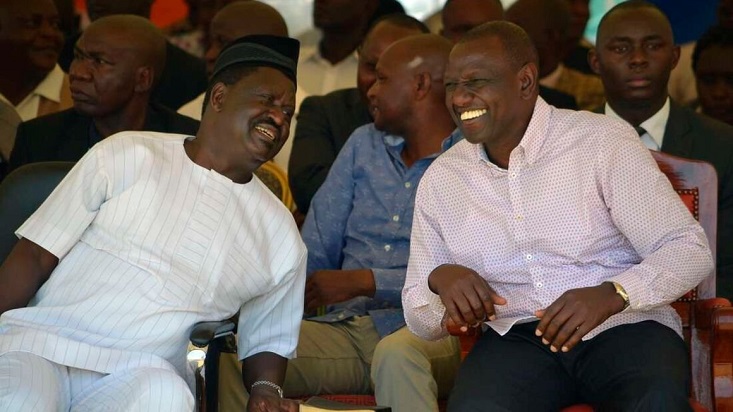

The two front-runners in the race to succeed President Uhuru Kenyatta in the August election, Deputy President William Ruto (right) and Opposition Leader Raila Odinga. FILE PHOTO | NMG

Treasury chiefs project that Kenya will spend KSh1.36 trillion (UShs41.8 trillion) annually in the year starting July for debt repayment, up from KSh1.15 trillion (UShs35.38 trillion) in the current fiscal period.

The debt costs will for the first time in Kenya’s history surpass the recurrent expenditure, projected at KSh1.34 trillion (UShs41.2 trillion)in the coming year from the current KSh1.27 trillion (UShs39 trillion).

The repayment expenses will eat up KSh6 out of every KSh10 the country will collect in taxes in the period, leaving little money for building roads, providing affordable housing and revamping of the ailing health sector — which are key for jobs creation.

Kenya has ramped up borrowing under Mr Kenyatta’s administration to build infrastructure, leading to a squeeze on its finances as the loans fall due amid criticism over the resulting debt burden.

Public debt stood at KSh8.2 trillion (UShs252.3 trillion) in December from Sh1.89 trillion (UShs58.1 trillion) in 2013. The loans — which include billions of dollars from China — are pushing against the nation’s debt ceiling.

The two front-runners in the race to succeed Mr Kenyatta in the August election — Deputy President William Ruto and Opposition Leader Raila Odinga — have both raised concerns over the mounting debt.

“Debt must be the last resort. We must not be slaves of debt from any place or any country,” Dr Ruto said last month while receiving his new party’s nomination to stand for Kenya’s presidency without elaborating how he intends to tackle the mounting debt.

Mr Odinga is mulling renegotiating short-term commercial loans, echoing the present government’s plan to refinance or substitute commercial loans with cheaper options from friendly nations or development financiers like the World Bank.

“We have two categories of loans but the short-term commercial debts with shorter times of repayment and higher interest rates are the ones that are punitive and we intend to find a way of renegotiating the repayment rates,” Mr Odinga told a forum at the Chatham House in the UK recently.

The Treasury sees repayments to foreign creditors rising 34.11 percent to KSh440.06 billion, while domestic debt costs are forecast to increase 11.65 percent to KSh919.06 billion in the year starting July compared to the estimates for the current year.

Some of the large external repayments in the next financial year include KSh103.75 billion to China’s Exim Bank which, among other projects, funded the standard gauge railway and KSh61.88 billion to a syndicated loan arranged by Comesa-owned Trade and Development Bank.

The growing debt burden reflects fast-maturing commercial and semi-concessional loans which the Jubilee administration contracted in its early years in office to build a modern railway, new road highways, bridges and electricity plants.

Credit: Business Daily