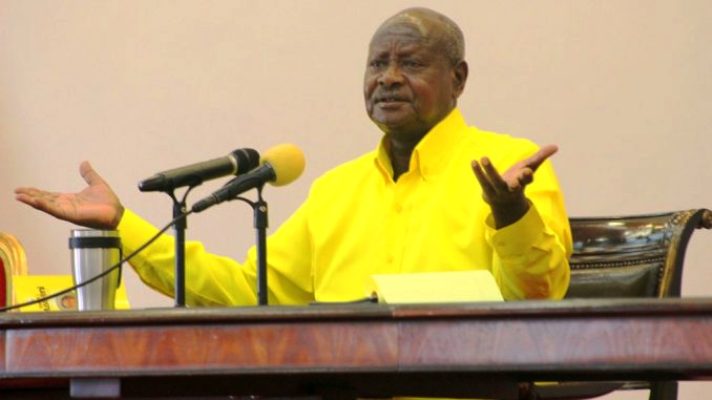

President Yoweri Kaguta Museveni has said taxing deposits was wrong and it should stop immediately. And re-imbursments will be made.

In a statement issued Thursday evening, Museveni said there was confusion about 1% and 0.5% charges on deposits on mobile money accounts which were not supposed to be taxed.

“It is because this was a new tax and people were not uniformly understanding what was involved. However, there are also elements who, on account of corruption, have been concealing possible tax sources from the government and have been aiding tax evasion,” he said.

He added: “They have been hiding the movement of money in and out of the country, the coming in and going of telephone calls, the misuse of social-media for subversion and malice. All these dishonest people tried to misinform the public in order to incite them against the efforts by the government to achieve financial independence from their foreign masters.”

He explained that Ugandans need to know that there are two types of corruption; Some of the thieves steal our money that we have already collected.

He added that others steal the money we have not collected in the form of concealing tax sources, under-declaring telephone calls, under-declaring rents collected from buildings and under-declaring the value of imports etc.

“Mobile money tax is a different category from the social-media tax. Mobile money transfer is not a luxury. It is, in fact, a necessity and a very convenient way of sending money. There is, however, another issue for the partially pre- capitalist and partially informal economy we are still having. Many people’s earnings are not known,” he said.

Apart from salary earners and those who use banks, the earnings of many other Ugandans are not known, he said, adding that Mobile money transfers have brought to the surface the big volumes of money that are moving around the country.

“Each day US$ 52m moves around in the form of mobile money. This is about US$ 19bn a year. Much of this money is by big people; but, of course, some of it is by, economicswise, small people. Therefore, in an effort to have self-sufficiency in budget, this is a convenient source we should not over- look. What small portion can the state take away to balance its budget without hurting the users? That is how the idea of 0.5% for sending and 0.5 %for receiving came up,” Museveni explained.

He added: “Due to the newness of the measure, the figure of 1%came up by mistake. I signed the law with the error because we could not delay the other measures. However, Parliament, when it reconvenes, will be requested to correct it. The ones whose deductions had been made on the basis of 1% should have their money re-imbursed. Should we only deduct from the sender or also from the receiver? Is it affordable? We should continue to study those questions. However, the necessity of using this for revenue generation is clear. The only question is: “By how much”? Let us discuss this in a disciplined manner.”

On Social Media Tax

He says social-media use is definitely a luxury item.

“Internet use can be sometimes for educational purposes and research. This should not be taxed. However, using internet to access social media for chatting, recreation, malice, subversion, inciting murder, is definitely a luxury,” he said.

“As I said in my earlier message, it is, moreover, a luxury that is costly to the country’s economy apart from the shillings the users keep spending to use the internet to access the social media (facebook). The foreign telephone companies accumulate a lot of local shillings from the social media merry- makers or malice promoters; they, then, go to the forex bureaus and buy the dollars I have earned from my milk products, from coffee, from tea etc etc and, guess what, send abroad (send back the very dollars we had just earned) this hard currency T. hereby, putting pressure on our shillings,” he said.

In this heammorage, he said, they are joined by the people of games betting where, again, betting machines are owned by the foreigners. This is not only extravagance but also parasitism.

“Our people are unknowingly being used by foreign interests (telephone companies, social media companies) to parasite on us- to take away our hard earned dollars in order to have fun or promote malice on social media. That is why a social media tax is, really, a minimum. Instead of re-introducing foreign exchange control which other countries still have, we have simply said: “Please since you are endlessly having fun or expressing your views at the expense of the dollars we have earned, make a modest contribution to the building of the country”. Those involved, should, surely, happily, at least, do this minimum.”