Ugandan banks have recorded high Non-Performing Loans (NPLs) and bad loans written off in recent years due to high interest rates and a sluggish economy that have forced many borrowers to default on their loans.

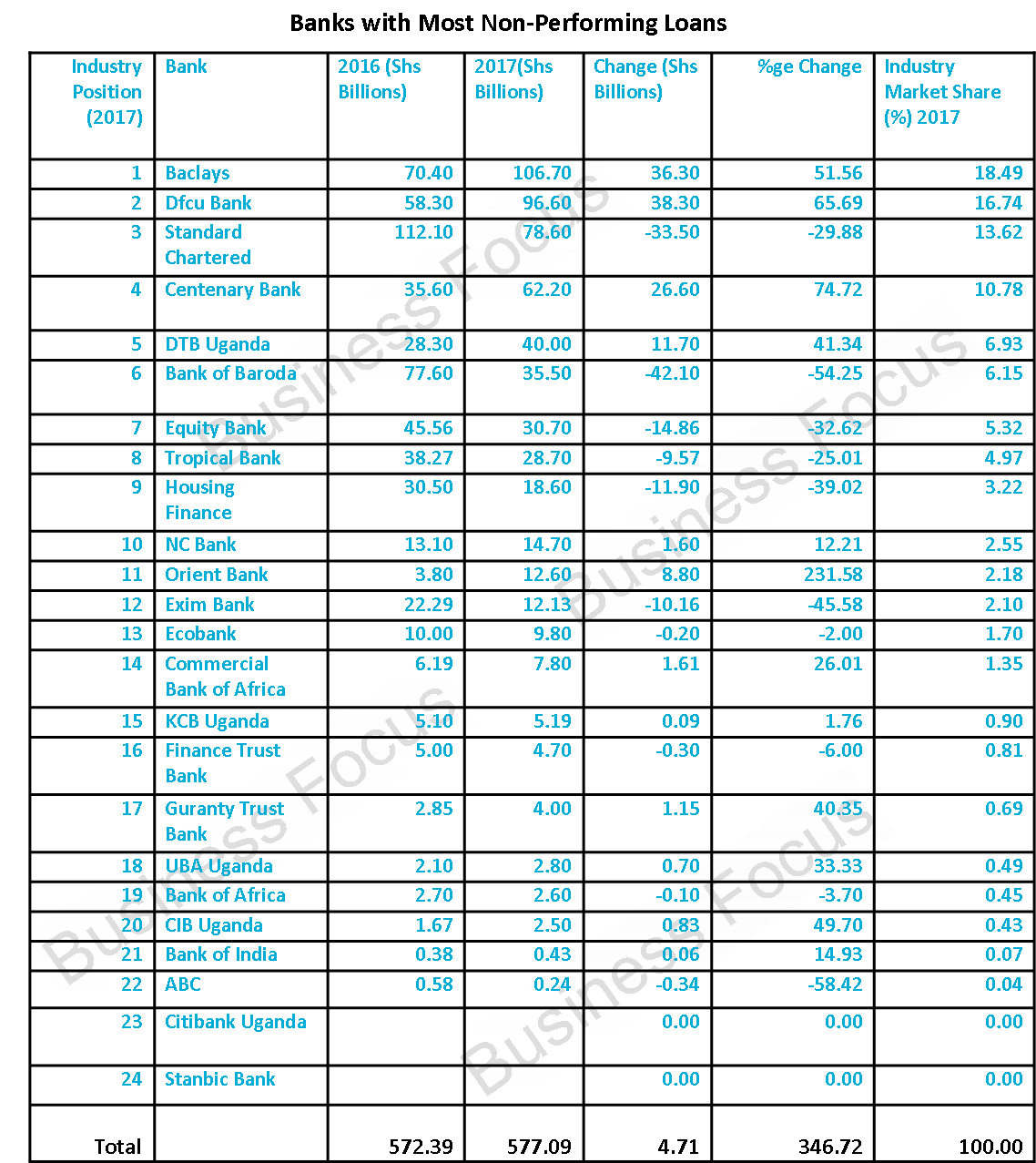

Business Focus exclusively ranked banks with most loan defaulters/NPLs basing on the results banks have been releasing in recent months for the year ended December 31, 2017.

