The future of banking and business/trade is no doubt digital. It is against this background that a number of banks have unveiled online banking products aimed at cutting costs and increasing convenience.

To position itself better for the future, Ecobank Uganda is now targeting University students with its Mobile App.

The bank staff are these days moving from one University to another explaining to students why they should open an Xpress account with Ecobank.

On Tuesday, the bank camped at Buganda Royal University to woo students to download the Mobile App and open the Xpress Account.

“Our mission is to make lives easier and transacting convenient,” Primrose Kobusingye, the Head of Marketing and Communications at Ecobank Uganda told Business Focus.

Asked why they are targeting University students, Kobusingye said: “This is because our app is all inclusive . You don’t need to come to the bank to open an account.”

She added: “You can do it right on your phone which is one thing we think would work well for university students. It also has a saving angle to it. We pay interest in amounts above Shs200, 000.” She revealed that the bank is targeting 10,000 downloads from University students this year.

In an earlier interview, Jael Christine Wawulira, the Manager-Consumer Banking at Ecobank Uganda revealed that the bank’s app is not only universal, but also open for both Ecobank customers and non-customers.

“One can open an Xpress account on Ecobank Mobile App [It takes about two minutes to download the app from Google play store] and you don’t need to be an Ecobank customer to open the Xpress account. All you need is your National ID Number to open the account. For customers from the other banks, all they need is their National ID Number and Visa Card Number,” Wawulira said.

“You can open an Xpress account instantly on your mobile phone with zero account fees, zero paperwork and no minimum balance,” she added.

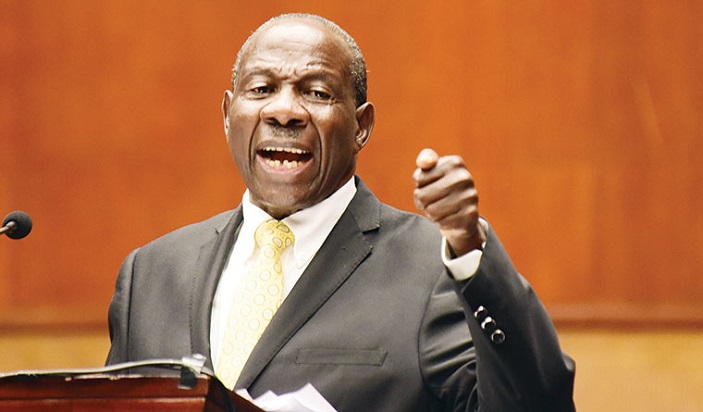

Ecobank Uganda Managing Director, Clement Dodoo earlier described the app as ‘fantastic’, revealing that it is solution based.

“We are targeting 150,000 customers by end of this year. We developed it to offer solutions to the people,” he said, adding: “The response so far is impressive given the fact that it is open for both Ecobank customers and non-customers.”