2017 was a tough year for Uganda’s banking sector just like the past five years.

However, the results commercial banks have been releasing in the past two months indicate that the sector is slowly recovering from the 2011 crisis when inflation and interest rates hit 30%, a thing that resulted into poor performance for the banking sector and the economy at large.

Business Focus obtained and critically analysed the results of the 24 banks, taking into account key performance parameters such as profits, customer deposits, loans advanced to customers, bad loans written off, total assets and Non-Performing Loans (NPLs) to rank the best and worst performing banks in Uganda as of December 31, 2017.

It is important to note that in 2017 inflation was controlled and the exchange rate was generally stable. This saw Bank of Uganda reduce the Central Bank Rate (CBR), a benchmark lending rate for commercial banks to a record 9%. Many banks followed suit by reducing their Prime Lending Rates, a thing that is expected to increase loans uptake going forward.

The economy is expected to grow by around 5% in 2017/18, up from 4.0% recorded in 2016/17.

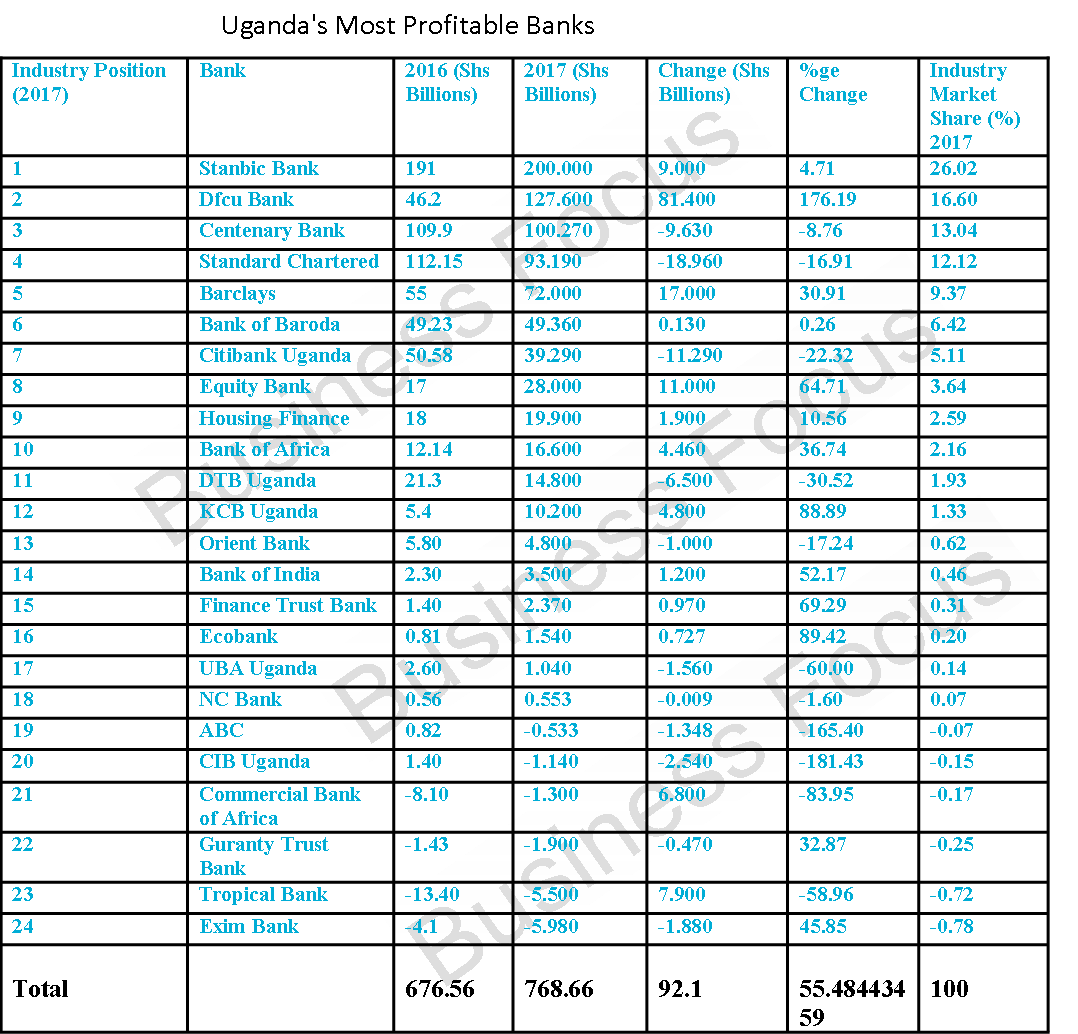

Most Profitable Banks

In 2017, 18 banks made profits, down from 20 in 2016. However, the 18 banks made a net profit of Shs768.66bn in 2017, up from Shs676.56bn in 2016. This means industry profits increased by Shs92.1bn, representing growth of of 13.6%.

