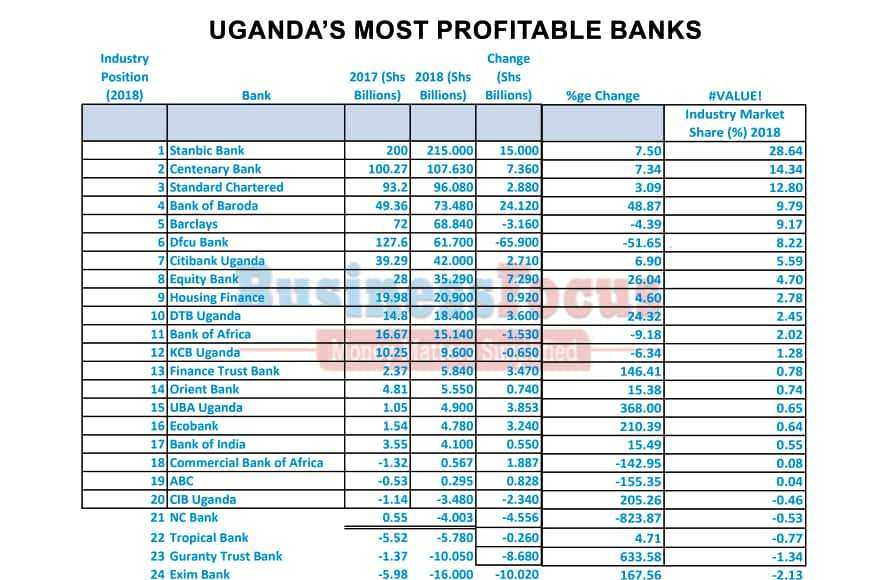

Uganda’s banking sector has 24 operating commercial banks. However, the market is controlled by a few banks going by the 2018 financial results analyzed by Business Focus.

For example, the top five most profitable banks including Stanbic, Centenary, Standard Chartered, Bank of Baroda and Barclays have a total market share of 74.74% of the industry profits.

The other five banks that make up the top 10 most profitable banks including dfcu, Citibank, Equity, Housing Finance and Diamond Trust Bank have 23.73% market share of the total industry profits.

In total, the above 10 banks control 98.48% of the total industry profits.

This means that the remaining 14 banks’ profit share is less than 2%.

It is shocking that out of these 10 banks, only one is headed by a woman (Sarah Arapta of Citibank).

It is worth noting that out of 24 banks, 19 banks recorded net profits of Shs790.092bn in 2018 compared to the 17 banks that posted a profit of Shs785bn.

This means that loss-making banks reduced from seven (7) to five (5) in 2018. However, whereas the seven banks made a total loss of Shs15.86bn in 2017, the five-loss making banks in 2018 made a total net loss of Shs39.31bn.

This means that the total industry net profit stood at Shs750.7bn in 2018.

Enter assets

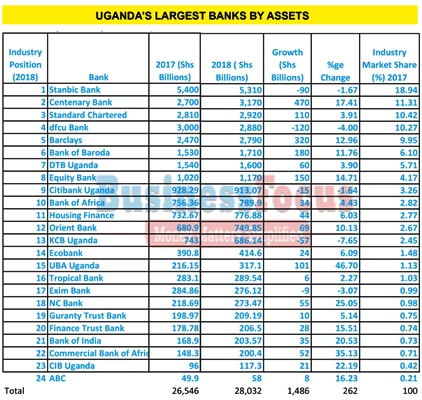

Total banking industry assets increased by 262% to Shs28.032 trillion in 2018, up from Shs26.55 trillion in 2017.

Under this category, the top five banks control 60.89% of the total industry assets. These include Patrick Mweheire’s Stanbic (18.94%), Centenary (11.31%), Albert Saltson’s Standard Chartered (10.42%), dfcu (10.27%) and Barclays (9.95%).

The other banks that make up top 10 banks with largest assets are Bank of Baroda (6.1%), Diamond Trust Bank (5.71%), Equity Bank (4.17%), Citibank (3.26%) and Bank of Africa (2.82%).

The top 10 banks control 82.95% of the total industry assets market share.

This means that the other 14 banks share the remaining 17.05%.

Customer deposits

On customer deposits, the top 10 banks control 83.69% of the total industry market share. The other 14 banks are left to share a paltry 16.31%.

The 10 banks are Stanbic (19.92%), Centenary (11.68%), dfcu (10.09%), Standard Chartered (9.83%), Barclays (9.12%), Bank of Baroda (6.66%), DTB (5.84%), Equity (4.48%), Orient (3.16%) and Bank of Africa (2.91%).

Loans

On loans advanced to customers, the top 10 banks control 85.28% of the industry market share under this segment.

These include Stanbic (18.78%), Centenary (11.49%), dfcu (10.44%), Standard Chartered (9.84%), Barclays (8.79%), DTB (8.56%), Bank of Baroda (5.69%), Equity Bank (5.26%), Housing Finance (3.84%) and Bank of Africa (2.59%).

From the above analysis, it’s clear that Uganda’s banking sector is controlled by largely foreign owned banks. This is because Centenary Bank is the only consistent indigenous bank on all the parameters considered.

The implication of this is that these banks will not only dictate interest rates, but the economy can adversely be affected if the leading foreign owned banks get financial problems.