The French Ambassador to Uganda, Stephanie Rivoal has warned Ugandans against unnecessary expenditures, noting that the country can’t develop without a strong savings culture.

“Uganda is one of the countries with the lowest savings culture in the word,” Rivoal said, “Ugandans like spending.

Majority working class [people] don’t save; only 5% save with NSSF (National Social Security Fund).”

Rivoal was speaking as Chief Guest at dfcu bank ‘Battle for Cash’ finale held at Serena Hotel on Thursday.

She noted that Uganda lags behind her counterparts n Kenya and Tanzania where saving is at 25% and 13% respectively.

She noted that given the high levels of youth unemployment in the country, it is important that Ugandans embrace entrepreneurship and vocational studies.

“Agriculture is the biggest employer in Uganda, but left to the peasants. The youth should join agriculture and do it as a business,” she said, adding that people should protect the environment through organic farming.

She added that Ugandans shouldn’t wait for everything from government, urging them to form investment clubs to raise capital.

William Sekabembe, the Chief of Business and Executive Director at dfcu bank revealed that dfcu bank launched the Investment Club Product 10 years ago and so far, they have 20,000 investment clubs registered with the bank.

An investment club is a group of people who pool their money to make investments. Usually, investment clubs are organized as partnerships and, after the members study different investments, the group decides to buy or sell based on a majority vote of the members.

Sekabembe added that they came up with the ‘Battle for Cash’ campaign three months ago to encourage Ugandans save given the fact that Uganda’s savings to GDP ratio stands at 12%.

dfcu Bank partnered with NTV Uganda and Price Waterhouse Coopers (PwC) to start a a nationwide campaign aimed at driving a savings and investment culture in Uganda.

Between June and August, dfcu Bank had teams going round the country carrying out regional saving and financial literacy workshops. Some of the topics covered included; Why and how to save; where to invest money so it can grow, things to think about when thinking of investing and so much more. This was aimed at changing the perceptions and attitudes about money, savings and investments.

The Battle for Cash challenge has been running on NTV every Thursday at 8:00pm. As part of the application process, clubs were tasked to develop a Business plan for an innovative investment project.

Sekabembe noted that the campaign attracted many participants, but only 20 were selected to take part in the televised show.

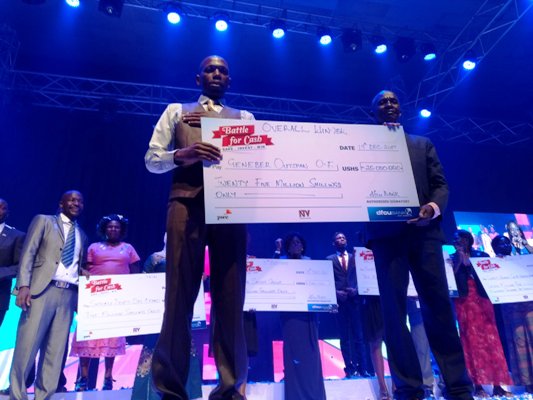

Eventually, 10 investment clubs made it to the final and seven of them were winners. They shared Shs70m.

Geneber Out span Organic Farmers were the overall winners, walking away with Shs25m.

The third winner Sikyomu Development Organisation got Shs10 Million while the fourth and fifth clubs both got Shs5 Million each.

In recognition of the role of women and youth in development there was a special category for women and youth. The best youth club price was scooped by Plus Save Group and Soroti Women Cooperative Union were awarded in the best women club category. Both clubs walked away with Shs7.5 Million each.

Ssekabembe said dfcu bank plans to raise the number of investment clubs to 50,000 in 18 months.