Out of the 24 banks, it’s only Citibank that has zero NPLs.

Stanbic bank didn’t indicate its NPLs in its financial statements and our efforts to get the figures were futile.

Excluding Stanbic, industry NPLs increased to Shs577.09bn in 2017, up from Shs572.39bn in 2016.

Barclays has the highest loan defaulters. Its NPLs increased to Shs106.7bn in 2017, up fromShs70.4bn, representing 51.56% growth/increase.

On the other hand, Barclays’ loans written off reduced to Shs14.9bn in 2017, from Shs15.19bn in 2016.

This means Rakesh Jha, Barclays Uganda Managing Director has a huge task to reduce on the NPLs if the bank is to remain competitive.

dfcu bank comes 2nd slot in as far as NPLs are concerned. The bank’s NPLs increased by 65.69% to Shs96.6bn in 2017, up from Shs58.3bn in 2016. The bank’s loans written off increased to Shs27.2bn in 2017, up from Shs5bn in 2016. After acquiring Crane Bank, dfcu is now Uganda’s second most profitable bank in Uganda. It is also the 2nd largest bank by assets.

However, to knock off Stanbic in the number one spot as Uganda’s most profitable bank, Juma Kisaame, the dfcu Managing Director and his team will have to devise smarter ways to reduce on NPLs.

In 3rd is Standard Chartered. Its NPLs reduced to Shs78.6bn in 2017, down from Shs112.1bn. StanChart’s loans written off increased to Shs17bn in 2017, up from Shs14bn in 2016. Headed by Albert Saltson as CEO, StanChart has lost its 2nd spot as Uganda’s most profitable bank due to high NPLs.

Centenary Bank is also among the top banks with high NPLs. Its NPLs increased to Shs62.2bn in 2017, up from Shs35.6bn, making it the 4th bank with largest NPLs in Uganda.

Its loans written off increased to Shs18bn in 2017, up from Shs11.2bn in 2016.

Diamond Trust Bank comes 5th, registering Shs40bn in NPLs in 2017, up from Shs28.3bn in 2016. Its loans written off increased to Shs35.7bn in 2017, up from Shs34.4bn in 2016.

Bank of Baroda also has high NPLs. Its NPLs reduced to Shs35.5bn in 2017, down from Shs77.6bn in 2016. However, its loans written off increased to Shs23.47bn in 2017, up from Shs6.39bn in 2016.

It is followed by Equity Bank. Its NPLs reduced to Shs30.7bn in 2017, down from Shs45.56bn in 2016. Its bad loans written off reduced to Shs4.9bn in 2017, up from 8.3bn in 2016.

Tropical Bank’s NPLs reduced to Shs28.7bn in 2017, up from Shs38.27bn in 2016, making it the 8th bank with largest NPLs.

Tropical wrote off loans worth Shs12.06bn in 2017, up from Shs11.79bn in 2016.

In 9th position is Housing Finance that saw its NPLs reduce to Shs18.6bn in 2017, down from Shs30.5bn in 2016.

NC Bank completes the top 10 banks with largest NPLs. Its NPLs increased slightly to Shs14.7bn in 2017, up from Shs13.1bn a year earlier.

Banks with lowest loans defaulters/NPLs include ABC (Shs24m in 2017, up from Shs58m), Bank of India (Shs24m from Shs43m), Cairo (Shs2.5bn from Shs1.67bn), Bank of Africa (Shs2.6bn from Shs2.7bn), UBA (Shs2.8bn from Shs2.1bn), Guaranty Trust Bank (Shs4bn from Shs2.85bn) and Finance Trust Bank (Shs4.7bn from Shs5bn).