StanbicBank Uganda Ltd (SBU) that is headed by Patrick Mweheire as Managing Director maintained the number one position as Uganda’s most profitable bank for the 5thyear running.

SBU made a net profit of Shs200bn in 2017, up from Shs191bn recorded in 2016, representing 4.7% growth.

Mweheire said the bank reduced on its operational costs by going digital and cutting on employees to record impressive performance.

“This outcome confirms our customer centric approach is working. Our Investments in the further integration of digital technology within our product and service offering also contributed to a reduction in our cost to serve while giving our customers greater access and flexibility to bank if, when and whichever way they wanted,” he said.

The bank holds a commanding 26% of the industry profit market share.

After taking over Crane Bank in early 2017, dfcu bank jumped from the 7th position in 2016 to become the 2nd most profitable bank in Uganda.

It made a net profit of Shs127.6bn in 2017, up from Shs46.2bn in 2016, representing a growth of 176.19%.

Headed by Juma Kisaame as Managing Director, dfcu bank holds 16.6% of the industry profit market share.

Centenary Bank headed by Fabian Kasi as Managing Director maintained its 3rd position under this category. It made a net profit of Shs100.27bn in 2017, down from Shs109.9bn recorded in 2016.

Standard Chartered Bank (StanChart) that was the 2nd most profitable bank in 2016 is now in 4th position. It is headed by Albert Saltson as CEO.

Its profits reduced to Shs93.19bn in 2017, down from Shs112.15bn in 2016. This was due to high Non-Performing Loans (NPLs) that reduced to Shs78.6bn from Shs112.1bn in 2016.

Barclays is now the 5th profitable bank in Uganda, having recorded Shs72bn in 2017, up from Shs55bn in 2016.

Other profitable banks that make it to the top 10 in order include Bank of Baroda (Shs49.36bn), Citibank (Shs39.29bn), Equity Bank (28bn), Housing Finance(Shs19.9bn) and Bank of Africa (16.6bn). What is shocking though is that the 10 banks control 97% of the industry profit share, leaving the 14 banks to share the remaining 3%.

Ecobank, UBA Record Profits For 2nd Year Running

For a second year running, Ecobank and United Bank of Africa (UBA) recorded profits, an indicator that their worst years could be over. The West African banks had operated in Uganda for about nine years without posting a profit.

Ecobank Uganda headed by Clement Dodoo as Managing Director made a net profit of Shs1.54bn, up from Shs813.3m recorded in 2016. This represents a record growth of 89.4%. Commenting on the results, Dodoo said: “…we were a little careful with asset growth. We also kept a close lid on operational losses to ensure we do not lose money. We were a bit conservative with aggressive revenue growth because we were consolidating our solid controls position.”

UBA’s profits reduced to Shs1.04bn, down from Shs2.6bn recorded in 2016.

UBA is headed by Johnson Agoreyo as its Managing Director/CEO. He is credited for turnaround the bank just like Ecobank’s Dodoo.

Loss making banks

In 2017, loss making banks increased to six, up from four recorded in 2016, but total industry loss reduced to Shs16.053bn, down from Shs26.528bn recorded by the four banks in 2016.

Under the profits/loss category, Exim Bank that acquired Imperial Bank a few years ago is the worst performing; having recorded a net loss of Shs5.98bn in 2017, up from 4.1bn loss recorded in 2016.

The bank hasn’t been performing well since it joined the Ugandan market in 2011. The rise in losses could be attributed to the bad loans written off that increased to Shs14.69bn in 2017, up from Shs1.4bn recorded a year earlier. The bank that is managed by Sabhapathy Krishnan as CEO saw its NPLs reduce to Shs12.13bn in 2017 from Shs22.3bn in 2016.

It is followed by Tropical Bank that made a loss of Shs5.5bn in 2017, down from a loss Shs13.4bn.

According to a critical analysis of the figures, Tropical’s loss can be attributed to high NPLs and bad loans written off. NPLs reduced to Shs28.7bn in 2017 from Shs38.27bn in 2016, while bad loans written off increased to Shs12.06bn in 2017 from Shs11.79bn in 2016.

Krekshi Sameh Mahmud, the Managing Director of the bank has huge task to turnaround the bank that has been performing poorly for many years.

