Tycoon Sudhir Ruparelia

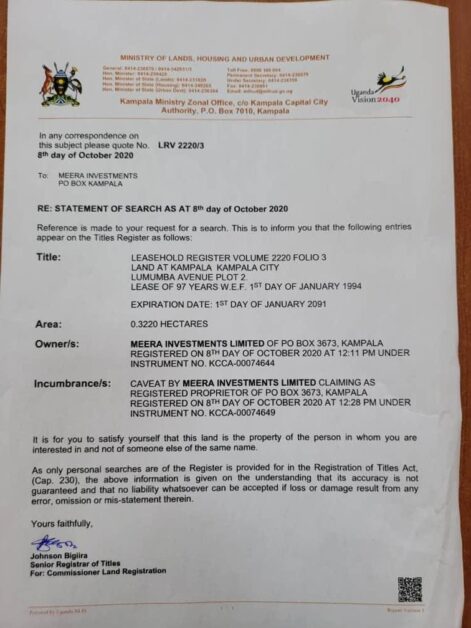

Meera Investments Ltd owned by property mogul, Sudhir Ruparelia has acquired Simbamanyo House in the central business district at a cost of $5m (Shs18.51bn).

According to Matooke Republic, Sudhir’s Meera Investments emerged highest bidder when the building was put up on auction by Equity Bank through public bidding, with the process concluded yesterday.

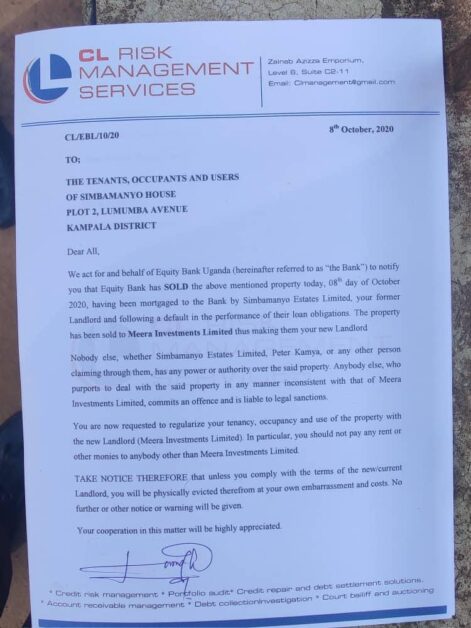

Equity Bank Limited then wrote to the tenants of Simbamanyo House, located on Lumumba Avenue, informing them of change of ownership.

“We are writing to inform you that Equity Bank Uganda Limited, as mortgagee, has completed the sale of the above mentioned property, after a public auction concluded on October 8, 2020, to the evaluated bidder M/S Meera Investments Ltd. All the tenants were put on notice of the said auction via an advert in the Daily Monitor Newspaper dated September 8, 2020,” reads the notice.

It adds: “The new owners will get in touch with all tenants individually to work out the modalities for the ownership transition. We trust you accord the new owners all the courtesy and all future rental payments and other tenant inquiries and obligations will be handled by Meera Investments Ltd or their agents.”

Sudhir has just added to his property portfolio

In a 2016 interview, Sudhir revealed that he had “more than 300 titles [of land] in my closet and still counting.”

For example, he said, he had more than 14 buildings along Kampala Road alone.

This has since grown considering the fact that he has been opening more new buildings in Kampala and the surrounding areas.

In 2016, he valued his titles at around US$1bn (roughly Shs3.7trillion) excluding the now defunct Crane Bank that was controversially taken over by the Bank of Uganda and later sold.

The Genesis

Equity Bank, acting through Katende Ssempebwa & Co Advocate and AF Mpanga, Advocates, had earlier said it would after October 7 proceed to sell properties contained in plots on Lumumba Avenue and Mutungo-Luzira, both within Kampala if Simbamanyo Estates fails to pay Shs11.5 billion.

In a notice published on September 7 in the Daily Monitor, Equity Bank said Simbamanyo had until October 7 within which it must pay at least 30 per cent of the disputed Shs38.6 billion, failure of which it will proceed to sell properties against which the money was advanced.

Simbamanyo had at the end of August put a caveat on the disputed properties, noting Equity Bank was trying to upstage the court process in which it is challenging the sum in dispute and the legality of loans drawn from Equity Bank Kenya.

Simbamanyo is embroiled in a property dispute with Equity Bank Uganda and Equity Bank Kenya resulting from unpaid loans that had been advance to the real estate company.

According to court documents filed in the Commercial Division of the High Court, on August 20, 2012, Equity Bank Kenya and Equity Bank Uganda entered into a loan agreement in which the two banks agreed to advanced Simbamanyo with $6m.

The loans, which would make up a consolidate sum of $8.10m (Shs29.83b) including interest and operational fees, among others, sought to finance the construction of Afrique Suites Hotel in Mutungo, Luzira north east of Kampala and facilitate the takeover of a prior facility advanced to Simbamanyo by Shelter Afrique.

The two banks, pooled money together with at least $3.5m drawn from Equity Bank Kenya and $2.5m from Equity Bank Uganda.

However, Simbamanyo Estates is challenging the outstanding sum, saying it is only aware of $7.19m (Shs26.48b).

Simbamanyo Estates is also accusing Equity Bank Uganda of providing Equity Bank Kenya with an illegal cover to conduct business in Uganda where it has no jurisdiction.

The real estate company wonders how, according to court document, Equity Bank and Bank One, which provided bridge financing of ($10m) were drafted into the loan agreement yet Simbamanyo had never applied for any facility from the two banks later alone own a bank account in any of the said financial institutions.

However, in its defense, Equity indicates that Sambamanyo benefited and was aware of every financial transaction that was advanced to it.

Equity also argues that Bank One, based in Mauritius, was drafted into the transaction on the request of Simbamanyo, which had sought to obtain bridge financing of up to $10m.

Court documents indicate that Simbamanyo Estates had sought to offset the outstanding sum in a November 16, 2017 letter to Mr Samuel Kirubi of Equity Bank Group Kenya.