PostBank is headed by Julius Kakeeto as CEO/MD.

Additionally, Afriland First Bank Uganda Limited which joined the Ugandan market in September 2019 published its financial results for the first time. Further, Orient Bank officially became I&M Bank in 2021.

This is after I&M Group Plc based in Kenya became the major shareholder of Orient Bank, with a 90 percent stake in April 2021. Earlier on in 2020, Commercial Bank of Africa merged with NC Bank to form NCBA.

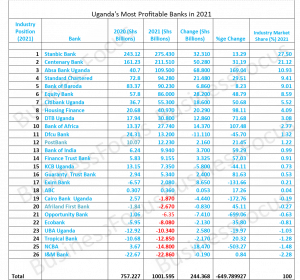

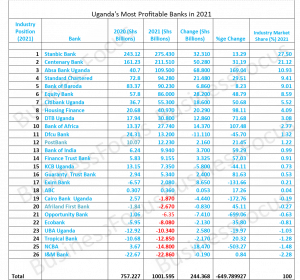

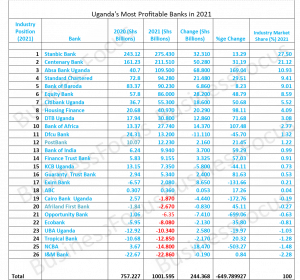

According to the results, out of the 26 banks, 18 banks made a record net profit of Shs1.081 trillion in 2021, up from Shs817.85bn profit posted by 20 banks in 2020. This is the highest ever profit recorded by banks in Uganda’s banking industry.

There are eight (8) banks in the red zone; they made a net loss of Shs79.82bn in 2021 compared to Shs60.63bn loss made by six banks in 2020.

Most Profitable Banks

Although banks made whopping profits in 2021, they are yet to be cleared by the Bank of Uganda (BoU), the regulator of the baking industry, to share dividends. In April 2020, Bank of Uganda put in place enhanced guidelines for all Supervised Financial Institutions (SFIs), in relation to discretionary payments, including dividends, for purposes of capital preservation-in light of the COVID-19 pandemic.

It is understood that the proposed dividends for 2020 remain under review by Bank of Uganda, the results of which will most likely inform the 2021 dividend recommended by several banks. Importantly, there are two banks that are undercapitalized (we’ll give you this detailed story separately).

According to the results, Stanbic Bank Uganda Ltd (SBUL) which is headed by Anne Juuko as Chief Executive maintained its number one position as Uganda’s most profitable bank. Stanbic made a net profit of Shs275.43bn in 2021, up from Shs243.12bn recorded a year earlier. This represents an increment of 13.29%. In terms of industry market share, Stanbic which is listed on the Uganda Stock Exchange (USE), enjoys 27.5% of the total industry profit.

Stanbic Bank limited is the anchor subsidiary of Stanbic Uganda Holdings Limited that has other four subsidiaries trading in different sectors.

Commenting on the results, Juuko said the business focused on sustained management of asset quality through proactive engagement of customers, restructuring loan repayments, and waiving or suspending interest repayment on loans by client businesses in sectors such as education that were most hit by the impact of covid-19 pandemic.

As a result of this, non-performing loans dropped to 4.6% from 4.7% (IFRS 9 standards) the previous year and saw the provision for the same, reduce to Ushs70 billion from Ushs92 billion in 2020.

For the third year running, Centenary Bank, an indigenous financial institution headed by Fabian Kasi as Managing Director, maintained its position as the country’s second most profitable bank.

Centenary’s profit grew by 31.19% to Shs211.51bn in 2021, up from Shs161.23bn recorded a year earlier. This gives the bank an industry market share under this category of 21.12%.

Commenting about the results, Kasi said: “We leveraged technology, people and good relationships, to deliver good performance, despite the year’s challenging operating environment.”

He was referring largely to the COVID-19 pandemic which was prevalent during the first half of 2021 and the economic and social lockdown which followed.

“The registered growth in 2021 in profits and total assets amidst slackness in the economy reflects our customer-centric value proposition delivery. This was guided by the Bank’s strategy, supported by investment in technology, lean processes and Risk Management,” he added.

Absa Bank Uganda bounced strongly in 2021. Having been the 6th most profitable bank in 2020, Absa posted Shs109.5bn in 2021, up from Shs40.7bn in 2020. The 169.04% growth in profit saw Absa become the third most profitable bank in 2021. Headed by Mumba Kalifungwa as Managing Director, Absa’s industry profit market share is 10.93%.

In 4th position is Standard Chartered Bank whose profit grew by 29.51% to Shs94.28bn in 2021, up from Shs72.8bn in 2020. Its industry profit market share is 9.41%. StanChart is currently headed by Godfrey Sebaana as the Ag. Managing Director. The bank was previously managed by Albert Saltson as MD/CEO.

Bank of Baroda lost its third position. The bank is now the 5th most profitable bank. Bank of Baroda’s profit grew by 8.23% to Shs90.23bn in 2021, up from Shs83.37bn recorded a year earlier. Headed by Raj Kumar Meena as Managing Director, Bank of Baroda enjoys 9.01% industry profit market share.

Importantly, the gap between bigger and smaller banks continues to widen across all key performance parameters. For example, the top five most profitable banks control 77.97% of the industry profit market share, leaving the 21 banks to share a paltry 22.03%.

Uganda-Banks-Net-Profits1-2021Equity Bank continues to give ‘big boys’ sleepless nights. Although the bank lost its 5th position, Equity Bank’s profit grew by 48.79% to Shs86bn in 2021, up from Shs57.8bn in 2020.