Guaranty Trust Bank (GTBank) scoops the 3rd position in as far as banks in the red are concerned. The bank made a loss of Shs1.9bn in 2017, up from Shs1.43bn loss in 2016. The loss could be attributed to high NPLs, hitting Shs4bn in 2017, up from Shs2.85bn in 2016.

The bank recently appointed Lekan Sanusi as its Managing Director, replacing Olufemi Omotoso, who returned to the Group’s head offices in Nigeria. It should be noted that GTBank entered the East African market in 2014 after acquiring 70 percent in Fina Bank Group’s operations in Kenya, Uganda and Rwanda.

Commercial Bank of Africa (CBA) has also found it hard to hit the ground running after re-joining the Ugandan market in 2014 (It had exited the market in 1969 due to political instability). The bank has been recording losses since inception. In 2017, it made a loss of Shs1.3bn, down from Shs8.1bn loss in 2016. Like other loss making banks, CBA’s loss is certainly due to NPLs that increased to Shs7.8bn from Shs6.19bn in 2016.

However, other key performance parameters are positive for CBA that is headed by Samuel Odeke as Managing Director.

Troubled Cairo International Bank (CBA) that had made a net profit of Shs1.4bn in 2016 bounced back in the red chart, registering a loss of Shs1.14bn in 2017. The loss is attributed to high NPLs and bad loans written off; NPLs increased to Shs2.5bn from Shs1.67bn, while bad loans written off increased to Shs450.5m in 2017, from Shs235.7m in 2016.

ABC Capital completes the table of the loss making banks, having recorded Shs533m loss in 2017, from Shs815m net profit registered in 2016.

Banks With Huge NPLs

This category is important because Non-Performing Loans (NPLs) have adversely affected Uganda’s banking industry since 2011. Some have gone under due to huge NPLs.

Out of the 24 banks, it’s only Citibank that has zero NPLs. Stanbic bank didn’t indicate its NPLs in its financial statements and our efforts to get the figures were futile.

Excluding Stanbic, industry NPLs increased to Shs577.09bn in 2017, up from Shs572.39bn in 2016.

Barclays has the highest loan defaulters. Its NPLs increased to Shs106.7bn in 2017, up fromShs70.4bn, representing 51.56% growth/increase.

dfcu bank occupies the 2nd slot. The bank’s NPLs increased by 65.69% to Shs96.6bn in 2017, up from Shs58.3bn in 2016.

In 3rd is Standard Chartered whose NPLs reduced to Shs78.6bn in 2017, down from Shs112.1bn.

Centenary Bank is also among the top banks with high NPLs. Its NPLs increased to Shs62.2bn in 2017, up from Shs35.6bn.

Diamond Trust Bank comes 5th, registering Shs40bn in NPLs in 2017, up from Shs28.3bn in 2016.

Others with high NPLs as of 2017 are Bank of Baroda (Shs35.5bn), Equity Bank (Shs30.7bn), Tropical Bank (Shs28.7bn), Housing Finance (Shs18.6bn) and NC Bank (Shs14.7bn).

Bad Loans Written Off

Under this category, DTB leads the chart. It wrote off Shs35.7bn in 2017, up from Shs34.4bn in 2016.

It is followed by dfcu (Shs27.2bn in 2017 from Shs5bn in 2016), Bank of Baroda (Shs23.47bn in 2017 from Shs6.39bn in 2016, Centenary (Shs18bn in 2017 from Shs11.2bn in 2016), StanChart (Shs17bn in 2017 from Shs14bn in 2016), Barclays (Shs14.9bn in 2017, from Shs15.19bn in 2016), Exim Bank (Shs14.69bn from Shs1.4bn and Tropical (Shs12.06bn in 2017 from Shs11.79bn in 2016).

