Professional Accountants in Uganda have blamed themselves for some of the mess in the public and private sector where public resources could have been saved if they had done better.

Professor Twaha Kaawaase, a Certified Public Accountant and Trainer says many of the private and public corporations that are at the centre of financial mismanagement scandals have certified accountants involved.

A professional accountant -which includes financial accountants, auditors and costing managers- is one who has attained a qualification in the field, provided by any globally recognized professional body which then admits them as members.

For one to practice, they are given a practicing license which can be withdrawn in case the holder violates the ethics of the profession. In Uganda, this is the role of the Institute of Certified Public Accountants of Uganda, ICPAU.

Professor Kaawaase told ICPAU members, government and private sector corporate organisations to style up, giving an example of the commercial banks that have been closed over the last two decades.

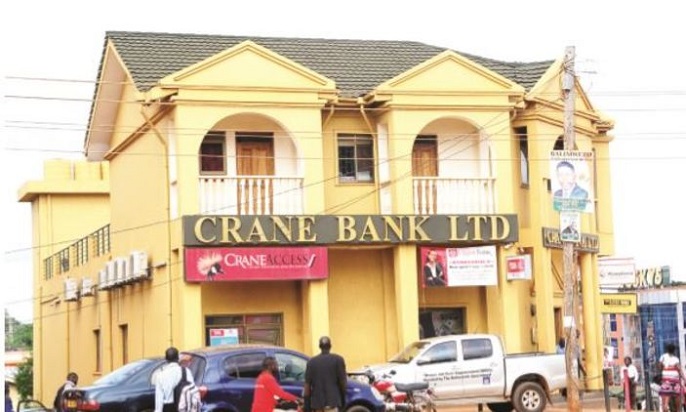

He says that such institutions, including Crane Bank which is still a centre of conflict between the Bank of Uganda and the bank’s shareholders, always have audit reports with the unqualified opinions of the auditors, on such institutions’ financial positions. He then wonders what the duty of the auditor was.

In 2016 Bank of Uganda took control of Crane Bank accusing management of mismanaging the institution which has reportedly led to a financial crisis and inadequate capital. This came just a few months after the publication of the bank’s financial statements for the year 2015, which were audited by the international firm KPMG.

The statements showed that the bank was financially strong with a paid-up capital of 210 billion Shillings, which was multiple times more than the 25 billion Shillings required by the BOU’s regulations.

Crane Bank’s financials had for all the previous years, been audited by international firms including PWC and Deloitte. In its last year of operation, the bank reportedly made a profit before tax of 1.8 billion, according to the statements.

BOU’s decision to seize the bank months later was based on a re-audit it carried out after detecting some anomalies.

Prof Kaawaase says a professional auditor must be skeptical every time they are presented with statements to audit, and this skepticism gives the auditor room to detect an error or omission in the statements and report it.

The Crane Bank/BOU crisis prompted an investigation by parliament’s Committee on Statutory Agencies and State Enterprises, COSASE, into the closure of six other banks in the last two decades. The Committee’s report largely faulted the Bank of Uganda’s process for lacking proper procedure. Crane Bank owners have since succeeded, through court, in blocking the regulator from winding it up.

A majority of people doing accountancy and auditing work in most public and private institutions, only have attained academic levels up to university. ICPAU has released findings of a study commissioned in 2019 about the quality of graduates and professionals, with the aim of finding where there is a need for improvement.

The study featured Professional Skepticism and Audit Quality in Uganda, the Efficacy of the Auditing function in the Public Sector Financial Management in Uganda and Graduate Tracer Study and Employers’ Expectations Survey.

Proscovia Namubiru Ssentamu, Associate Professor at Uganda Management Institute who was a lead researcher says they discovered that the professional qualifications generally add quality to the productivity of the graduate, though there are also reports of ethical misconduct.

The studies targeted heads of government ministries, departments and agencies (MDAS), Local Governments, Internal Auditor General, oversight committees of parliament and staff at the Auditor General’s office.

But like in most other professions, having a qualification is not a guarantee that one will get the professional employment expected. Prof Ssentamu says almost a quarter of the respondent graduates either had no jobs or were doing jobs that they were not trained for.

Dr Gerald Kasigwa a Makerere University lecturer and financial consultant argued that the parliament rules on oversight committees should be amended so as to include professionals from outside parliament.

This would make the committees like COSASE, The Local Government Accounts Committee and the Public Accounts Committee more capable of handling investigations on professional failures. He adds that government ministries, departments and agencies should be compelled to always show reports of implementation of previous audit reports made on them.

-URN