Headed by Samuel Kirubi as Managing Director, Equity Bank has in recent years come up with a number of innovations aimed at delivering excellent services to customers. Its market share under this category is 8.59%.

In seventh position is Citibank headed by Sarah Arapta as CEO. The bank’s profit grew by 50.68% to Shs55.3bn in 2021, up from Shs36.7bn in 2020. This gives the bank 5.52% industry market share under this category.

Michael Mugabi continues to steer Housing Finance Bank in the right direction. As Managing Director, Mugabi saw Housing Finance Bank profit grow by 98.11% to Shs40.97bn in 2021, up from Shs20.68bn in 2020.

With a market share of 4.09%, Housing Finance Bank, one of the few indigenous banks, is the 8th most profitable bank in Uganda.

Diamond Trust Bank (DTB) is the 9th most profitable bank, having made Shs30.8bn profit in 2021.

Headed by Varghese Thambi as Managing Director, DTB has an industry market share of 3.08% under the profits category.

Bank of Africa completes the top 10 most profitable banks.

It made a net profit of Shs27.74bn in 2021, giving it an industry market share of 2.77% under the profit category.

The top 10 most profitable banks control over 90% of the industry market share under the profit category.

Importantly, among the top 10 most profitable banks, only two banks are headed by a female CEO/MD 1.e Anne Juuko, the Stanbic Bank Chief Executive and Sarah Arapta, the CEO of Citibank.

Others

For many years, dfcu has always been among the top five most profitable banks in Uganda. However, 2021 will be one of those years to forget for the bank.

Headed by Mathias Katamba as Chief Executive Officer, dfcu Bank posted Shs13.2bn net profit, making it the 11th most profitable bank in Uganda.

Commenting about the results, Katamba said: “We achieved a good leap forward on the core metrics with robust growth in total income and continued reduction in operating costs. The pre-provisioning profit i.e. profit before provisions, fair value losses and tax grew significantly from Ushs114 Billion in 2020 to Ushs 190 Billion in 2021. The Bank’s overall profit was significantly impacted by the loan impairment charge, resulting from the adverse impact of the Covid – 19 pandemic, the associated containment measures on our customers businesses and the impairment of the financial asset. We continued to support our customers, especially those operating in sectors that remained locked down for an extended period, with credit relief and business recovery loans.”

Other banks that posted profits in 2021 in ascending order include PostBank (Shs12.23bn), Bank of India (Shs9.94bn), Finance Trust Bank (Shs9.15bn), KCB Bank (Shs7.35bn), Guaranty Trust Bank (Shs5.34bn), Exim Bank (Shs2.08bn) and ABC Capital Bank (Shs36m).

Banks in red

Leading in the red zone is I&M Bank headed by Kumaran Pather as the Managing Director / CEO. The bank made a net loss of Shs22.86bn in 2021. The bank has not been performing well in the last five years. Therefore, Pather has an arduous task of turning around the bank that was formerly known as Orient Bank.

Second from bottom is NCBA which is headed by Mark Muyobo as Ag.Managing Director. The bank made a loss of Shs14.8bn. It is closely followed by Tropical Bank that made a net loss of Shs12.85bn. Abdulaziz M.A. Mansur, the Tropical Bank Managing Director has struggled to turnaround the bank, having joined the troubled institution in 2019.

United Bank for Africa (UBA) headed by Chioma A. Mang as Managing Director/Chief Executive also continues to struggle. It made a net loss of Shs10.34bn in 2021. It is closely followed by Ecobank, a troubled bank that has posted inconsistent results in the last 10 years. The bank made a net loss of Shs8.08bn. Other banks that made losses include Opportunity Bank (Shs6.35bn), Afriland First Bank(Shs2.67bn) and Cairo Bank Uganda (Shs1.87bn).

Outlook for 2022

A number of bank CEOs are optimistic about 2022 following the full reopening of the economy in January 2022.

Stanbic Bank Chief Executive, Anne Juuko said: “The economy is now fully open after nearly two years of slow activity due to the pandemic—we are upbeat and ready to support full economic recovery. We shall continue to innovate for the customer and avail digitally disbursed affordable credit through bespoke products for women, youth, farmers and our corporate customers.”

Fabian Kasi, the Centenary Bank boss said that moving forward, the bank would steady execution of its strategy, which focuses on innovation, digitization, managing risk, embracing change and sustainability will be key for our future.

“Our 2022 Strategic Objectives are focused on customer centricity, efficiency, process automation, sustainability, learning and growth. In the pursuit of the above, we are desirous to provide a nurturing environment for our employees to enhance their productivity,” he said.

Absa Uganda intends to continue to leverage digital technology to deliver seamless customer experiences and drive business growth as innovation remains key to the realization of its ambition to be a digitally led bank.

“We remain cautiously optimistic in our outlook for 2022. Full reopening bodes well for economic rebound and monetary policy remains supportive of the recovery of the economy,” Mumba, the Absa Bank Uganda MD, said.

Katamba, the dfcu Bank MD said: “Following the full reopening of the economy, we expect that economic activity will bounce back with real GDP projected to grow by 6% in 2022. We also expect demand for credit to return as businesses recover and reposition for growth.”

He added: “We will continue to focus on the growth of our retail business, supporting businesses and individuals in the post covid recovery during 2022, in addition to building resilience in our loan book through rehabilitation and debt recovery programs. The full reopening of the economy provides renewed optimism about the prospects of our business customers getting back to full operations which will improve their repayment ability, increasing demand for credit and providing a positive outlook for our performance.”

We’ll continue giving you unmatched analysis about the performance of banks in 2021. For tips, opinions and advertising, Tel: 0775170346/0703828741/staddewo@gmail.com. Follow us on Twitter: @TaddewoS @BusinessFocusug