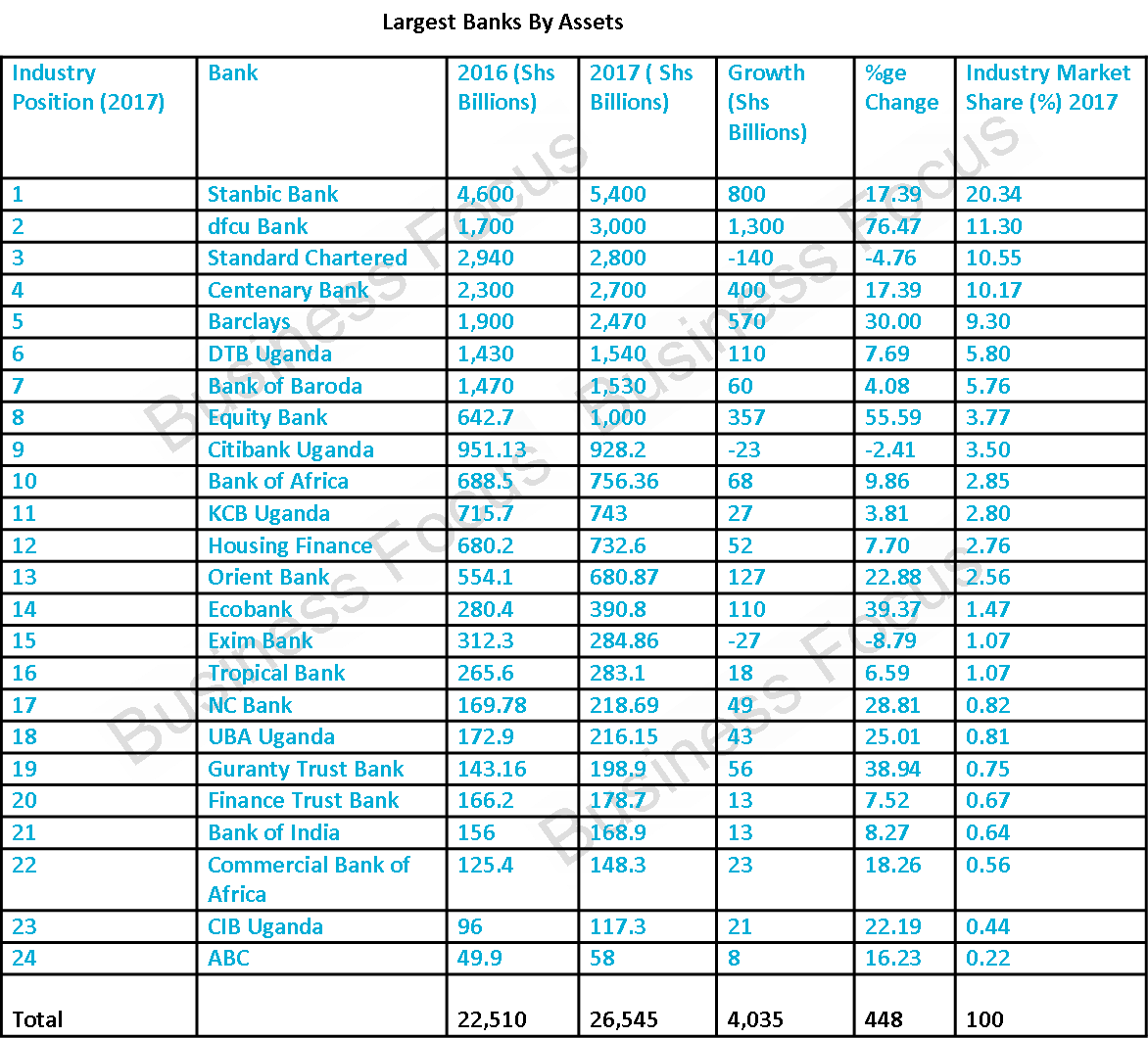

Largest Banks By Assets

Banks continue to accumulate assets. In 2017, industry assets increased to Shs26.5 trillion, up from Shs22.5trillion recorded a year earlier.

Under this category, Stanbic leads. Its assets increased to Shs5.4 trillion in 2017, up from Shs4.6 trillion in 2016, representing 17.39%. The bank holds 20.34% of the total industry share.

It is followed by dfcu Bank, whose assets increased to Shs3 trillion in 2017, up from Shs1.7 trillion in 2016 . The impressive growth is attributed to assets acquired from Crane Bank.

In 3rd position is Standard Chartered. Its assets reduced to Shs2.8 trillion in 2017 from Shs2.94 trillion in 2016.

Centenary Bank’s assets increased to Shs2.7 trillion in 2017, up from Shs2.3 trillion recorded in 2016, making it the 4th largest bank by assets.

Barclays is the 5th largest bank by assets. Its assets increased to Shs2.47 trillion in 2017, up from Shs1.9 trillion in 2016. Surprisingly, the five banks control 61.66% of the total assets industry market share.

Other banks with huge assets in ascending order are; DTB (Shs1.54 trillion), Bank of Baroda (1.53trillion), Equity Bank (Shs1 trillion), Citibank (Shs928.2bn) and Bank of Africa (Shs756.36bn).

