A photo montage of top bank CEOs

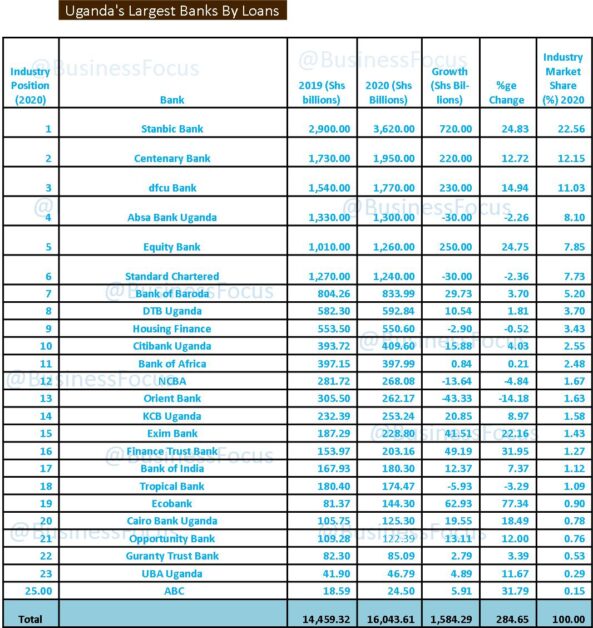

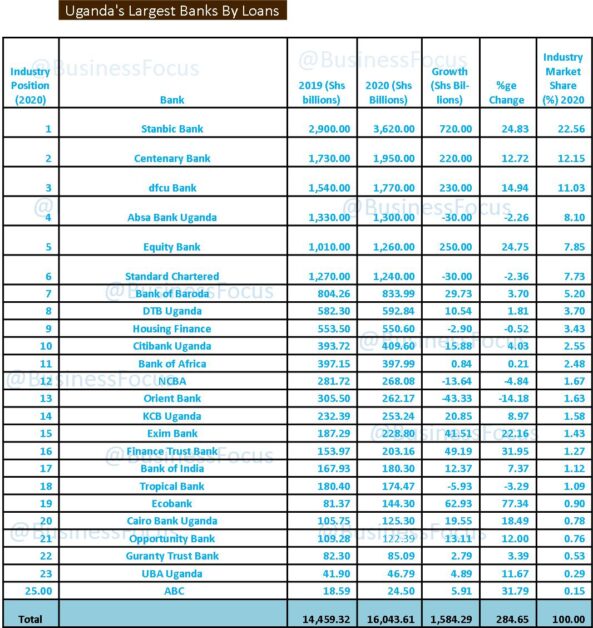

Ugandan commercial banks advanced loans worth Shs16.04 trillion to customers in 2020, up from Shs14.46 trillion in 2019. This represents an increase of 11%.

This is according to financial statements for the year ended 31st December 2020 analyzed by Business Focus.

Like other key performance indicators analyzed earlier like assets, profit and customer deposits among others, a few banks also dominate the market under the loans category.

It’s worth noting that despite the disruptions caused by COVID-19 pandemic on banking and other key sectors of the economy, banks generally performed well as 19 banks made Shs817.7bn profit in 2020. In 2019, 17 banks made a profit of 903.65bn.

In 2020, loss-making banks reduced to five (5). The five banks made losses amounting to Shs42.31bn. A year earlier (2019), seven banks made a loss of Shs52.23bn.

This means that the total industry net profit in 2020 was Shs776.4bn.

Largest Banks By Loans

Stanbic Bank leads this category. Headed by Anne Juuko as Chief Executive Officer, Stanbic saw its loans to customers increase by 24.83% to Shs3.62 trillion in 2020, up from Shs2.9 trillion in 2019.

The bank enjoys a commanding industry market share of 22.56% under the loans category.

Stanbic is followed by Centenary Bank that is headed by Fabian Kasi as Managing Director. Centenary’s loans to customers increased by 12.72% to Shs1.95 trillion in 2020, up from Shs1.73 trillion in 2019.

This gives it an industry loans market share of 12.15%.

In 3rd position is dfcu Bank. Headed by Mathias Katamba as Managing Director, dfcu’s loans to customers increased by 14.94% to Shs1.77 trillion in 2020, up from Shs1.54 trillion recorded a year earlier. Its market share under this category is 11.03%.

It is closely followed by Absa Bank Uganda that is headed by Mumba Kalifungwa as Managing Director. Its loans to customers reduced slightly to Shs1.3 trillion in 2020, up from Shs1.33 trillion recorded a year earlier. Its market share is 8.10%.

Equity Bank comes 5th. Headed by Samuel Kirubi as Managing Director, Equity’s loans to customers increased from Shs1.01 trillion in 2019 to Shs1.26 trillion in 2020. This gives it an industry market share of 7.85% under this category.

The five banks control a commanding 61.69% of the total industry loans. This means the remaining 19 banks share 38.3%.

This further shows that the market is dominated by a few banks. This trend could lead to more mergers and acquisitions.

ALSO READ: ANALYSIS: 19 Banks Post Shs817.7bn Profit In 2020, Loss-Making Institutions Revealed

EXCLUSIVE: Uganda’s Largest Banks By Assets Named, Total Industry Assets Hit Shs38 Trillion

EXCLUSIVE: Banks With Highest Non-Performing Loans Revealed

EXCLUSIVE: Banks With Biggest, Smallest Customer Deposits Named

Equity Bank is followed by Standard Chartered Bank (StanChart) that is headed by Albert Saltson as Chief Executive Officer and Managing Director.

StanChart’s loans reduced slightly to Shs1.24 trillion in 2020, down from Shs1.27 trillion in 2019. This gives it 7.73% market share under the loans category.

In 7th position is Bank of Baroda headed by Raj Kumar Meena as Managing Director.

Its loans to customers increased to Shs833.99bn in 2020, up from Shs804.26bn in 2019. Its market share is 5.2%.

It is followed by Diamond Trust Bank in 8th position. Its loans to customers increased from Shs582.3bn in 2019 to Shs592.84bn in 2020, giving it 3.7% market share.

In 9th position is Housing Finance Bank headed by Michael Mugabi as Managing Director. The bank’s loans advanced to customers reduced slightly to Shs550.6bn in 2020 from Shs553.5bn in 2019.

Its market share under this category is 3.43%.

Citibank completes the top 10 largest banks by loans advanced to customers. Its loans grew by 4.03% to Shs409.6bn in 2020, up from Shs393.72bn in 2019. Its market share is 2.55%.

The top 10 banks control 84.3% of the total industry market share under the loans category. This means 14 banks share a paltry 15.7%.

Others

Bank of Africa is the 11th largest bank by loans in Uganda with 2.48% market share. Other banks have less than 2% market share. These include NCBA (1.67%), Orient Bank (1.63%), KCB (1.58%), Exim Bank (1.43%), Finance Trust Bank (1.27%), Bank of India (1.12%) and Tropical Bank (1.09%).

Five banks have less than 1% industry market share under the loans category.

These include Ecobank (0.9%), Cairo Bank Uganda (0.78%), Opportunity Bank (0.76%), Guaranty Trust Bank (0.53%), UBA (0.29%) and ABC (0.15%).

For further details on Uganda’s largest banks by loans advanced to customers, check the table below.

For story tips, opinions, advertising or feedback, reach out to us via staddewo@gmail.com/0775170346/0705888301. Follow us @BusinessFocusug, @TaddewoS for further unmatched analysis on Uganda’s banking sector and the economy at large.