These top 10 banks with largest assets control 83.34% of industry assets market share. The remaining 14 banks share a paltry 16.66%.

From the bottom, ABC leads. It has the lowest assets in the industry (Shs58bn). Cairo International comes 2nd in as far as banks with lowest assets are concerned. Its assets increased to Shs117.3bn in 2017, up from Shs96bn. Other banks with limited assets include Commercial Bank of Africa (Shs148.3bn), Bank of India (Shs168.9bn) and Finance Trust Bank (Shs178.7bn).

Largest Banks By Loans To Customers

Industry loans advanced to customers increased Shs11.331 trillion in 2017, up from Shs10.036 trillion, a pointer that private sector credit growth continues to recover.

Just like on other key performance parameters, Stanbic leads this category.

Its loans advanced to customers increased by 10% to Shs2.2 trillion in 2017, up from Shs2 trillion in 2016.

It is followed by Centenary Bank whose loans increased to Shs1.3 trillion in 2017, up from Shs1.24 trillion a year earlier.

In 3rd position is dfcu Bank whose assets grew by 55.5% to Shs1.3 trillion from Shs834.8bn in 2016.

Standard Chartered loans to customers reduced to Shs1.22 trillion in 2017, down from Shs1.23 trillion the previous year. The bank is understood to be cautious in giving out loans due to high NPLs as indicated earlier in this story.

Barclays whose assets increased to Shs1 trillion in 2017 from Shs822bn in 2016 completes the top five banks with huge loans to customers.

Banks that complete the top 10 banks with huge loans to customers are DTB (Shs623bn), Bank of Baroda (Shs616.57bn), Equity (Shs495.9bn), Housing Finance (Shs455.1bn) and Bank of Africa (Shs320.37bn).

The bottom side of the table is topped by ABC that advanced Shs18.4bn in 2017, up from Shs14.58bn in 2016. It is closely followed by UBA whose loans to customers increased to Shs27.5bn in 2017 from Shs17.7bn in 2016.

Others with small loans to customers are Cairo (Shs47.6bn), Commercial Bank of Africa (Shs71.79bn), Guaranty Trust Bank (Shs79.28bn), Bank of India (Shs85.6bn) and Finance Trust Bank (Shs110.4bn).

Customer Deposits

Total industry customer deposits increased to Shs18.122 trillion in 2017, up from Shs15.527 trillion in 2016.

Uganda’s largest banks by customer deposits as of December 2017 include Stanbic (Shs3.6 trillion), dfcu (Shs1.98 trillion), Standard Chartered (Shs1.9 trillion), Centenary Bank (Shs1.9 trillion), Barclays (Shs1.68 trillion), Bank of Baroda (Shs1.166 trillion), DTB (Shs1.16 trillion), Equity Bank (Shs729.4bn), Orient Bank (Shs555.2bn) and Citibank (Shs547.8bn).

Those doing badly under this category include; ABC (Shs26.47bn), Cairo (Shs74bn), Commercial Bank of Africa (Shs85bn), Finance Trust Bank (Shs102.9bn), Bank of India (Shs114bn) and NC Bank (Shs114.4bn).

2018 Outlook

A number of bankers are optimistic about a better 2018 owing to the fact that inflation remains contained and interest rates continue to reduce. Currently, the Central Bank Rate (CBR), a benchmark lending rate for commercial banks stands at 9%, a development that has seen banks reduce their Prime Lending Rates to as low as 17%. The increasing activity in the oil and gas sector is also one of the factors banks think will spur the sector going forward.

Additionally, the introduction of agency banking, Bancassurance and digital banking present a huge opportunity for banks to grow.

Stanbic’s Mweheire said his bank posted record results in 2017 despite a challenging operating and business environment, adding that 2018 promises to be a better year.

“I remain optimistic that we will see stronger economic recovery in 2018 supported by improving aggregate demand with moderate inflation in a benign low interest rate environment,” he said.

Ecobank’s Dodoo noted that they have put in place best systems to ensure sustainable growth.

“We are now very convinced that we have put the right systems in place to avert leakages; we will be focusing on asset growth henceforth,” he said, adding: “We are ensuring gradual growth as rapid growth in itself can kill you.”

We’ll keep you posted with unmatched analysis and more tables. For feedback, contact: staddewo@gmail.com, 0775170346

Hi, this is really helpful.

However, I want to bring your attention to the first paragraph under “the most profitable banks” where you indicate an increase in general profits of 92.1% which I think should be Shs 92.1 bn. The percentage increase then is about 13.6%.

Regards.

You’re right. Thanks for the feedback and correction.